Answered step by step

Verified Expert Solution

Question

1 Approved Answer

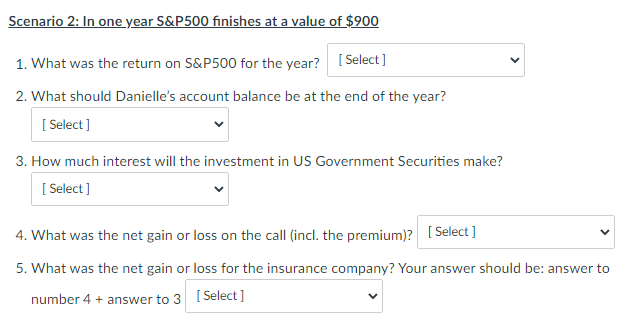

Question 1 Drop down answers -10% -100% -30% -20% Question 2 Drop down answers 1000 1120 1100 900 Question 3 Drop down answers 0 1

| Question 1 Drop down answers | -10% | -100% | -30% | -20% |

| Question 2 Drop down answers | 1000 | 1120 | 1100 | 900 |

| Question 3 Drop down answers | 0 | 1 | 10 | 100 |

| Question 4 Drop down answers | -10 | 20 | 10 | 0 |

| Question 5 Drop down answers | 0 | 10 | 1000 | -10 |

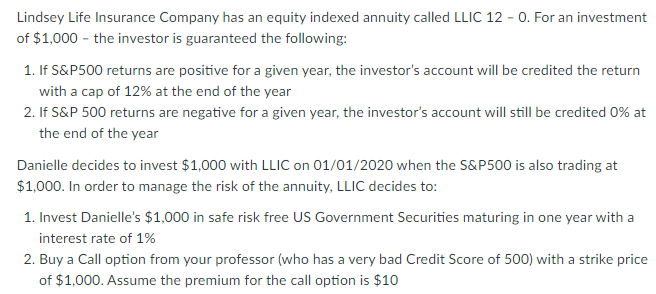

Lindsey Life Insurance Company has an equity indexed annuity called LLIC 12 -0. For an investment of $1,000 - the investor is guaranteed the following: 1. If S&P500 returns are positive for a given year, the investor's account will be credited the return with a cap of 12% at the end of the year 2. If S&P 500 returns are negative for a given year, the investor's account will still be credited 0% at the end of the year Danielle decides to invest $1,000 with LLIC on 01/01/2020 when the S&P500 is also trading at $1,000. In order to manage the risk of the annuity, LLIC decides to: 1. Invest Danielle's $1,000 in safe risk free US Government Securities maturing in one year with a interest rate of 1% 2. Buy a Call option from your professor (who has a very bad Credit Score of 500) with a strike price of $1,000. Assume the premium for the call option is $10 Scenario 2: In one year S&P500 finishes at a value of $900 1. What was the return on S&P500 for the year? [Select] 2. What should Danielle's account balance be at the end of the year? [ Select] 3. How much interest will the investment in US Government Securities make? [ Select] 4. What was the net gain or loss on the call (incl. the premium)? [Select] 5. What was the net gain or loss for the insurance company? Your answer should be: answer to number 4 + answer to 3 (Select] Lindsey Life Insurance Company has an equity indexed annuity called LLIC 12 -0. For an investment of $1,000 - the investor is guaranteed the following: 1. If S&P500 returns are positive for a given year, the investor's account will be credited the return with a cap of 12% at the end of the year 2. If S&P 500 returns are negative for a given year, the investor's account will still be credited 0% at the end of the year Danielle decides to invest $1,000 with LLIC on 01/01/2020 when the S&P500 is also trading at $1,000. In order to manage the risk of the annuity, LLIC decides to: 1. Invest Danielle's $1,000 in safe risk free US Government Securities maturing in one year with a interest rate of 1% 2. Buy a Call option from your professor (who has a very bad Credit Score of 500) with a strike price of $1,000. Assume the premium for the call option is $10 Scenario 2: In one year S&P500 finishes at a value of $900 1. What was the return on S&P500 for the year? [Select] 2. What should Danielle's account balance be at the end of the year? [ Select] 3. How much interest will the investment in US Government Securities make? [ Select] 4. What was the net gain or loss on the call (incl. the premium)? [Select] 5. What was the net gain or loss for the insurance company? Your answer should be: answer to number 4 + answer to 3 (Select]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started