Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Decrease in extent of taxable use of capital goods or services Ms C ( a registered VAT vendor ) owns a double -

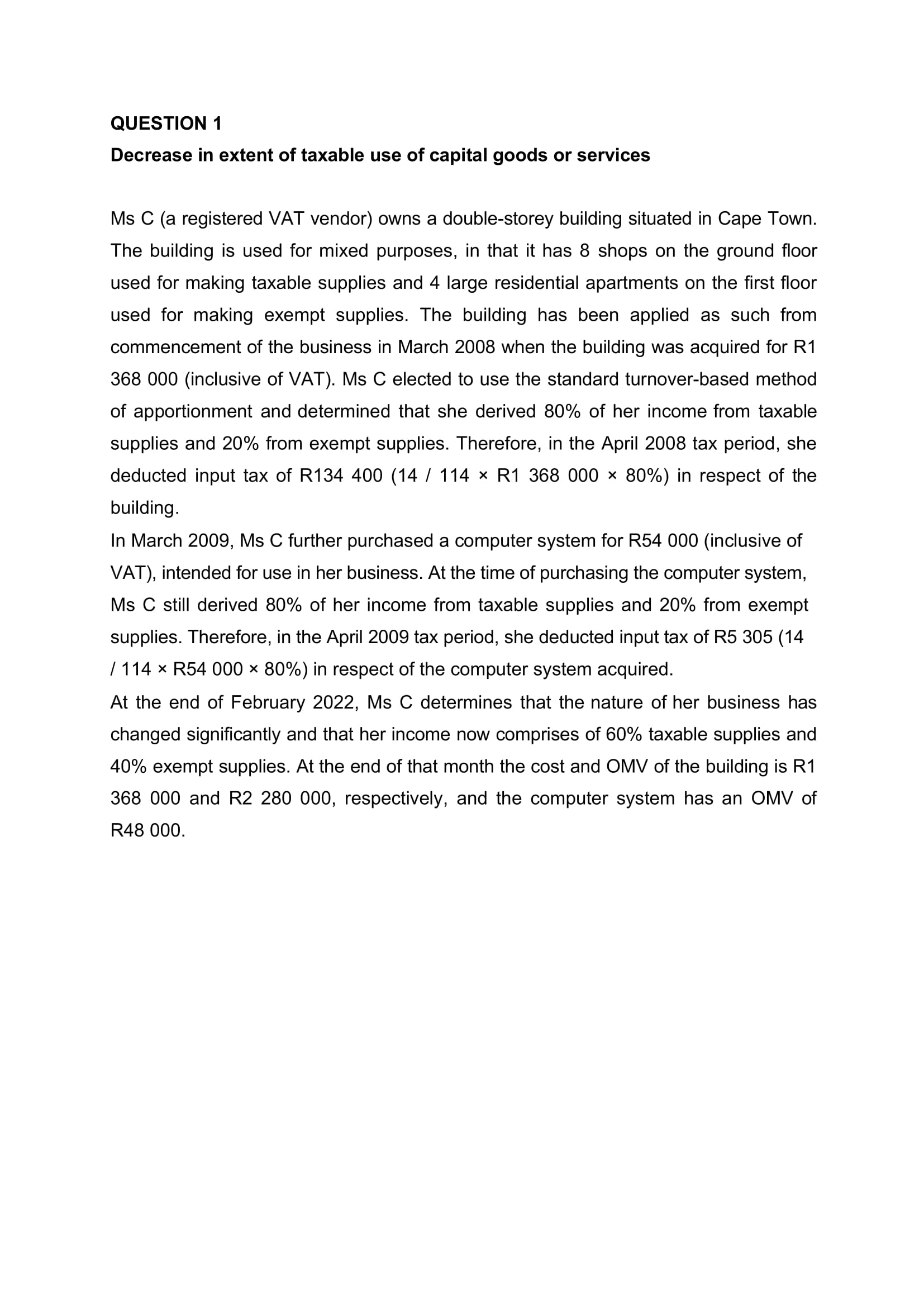

QUESTION

Decrease in extent of taxable use of capital goods or services

Ms C a registered VAT vendor owns a doublestorey building situated in Cape Town.

The building is used for mixed purposes, in that it has shops on the ground floor

used for making taxable supplies and large residential apartments on the first floor

used for making exempt supplies. The building has been applied as such from

commencement of the business in March when the building was acquired for R

inclusive of VAT Ms C elected to use the standard turnoverbased method

of apportionment and determined that she derived of her income from taxable

supplies and from exempt supplies. Therefore, in the April tax period, she

deducted input tax of R R in respect of the

building.

In March Ms C further purchased a computer system for Rinclusive of

VAT intended for use in her business. At the time of purchasing the computer system,

Ms C still derived of her income from taxable supplies and from exempt

supplies. Therefore, in the April tax period, she deducted input tax of R

R in respect of the computer system acquired.

At the end of February Ms C determines that the nature of her business has

changed significantly and that her income now comprises of taxable supplies and

exempt supplies. At the end of that month the cost and OMV of the building is R

and R respectively, and the computer system has an OMV of

R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started