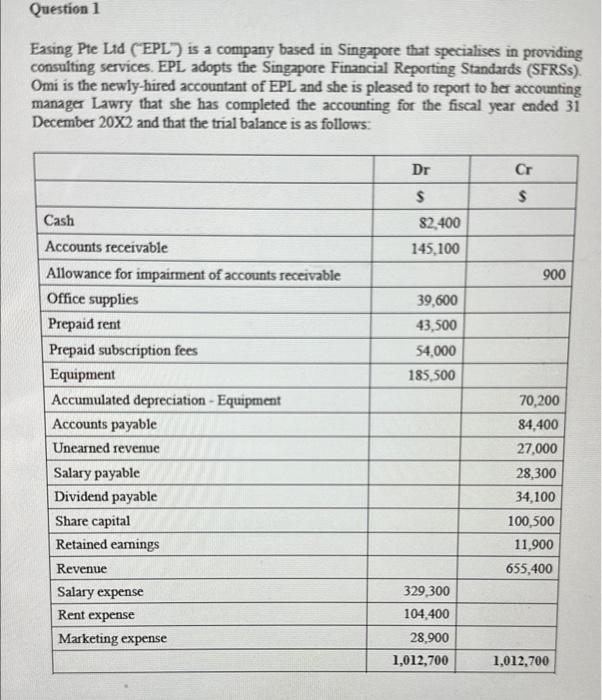

Question 1 Easing Pte Ltd (EPL) is a company based in Singapore that specialises in providing consulting services. EPL adopts the Singapore Financial Reporting Standards (SFRSs). Omi is the newly-hired accountant of EPL and she is pleased to report to her accounting manager Lawry that she has completed the accounting for the fiscal year ended 31 December 20X2 and that the trial balance is as follows: Cash Accounts receivable Allowance for impairment of accounts receivable Office supplies Prepaid rent Prepaid subscription fees Equipment Accumulated depreciation - Equipment Accounts payable Unearned revenue Salary payable Dividend payable Share capital Retained earnings Revenue Salary expense Rent expense Marketing expense Dr $ $2,400 145,100 39,600 43,500 54,000 185,500 329,300 104,400 28,900 1,012,700 Cr $ 900 70,200 84,400 27,000 28,300 34,100 100,500 11,900 655,400 1,012,700

please answer the full question

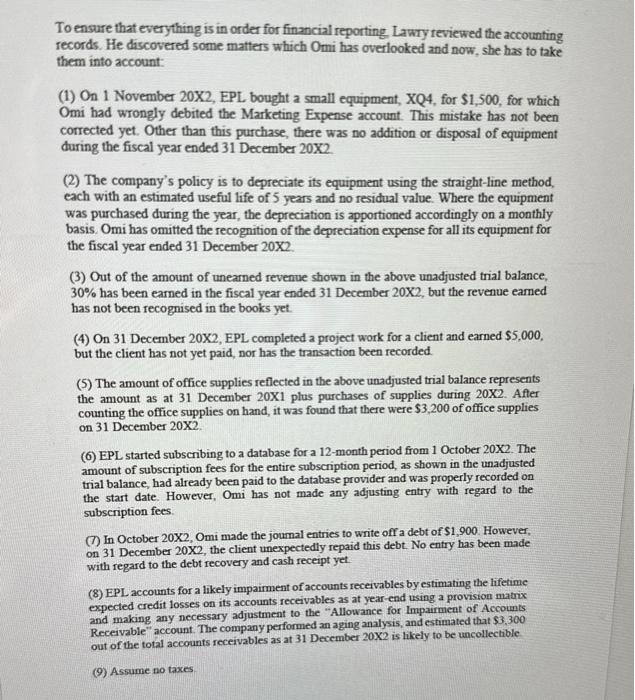

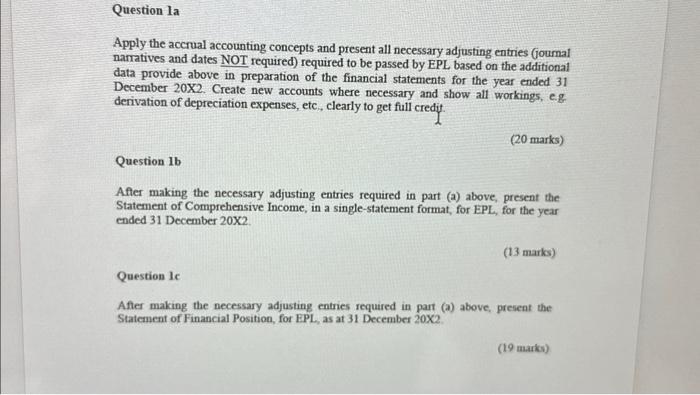

Easing Pte Ltd (EPL) is a company based in Singapore that specialises in providing consulting services. EPL adopts the Singapore Financial Reporting Standards (SFRSs). Omi is the newly-hired accountant of EPL and she is pleased to report to her accounting manager Lawry that she has completed the accounting for the fiscal year ended 31 December 202 and that the trial balance is as follows: To ensure that everything is in order for financial reporting. Lawry reviewed the accounting records. He discovered some matters which Omi has overlooked and now, she has to take them into account: (1) On 1 November 20X2, EPL bought a small equipment, XQ4, for $1,500, for which Omi had wrongly debited the Marketing Expense account. This mistake has not been corrected yet. Other than this purchase, there was no addition or disposal of equipment during the fiscal year ended 31 December 20X2 (2) The company's policy is to depreciate its equipment using the straight-line method, each with an estimated useful life of 5 years and no residual value. Where the equipment was purchased during the year, the depreciation is apportioned accordingly on a monthly basis. Omi has omitted the recognition of the depreciation expense for all its equipment for the fiscal year ended 31 December 20X2. (3) Out of the amount of uneamed revenue shown in the above unadjusted trial balance, 30% has been earned in the fiscal year ended 31 December 202, but the revenue eamed has not been recognised in the books yet. (4) On 31 December 20X2, EPL completed a project work for a client and earned $5,000, but the client has not yet paid, nor has the transaction been recorded. (5) The amount of office supplies reflected in the above unadjusted trial balance represents the amount as at 31 December 201 plus purchases of supplies during 20X2. After counting the office supplies on hand, it was found that there were $3,200 of office supplies on 31 December 20X2. (6) EPL started subscribing to a database for a 12 -month period from 1 October 20X2. The amount of subscription fees for the entire subscription period, as shown in the unadjusted trial balance, had already been paid to the database provider and was properly recorded on the start date. However, Omi has not made any adjusting entry with regard to the subscription fees. (7) In October 202, Omi made the joumal entries to write off a debt of $1,900. However, on 31 December 202, the client unexpectedly repaid this debt. No entry has been made with regard to the debt recovery and cash receipt yet. (8) EPL accounts for a likely impairment of accounts receivables by estimating the lifetime expected credit losses on its accounts receivables as at year-end using a provision matrix and making any necessary adjustment to the "Allowance for Impaiment of Accounts Receivable" account. The company performed an aging analysis, and estimated that $3,300 out of the total accounts receivables as at 31 December 20X2 is likely to be uncollectible (9) Assume no taxes. Apply the accrual accounting concepts and present all necessary adjusting entries (joumal narratives and dates NOT required) required to be passed by EPL based on the additional data provide above in preparation of the financial statements for the year ended 31 December 20X2. Create new accounts where necessary and show all workings, e.g derivation of depreciation expenses, etc, clearly to get full credit. (20 marks) Question 1b After making the necessary adjusting entries required in part (a) above, present the Statement of Comprehensive Income, in a single-statement format, for EPL, for the year ended 31 December 20X2 (13 marks) Question lc After making the necessary adjusting entries required in part (a) above, present the Statement of Financial Position, for EPL, as at 31 December 20X2