Answered step by step

Verified Expert Solution

Question

1 Approved Answer

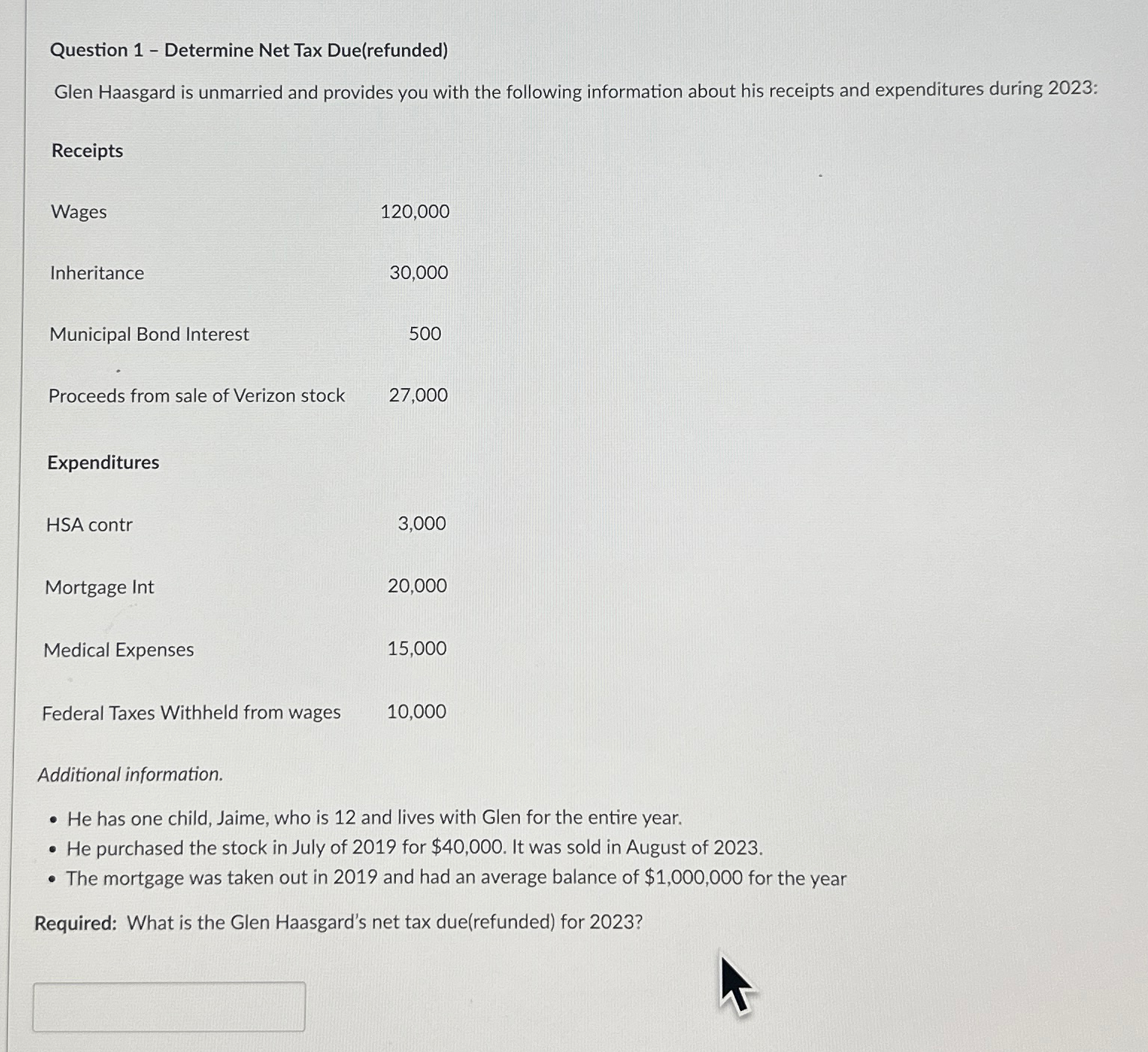

Question 1 - Determine Net Tax Due ( refunded ) Glen Haasgard is unmarried and provides you with the following information about his receipts and

Question Determine Net Tax Duerefunded

Glen Haasgard is unmarried and provides you with the following information about his receipts and expenditures during :

Receipts

Wages

Inheritance

Municipal Bond Interest

Proceeds from sale of Verizon stock

Expenditures

HSA contr

Mortgage Int

Medical Expenses

Federal Taxes Withheld from wages

Additional information.

He has one child, Jaime, who is and lives with Glen for the entire year.

He purchased the stock in July of for $ It was sold in August of

The mortgage was taken out in and had an average balance of $ for the year

Required: What is the Glen Haasgard's net tax duerefunded for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started