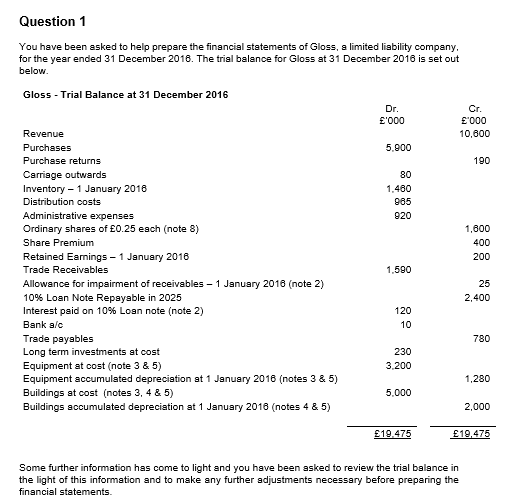

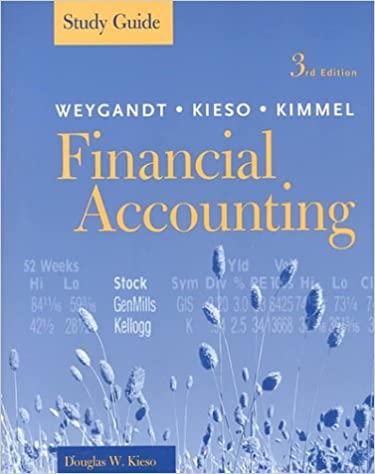

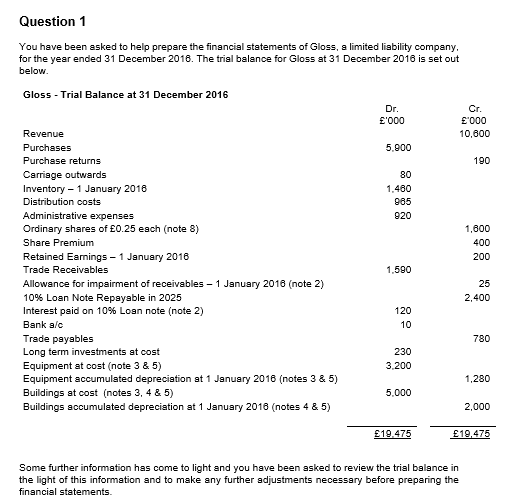

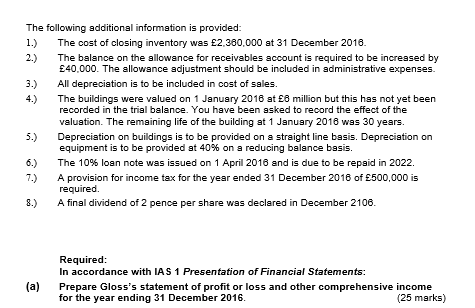

Question 1 Dr. You have been asked to help prepare the financial statements of Gloss, a limited liability company, for the year ended 31 December 2016. The trial balance for Gloss at 31 December 2016 is set out below. Gloss - Trial Balance at 31 December 2016 Cr. '000 '000 Revenue 10,600 Purchases 5.900 Purchase returns 190 Carriage outwards 80 Inventory - 1 January 2016 1.480 Distribution costs 965 Administrative expenses 920 Ordinary shares of 0.25 each (note 8) 1,600 Share Premium 400 Retained Earnings - 1 January 2016 200 Trade Receivables 1.500 Allowance for impairment of receivables - 1 January 2018 (note 2) 25 10% Loan Note Repayable in 2025 2,400 Interest paid on 10% Loan note (note 2) 120 Bank a/c 10 Trade payables 780 Long term investments at cost 230 Equipment at cost (note 3 & 5) 3.200 Equipment accumulated depreciation at 1 January 2016 (notes 3 & 5) 1.280 Buildings at cost (notes 3, 4 & 5) 5,000 Buildings accumulated depreciation at 1 January 2016 (notes 4 & 5) 2,000 19.475 19,475 Some further information has come to light and you have been asked to review the trial balance in the light of this information and to make any further adjustments necessary before preparing the financial statements The following additional information is provided: 1.) The cost of closing inventory was 2.360.000 at 31 December 2016 2.) The balance on the allowance for receivables account is required to be increased by 40.000. The allowance adjustment should be included in administrative expenses. 3.) All depreciation is to be included in cost of sales. 4.) The buildings were valued on 1 January 2016 at 8 million but this has not yet been recorded in the trial balance. You have been asked to record the effect of the valuation. The remaining life of the building at 1 January 2016 was 30 years. 5.) Depreciation on buildings is to be provided on a straight line basis. Depreciation on equipment is to be provided at 40% on a reducing balance basis. 6.) The 10% loan note was issued on 1 April 2016 and is due to be repaid in 2022. 7.) A provision for income tax for the year ended 31 December 2016 of 500,000 is required 8.) A final dividend of 2 pence per share was declared in December 2106. Required: In accordance with IAS 1 Presentation of Financial Statements: Prepare Gloss's statement of profit or loss and other comprehensive income for the year ending 31 December 2016. (25 marks) (a)