Question

QUESTION: 1. Determine consolidated Inventory as of 12/31/2022 2. Assume that no intra-entity inventory sales occurred between Parent and Sub. Instead, in 2021, Parent sold

QUESTION:

1. Determine consolidated Inventory as of 12/31/2022

2. Assume that no intra-entity inventory sales occurred between Parent and Sub. Instead, in 2021, Parent sold land costing $160,000 to Sub for $200,000

a. How much gain on the sale of land is recognized by the consolidated entity in 2021?

b. Determine the balance of land reported by the consolidated entity on 12/31/2022 (assume no other land owned by Parent or Sub)

c. If Sub sold the land to an outside party on 7/15/2023 for $235,000, the amount of gain on the sale of land recognized by the consolidated entity in 2023 is:

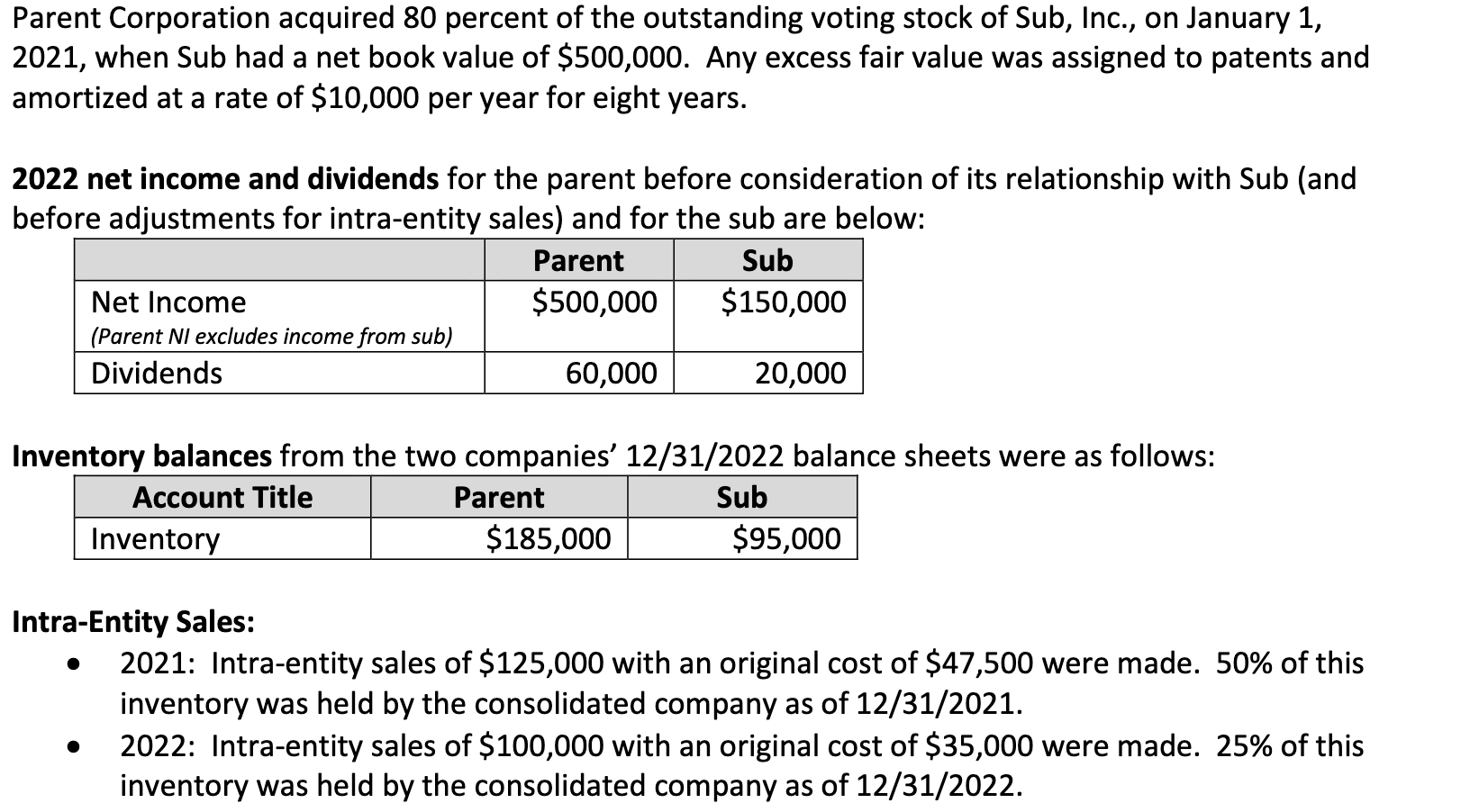

Parent Corporation acquired 80 percent of the outstanding voting stock of Sub, Inc., on January 1 , 2021 , when Sub had a net book value of $500,000. Any excess fair value was assigned to patents and amortized at a rate of $10,000 per year for eight years. 2022 net income and dividends for the parent before consideration of its relationship with Sub (and before adjustments for intra-entity sales) and for the sub are below: Inventory balances from the two companies' 12/31/2022 balance sheets were as follows: Intra-Entity Sales: - 2021: Intra-entity sales of $125,000 with an original cost of $47,500 were made. 50% of this inventory was held by the consolidated company as of 12/31/2021. - 2022: Intra-entity sales of $100,000 with an original cost of $35,000 were made. 25% of this inventory was held by the consolidated company as of 12/31/2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started