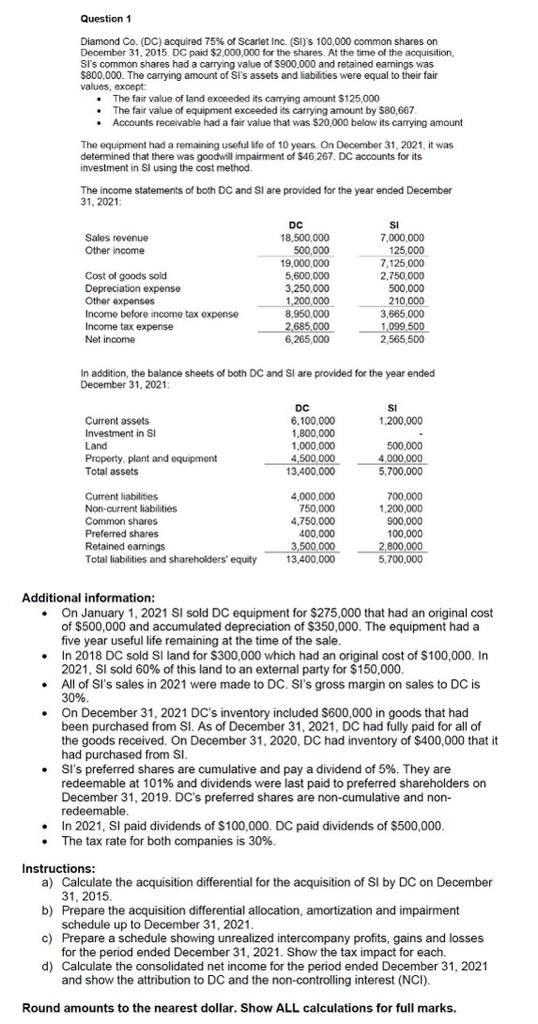

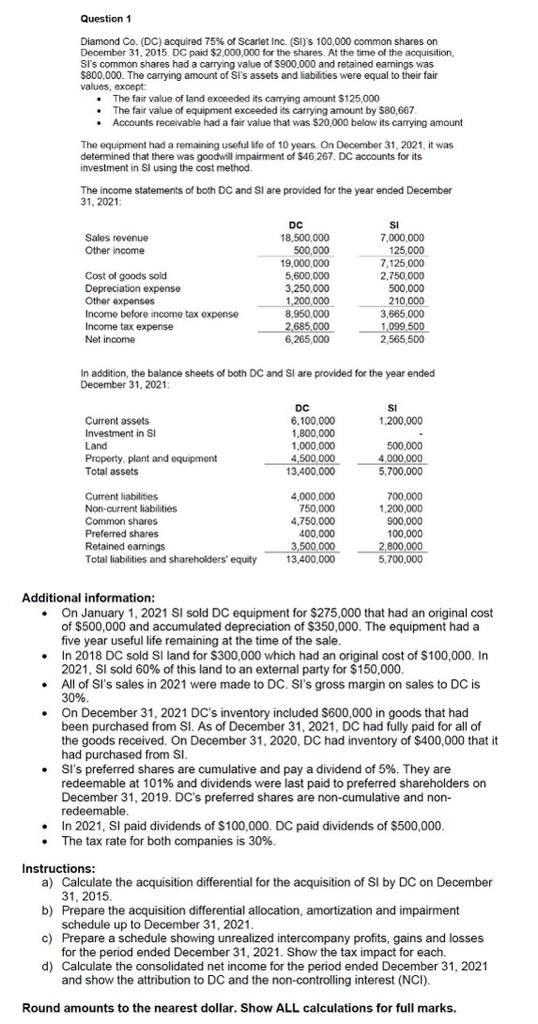

Question 1 Diamond Co. (DC) acquired 75% of Scarlet inc. (SI)'s 100,000 common shares on December 31,2015 . DC paid $2,000,000 for the shares. At the time of the acquisition, SI's common shares had a carrying value of $900.000 and retained eamings was $800,000. The carrying amount of SI's assets and liabilities were equal to their fair values, exoept: - The fair value of land exceeded its carrying amount $125,000 - The fair value of equipment exceeded its carrying amount by $80,667 - Accounts receivable had a fair value that was $20,000 below its carrying amount The equipment had a remaining useful life of 10 years. On December 31, 2021, it was detemined that there was goodwill impairment of $46,267. DC accounts for its investment in St using the cost method. The income statements of both DC and SI are provided for the year ended December 31, 2021: In addition, the balance sheets of both DC and SI are provided for the year ended December 31, 2021: Additional information: - On January 1, 2021 SI sold DC equipment for $275,000 that had an original cost of $500,000 and accumulated depreciation of $350,000. The equipment had a five year useful life remaining at the time of the sale. - In 2018DC sold SI land for $300,000 which had an original cost of $100,000. In 2021, SI sold 60% of this land to an external party for $150,000. - All of Sl's sales in 2021 were made to DC. SI's gross margin on sales to DC is 30%. - On December 31, 2021 DC's inventory included $600,000 in goods that had been purchased from SI. As of December 31, 2021, DC had fully paid for all of the goods received. On December 31, 2020, DC had inventory of $400,000 that it had purchased from SI. - SI's preferred shares are cumulative and pay a dividend of 5%. They are redeemable at 101% and dividends were last paid to preferred shareholders on December 31, 2019. DC's preferred shares are non-cumulative and nonredeemable. - In 2021, SI paid dividends of $100,000. DC paid dividends of $500,000. - The tax rate for both companies is 30%. Instructions: a) Calculate the acquisition differential for the acquisition of SI by DC on December 31,2015. b) Prepare the acquisition differential allocation, amortization and impairment schedule up to December 31, 2021. c) Prepare a schedule showing unrealized intercompany profits, gains and losses for the period ended December 31, 2021. Show the tax impact for each. d) Calculate the consolidated net income for the period ended December 31, 2021 and show the attribution to DC and the non-controlling interest ( NCl). Question 1 Diamond Co. (DC) acquired 75% of Scarlet inc. (SI)'s 100,000 common shares on December 31,2015 . DC paid $2,000,000 for the shares. At the time of the acquisition, SI's common shares had a carrying value of $900.000 and retained eamings was $800,000. The carrying amount of SI's assets and liabilities were equal to their fair values, exoept: - The fair value of land exceeded its carrying amount $125,000 - The fair value of equipment exceeded its carrying amount by $80,667 - Accounts receivable had a fair value that was $20,000 below its carrying amount The equipment had a remaining useful life of 10 years. On December 31, 2021, it was detemined that there was goodwill impairment of $46,267. DC accounts for its investment in St using the cost method. The income statements of both DC and SI are provided for the year ended December 31, 2021: In addition, the balance sheets of both DC and SI are provided for the year ended December 31, 2021: Additional information: - On January 1, 2021 SI sold DC equipment for $275,000 that had an original cost of $500,000 and accumulated depreciation of $350,000. The equipment had a five year useful life remaining at the time of the sale. - In 2018DC sold SI land for $300,000 which had an original cost of $100,000. In 2021, SI sold 60% of this land to an external party for $150,000. - All of Sl's sales in 2021 were made to DC. SI's gross margin on sales to DC is 30%. - On December 31, 2021 DC's inventory included $600,000 in goods that had been purchased from SI. As of December 31, 2021, DC had fully paid for all of the goods received. On December 31, 2020, DC had inventory of $400,000 that it had purchased from SI. - SI's preferred shares are cumulative and pay a dividend of 5%. They are redeemable at 101% and dividends were last paid to preferred shareholders on December 31, 2019. DC's preferred shares are non-cumulative and nonredeemable. - In 2021, SI paid dividends of $100,000. DC paid dividends of $500,000. - The tax rate for both companies is 30%. Instructions: a) Calculate the acquisition differential for the acquisition of SI by DC on December 31,2015. b) Prepare the acquisition differential allocation, amortization and impairment schedule up to December 31, 2021. c) Prepare a schedule showing unrealized intercompany profits, gains and losses for the period ended December 31, 2021. Show the tax impact for each. d) Calculate the consolidated net income for the period ended December 31, 2021 and show the attribution to DC and the non-controlling interest ( NCl)