Answered step by step

Verified Expert Solution

Question

1 Approved Answer

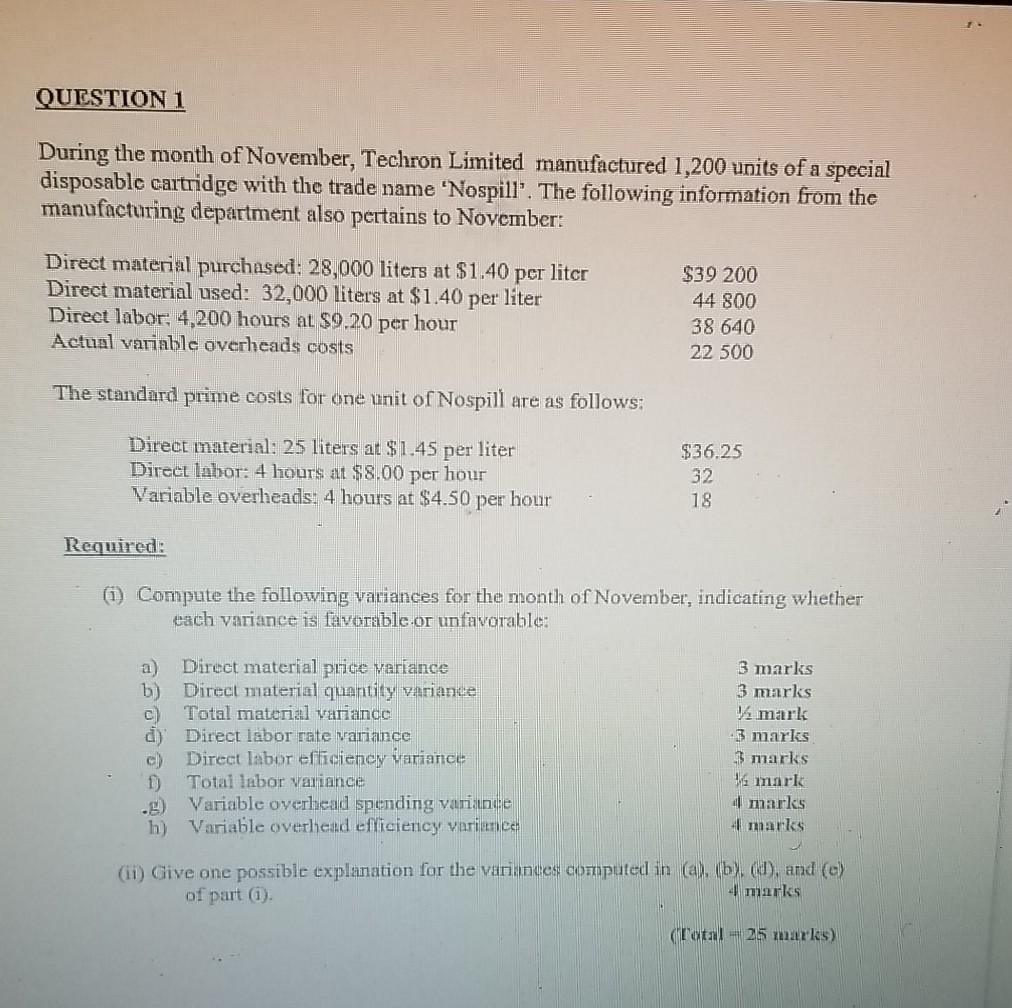

QUESTION 1 During the month of November, Techron Limited manufactured 1,200 units of a special disposable cartridge with the trade name 'Nospill'. The following information

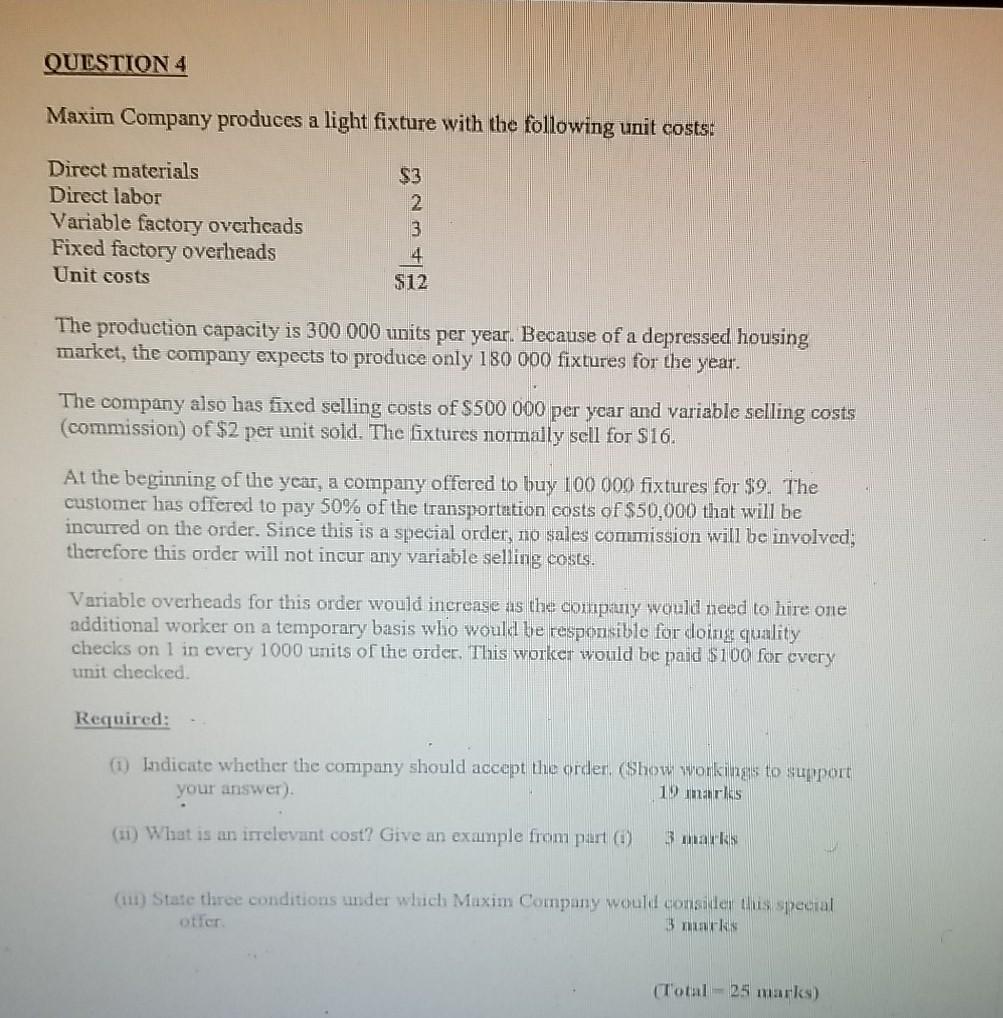

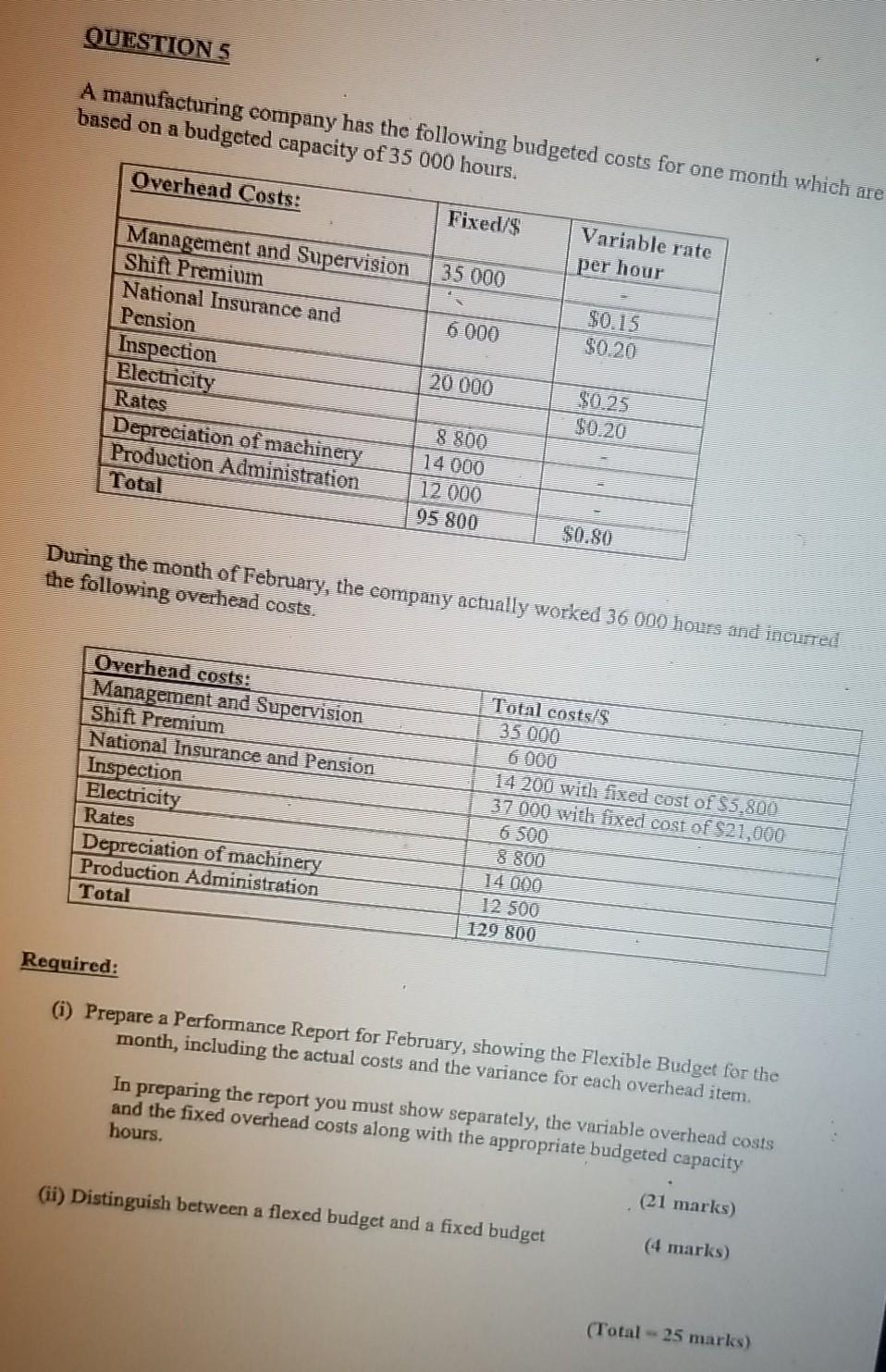

QUESTION 1 During the month of November, Techron Limited manufactured 1,200 units of a special disposable cartridge with the trade name 'Nospill'. The following information from the manufacturing department also pertains to November: Direct material purchased: 28,000 liters at $1.40 per liter Direct material used: 32,000 liters at $1.40 per liter Direct labor; 4,200 hours at $9.20 per hour Actual variable overheads costs $39 200 44 800 38 640 22 500 The standard prime costs for one unit of Nospill are as follows: Direct material: 25 liters at $1.45 per liter Direct labor: 4 hours at $8.00 per hour Variable overheads: 4 hours at $4.50 per hour $36.25 32 18 Required: (1) Compute the following variances for the month of November, indicating whether each variance is favorable or unfavorable: ABBAN a Direct material price variance b) Direct material quantity variante Total material variance d) Direct labor rate variance Direct labor efficiency variance 1) Total labor variance Variable overhead spending variande h) Variable overhead efficiency variance 3 marks 3 marks mark 3 marks 3 marks mark 4 marks 4 marks (ii) Give one possible explanation for the variantes computed in (a), (b), (d), and (c) marks of part (0) (Catal-25 marks) QUESTION 4 Maxim Company produces a light fixture with the following unit costs: Direct materials Direct labor Variable factory overheads Fixed factory overheads Unit costs $3 2 3 $12 The production capacity is 300 000 units per year. Because of a depressed housing market, the company expects to produce only 180 000 fixtures for the year. The company also has fixed selling costs of $500 000 per year and variable selling costs (commission) of $2 per unit sold. The fixtures 11011ally sell for $16. At the beginning of the year, a company offered to buy 100 000 fixtures for $9. The customer has offered to pay 50% of the transportation costs of $50,000 that will be incurred on the order. Since this is a special order, no sales comunission will be involved; therefore this order will not incur any variable selling costs. Variable overheads for this order would increase as the company would need to hire one additional worker on a temporary basis who would be responsible for doing quality checks on 1 in every 1000 units of the order. This worker would be paid $100 for every unit checked. Required: (1) Indicate whether the company should accept the order. (Show workings to support your answer) 19 marks (11) What is an irrelevant cost? Give an example from part) 3mal RS (11) State three conditions under wluch Maxim Company would consider this special offer. 3 mus (Total 25 marks) QUESTIONS A manufacturing company has the following budgeted costs for one month which are based on a budgeted capacity of 35 000 hours. Overhead Costs: Fixed/$ Variable rate 35 000 per hour 6 000 Management and Supervision Shift Premium National Insurance and Pension Inspection Electricity Rates Depreciation of machinery Production Administration Total $0.15 $0.20 20 000 $0.25 $0.20 8 800 14 000 12 000 95 800 $0.80 During the month of February, the company actually worked 36 000 hours and incurred the following overhead costs. Overhead costs: Management and Supervision Shift Premium National Insurance and Pension Inspection Electricity Rates Depreciation of machinery Production Administration Total Total costs/ 35 000 6 000 14 200 with fixed cost of $5.800 37 000 with fixed cost of $21,000 6 500 8 800 14 000 12 500 129 800 Required: (i) Prepare a Performance Report for February, showing the Flexible Budget for the month, including the actual costs and the variance for each overhead item. In preparing the report you must show separately, the variable overhead costs and the fixed overhead costs along with the appropriate budgeted capacity hours. (21 marks) (ii) Distinguish between a flexed budget and a fixed budget (4 marks) (Total - 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started