Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Finovax Company has recently borrowed $60,000 from its local bank for investment in a new production equipment. Its local bank expects that Finovax

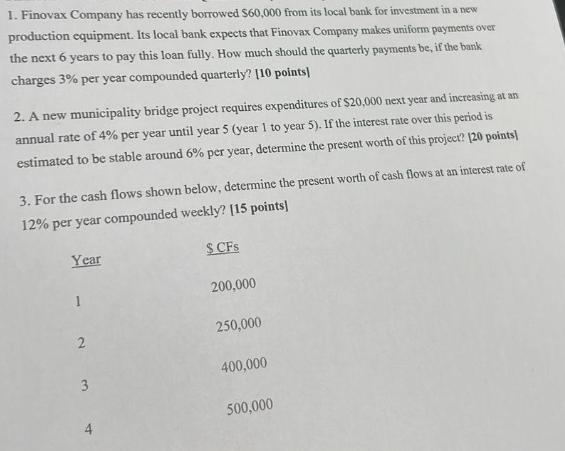

1. Finovax Company has recently borrowed $60,000 from its local bank for investment in a new production equipment. Its local bank expects that Finovax Company makes uniform payments over the next 6 years to pay this loan fully. How much should the quarterly payments be, if the bank charges 3% per year compounded quarterly? [10 points] 2. A new municipality bridge project requires expenditures of $20,000 next year and increasing at an annual rate of 4% per year until year 5 (year 1 to year 5). If the interest rate over this period is estimated to be stable around 6% per year, determine the present worth of this project? 120 points) 3. For the cash flows shown below, determine the present worth of cash flows at an interest rate of 12% per year compounded weekly? [15 points] Year 1 2 3 3 4 $CFS 200,000 250,000 400,000 500,000

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

question 1 prA11rn pquarterly payment amount rquarterly interset ratedivided by 4 Aloan amount n num...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started