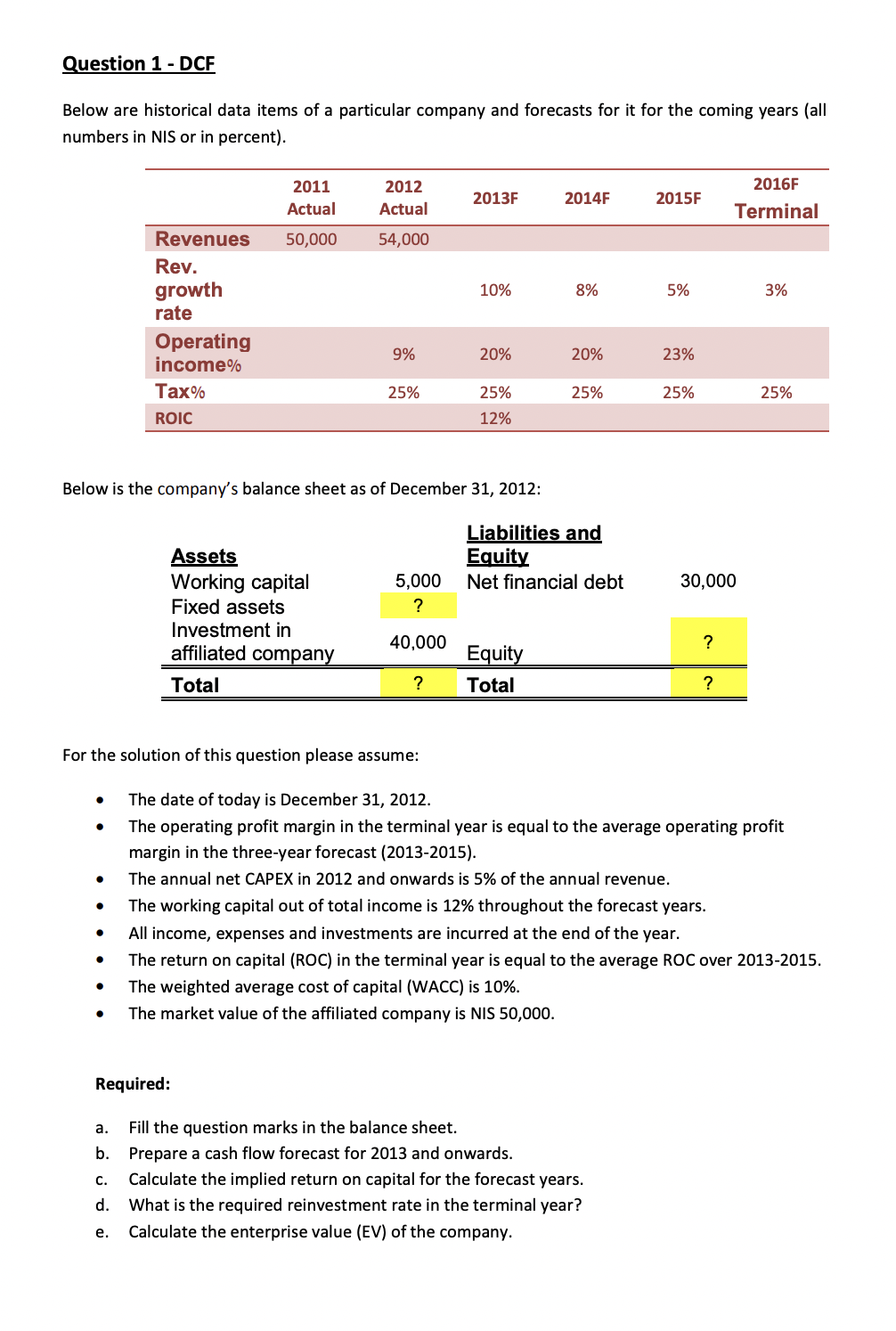

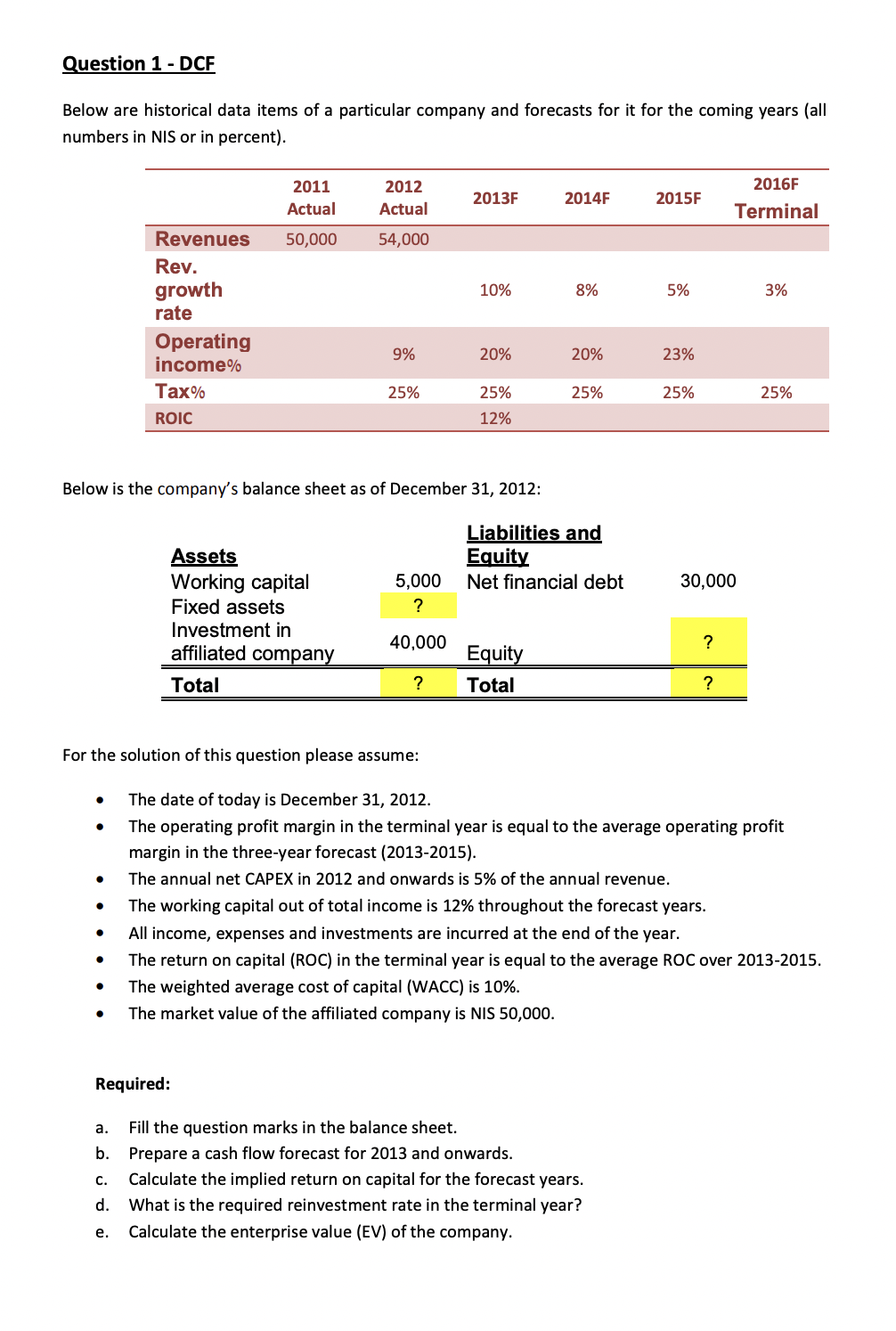

Question 1 - DCF Below are historical data items of a particular company and forecasts for it for the coming years (all numbers in NIS or in percent). Revenues Rev. growth rate Operating income% Tax% ROIC 2011 Actual 50,000 Assets Working capital Fixed assets Required: 2012 Actual 54,000 Investment in affiliated company Total 9% 25% Below is the company's balance sheet as of December 31, 2012: 5,000 ? 40,000 2013F ? 10% 20% 25% 12% Equity Total 2014F 8% 20% Liabilities and Equity Net financial debt a. Fill the question marks in the balance sheet. b. Prepare a cash flow forecast for 2013 and onwards. 25% 2015F 5% C. Calculate the implied return on capital for the forecast years. d. What is the required reinvestment rate in the terminal year? e. Calculate the enterprise value (EV) of the company. 23% 25% 30,000 ? 2016F Terminal ? For the solution of this question please assume: The date of today is December 31, 2012. The operating profit margin in the terminal year is equal to the average operating profit margin in the three-year forecast (2013-2015). The annual net CAPEX in 2012 and onwards is 5% of the annual revenue. 3% The working capital out of total income is 12% throughout the forecast years. All income, expenses and investments are incurred at the end of the year. The return on capital (ROC) in the terminal year is equal to the average ROC over 2013-2015. The weighted average cost of capital (WACC) is 10%. The market value of the affiliated company is NIS 50,000. 25% Question 1 - DCF Below are historical data items of a particular company and forecasts for it for the coming years (all numbers in NIS or in percent). Revenues Rev. growth rate Operating income% Tax% ROIC 2011 Actual 50,000 Assets Working capital Fixed assets Required: 2012 Actual 54,000 Investment in affiliated company Total 9% 25% Below is the company's balance sheet as of December 31, 2012: 5,000 ? 40,000 2013F ? 10% 20% 25% 12% Equity Total 2014F 8% 20% Liabilities and Equity Net financial debt a. Fill the question marks in the balance sheet. b. Prepare a cash flow forecast for 2013 and onwards. 25% 2015F 5% C. Calculate the implied return on capital for the forecast years. d. What is the required reinvestment rate in the terminal year? e. Calculate the enterprise value (EV) of the company. 23% 25% 30,000 ? 2016F Terminal ? For the solution of this question please assume: The date of today is December 31, 2012. The operating profit margin in the terminal year is equal to the average operating profit margin in the three-year forecast (2013-2015). The annual net CAPEX in 2012 and onwards is 5% of the annual revenue. 3% The working capital out of total income is 12% throughout the forecast years. All income, expenses and investments are incurred at the end of the year. The return on capital (ROC) in the terminal year is equal to the average ROC over 2013-2015. The weighted average cost of capital (WACC) is 10%. The market value of the affiliated company is NIS 50,000. 25%