Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Estimate the requried return for each component of the capital structure. only focuz of the question provided in the posted question on chegg

Question 1: Estimate the requried return for each component of the capital structure.

only focuz of the question provided in the posted question on chegg

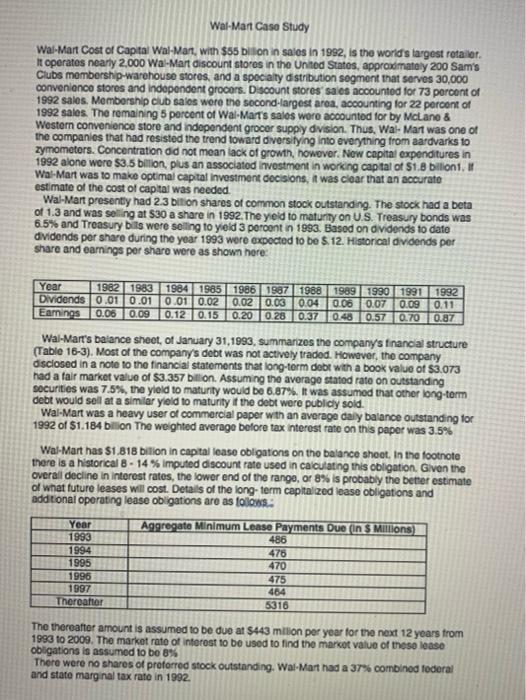

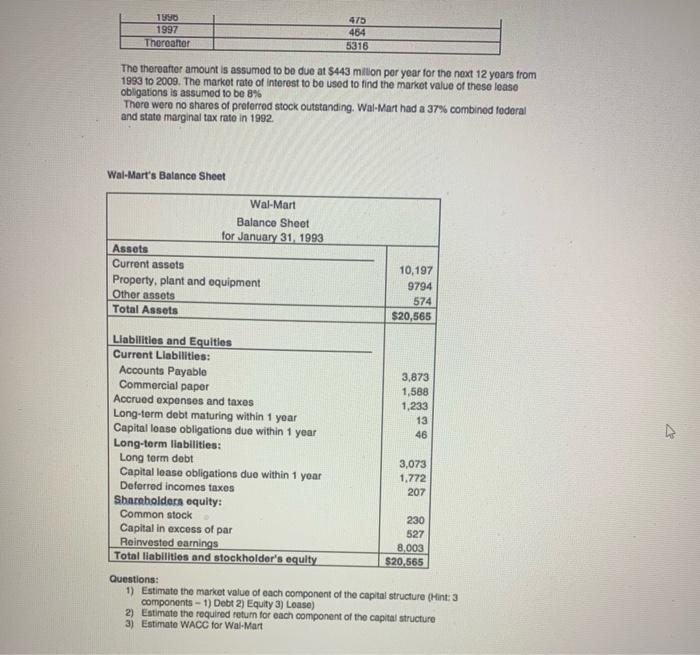

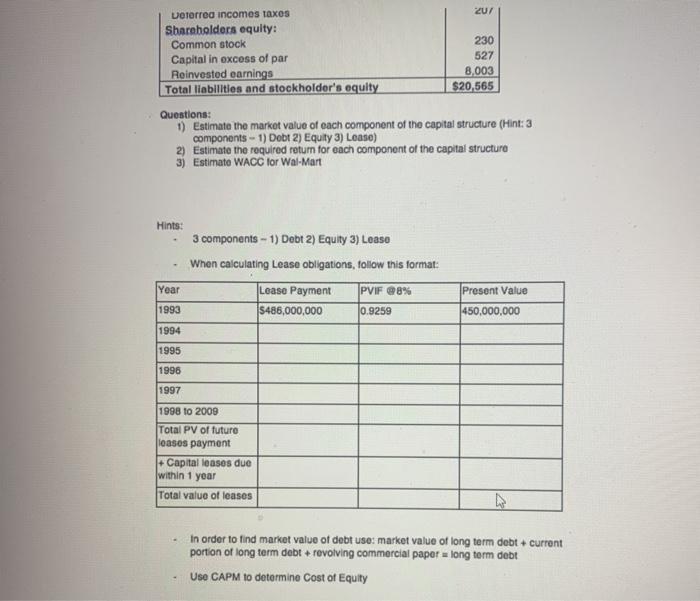

Wal-Mart Case Study Wal-Mart Cost of Capital Wal-Mart, with $55 billion in sales in 1992, is the world's largest retailer It operates nearly 2000 Wal-Mart discount stores in the United States, approudmately 200 Sam's Clubs membership-warehouse stores, and a specialty distribution segment that serves 30,000 convenienco stores and independent grocers. Discount stores sales accounted for 73 percent of 1992 sales. Membership club salos were the second-largest area, accounting for 22 percent of 1992 sales. The remaining 5 percent of Wal-Mart's salos woro accounted for by McLane & Western convenience store and independent grocer supply division. Thus, Wal-Mart was one of the companies that had resisted the trend toward diversitying into everything from aardvarks to zymometers. Concentration did not mean lack of growth, however. New capital expenditures in 1992 alone were $3.5 billion, plus an associated investment in working capital of $1.8 bilioni. W Wal-Mart was to make optimal capital Investment decisions, it was clear that an accurate estimate of the cost of capital was needed Wal-Mart presently had 2.3 billion shares of common stock outstanding. The stock had a beta of 1.3 and was selling at $30 a share in 1992. The yield to maturity on U.S. Treasury bonds was 6.5% and Treasury bits were selling to yield 3 percent in 1993. Based on dividends to date dividends per share during the year 1993 were expected to be $ 12. Historical dividends per share and earnings per share were as shown here: Year 1982 1983 1984 1985 1986 1987 1988 Dividends 0.01 0.01 0.01 0.02 0.02 0.03 0.04 Earnings 0.06 0.09 0.120.150.200.28 0.37 1989 1990 1991 1992 0.06 0.07 0.09 0.11 0.48 0.57 0.70 0.87 Wal-Mart's balance sheet, of January 31,1993, summarizes the company's financial structure (Table 16-3). Most of the company's debt was not actively traded. However, the company disclosed in a note to the financial statements that long-term debt with a book value of $3.073 had a fair market value of $3.357 billion. Assuming the average stated rate on outstanding securities was 7.5%, the yield to maturity would be 6.87%. It was assumed that other long-term debt would sell at a similar yield to maturity of the debt were publicly sold. Wal-Mart was a heavy user of commercial paper with an average daly balance outstanding for 1992 of $1.184 billion The weighted average before tax interest rate on this paper was 3.5% Wal-Mart has $1.818 bilion in capital lease obligations on the balance sheet. In the footnote there is a historical 8 - 14% imputed discount rate used in calculating this obligation. Given the overall decline in interest rates, the lower end of the range, or 8% is probably the better estimate of what tuture leases will cost. Details of the long-term capitalized lease obligations and additional operating lease obligations are as follows: Year 1993 1994 1995 1996 1997 Thereafter Aggregate Minimum Lease Payments Due (in Millions) 486 476 470 475 464 5316 The thereafter amount is assumed to be due at $443 milion per year for the next 12 years from 1993 to 2009. The market rate of interest to be used to find the market value of these lease obligations is assumed to be 8% There were no shares of proferred stock outstanding. Wal-Mart had a 37% combined federal and state marginal tax rate in 1992. 1990 1997 Thereafter 475 484 5316 The thereafter amount is assumed to be due at $443 million per year for the next 12 yoars from 1993 to 2009. The market rate of interest to be used to find the market value of these lease obligations is assumed to be 8% There were no shares of preferred stock outstanding, Wal-Mart had a 37% combined federal and state marginal tax rate in 1992. Wal-Mart's Balance Sheet Wal-Mart Balance Sheet for January 31, 1993 Assets Current assets Property, plant and equipment Other assets Total Assets 10,197 9794 574 $20,565 Liabilities and Equities Current Llabilities: Accounts Payable 3,873 Commercial paper 1,588 Accrued expenses and taxes 1,233 Long-term debt maturing within 1 year 13 Capital lase obligations due within 1 year 46 Long-term liabilities: Long term dobt 3,073 Capital lease obligations duo within 1 year 1,772 Deferred incomes taxes 207 Shareholders equity: Common stock 230 Capital in excess of par 527 Reinvested earnings 8,003 Total liabilities and stockholder's equity $20,565 Questions: 1) Estimate the market value of each component of the capital structure (Hint: 3 components - 1) Debt 2) Equity 3) Lease) 2) Estimate the required return for each component of the capital structure 3) Estimate WACC for Wal-Mart 207 Lotarred incomes taxes Shareholders equity: Common stock 230 Capital in excess of par 527 Roinvested earnings 8,003 Total liabilities and stockholder's equity $20,565 Questions: 1) Estimate the market value of each component of the capital structure (Hint: 3 components - 1) Debt 2) Equity 3) Lease) 2) Estimate the required return for each component of the capital structure 3) Estimate WACC for Wal-Mart Hints: 3 components - 1) Debt 2) Equity 3) Lease - When calculating Lease obligations, follow this format: Year PVIF @8% Lease Payment 5486,000,000 Present Value 450,000,000 1993 0.9259 1994 1995 1996 1997 1998 to 2009 Total PV of futuro loasos payment + Capital lasos due within 1 year Total value of leases In order to find market value of debt uso: market value of long term debt current portion of long term debt + revolving commercial paper - long term debt USO CAPM to determine Cost of Equity Wal-Mart Case Study Wal-Mart Cost of Capital Wal-Mart, with $55 billion in sales in 1992, is the world's largest retailer It operates nearly 2000 Wal-Mart discount stores in the United States, approudmately 200 Sam's Clubs membership-warehouse stores, and a specialty distribution segment that serves 30,000 convenienco stores and independent grocers. Discount stores sales accounted for 73 percent of 1992 sales. Membership club salos were the second-largest area, accounting for 22 percent of 1992 sales. The remaining 5 percent of Wal-Mart's salos woro accounted for by McLane & Western convenience store and independent grocer supply division. Thus, Wal-Mart was one of the companies that had resisted the trend toward diversitying into everything from aardvarks to zymometers. Concentration did not mean lack of growth, however. New capital expenditures in 1992 alone were $3.5 billion, plus an associated investment in working capital of $1.8 bilioni. W Wal-Mart was to make optimal capital Investment decisions, it was clear that an accurate estimate of the cost of capital was needed Wal-Mart presently had 2.3 billion shares of common stock outstanding. The stock had a beta of 1.3 and was selling at $30 a share in 1992. The yield to maturity on U.S. Treasury bonds was 6.5% and Treasury bits were selling to yield 3 percent in 1993. Based on dividends to date dividends per share during the year 1993 were expected to be $ 12. Historical dividends per share and earnings per share were as shown here: Year 1982 1983 1984 1985 1986 1987 1988 Dividends 0.01 0.01 0.01 0.02 0.02 0.03 0.04 Earnings 0.06 0.09 0.120.150.200.28 0.37 1989 1990 1991 1992 0.06 0.07 0.09 0.11 0.48 0.57 0.70 0.87 Wal-Mart's balance sheet, of January 31,1993, summarizes the company's financial structure (Table 16-3). Most of the company's debt was not actively traded. However, the company disclosed in a note to the financial statements that long-term debt with a book value of $3.073 had a fair market value of $3.357 billion. Assuming the average stated rate on outstanding securities was 7.5%, the yield to maturity would be 6.87%. It was assumed that other long-term debt would sell at a similar yield to maturity of the debt were publicly sold. Wal-Mart was a heavy user of commercial paper with an average daly balance outstanding for 1992 of $1.184 billion The weighted average before tax interest rate on this paper was 3.5% Wal-Mart has $1.818 bilion in capital lease obligations on the balance sheet. In the footnote there is a historical 8 - 14% imputed discount rate used in calculating this obligation. Given the overall decline in interest rates, the lower end of the range, or 8% is probably the better estimate of what tuture leases will cost. Details of the long-term capitalized lease obligations and additional operating lease obligations are as follows: Year 1993 1994 1995 1996 1997 Thereafter Aggregate Minimum Lease Payments Due (in Millions) 486 476 470 475 464 5316 The thereafter amount is assumed to be due at $443 milion per year for the next 12 years from 1993 to 2009. The market rate of interest to be used to find the market value of these lease obligations is assumed to be 8% There were no shares of proferred stock outstanding. Wal-Mart had a 37% combined federal and state marginal tax rate in 1992. 1990 1997 Thereafter 475 484 5316 The thereafter amount is assumed to be due at $443 million per year for the next 12 yoars from 1993 to 2009. The market rate of interest to be used to find the market value of these lease obligations is assumed to be 8% There were no shares of preferred stock outstanding, Wal-Mart had a 37% combined federal and state marginal tax rate in 1992. Wal-Mart's Balance Sheet Wal-Mart Balance Sheet for January 31, 1993 Assets Current assets Property, plant and equipment Other assets Total Assets 10,197 9794 574 $20,565 Liabilities and Equities Current Llabilities: Accounts Payable 3,873 Commercial paper 1,588 Accrued expenses and taxes 1,233 Long-term debt maturing within 1 year 13 Capital lase obligations due within 1 year 46 Long-term liabilities: Long term dobt 3,073 Capital lease obligations duo within 1 year 1,772 Deferred incomes taxes 207 Shareholders equity: Common stock 230 Capital in excess of par 527 Reinvested earnings 8,003 Total liabilities and stockholder's equity $20,565 Questions: 1) Estimate the market value of each component of the capital structure (Hint: 3 components - 1) Debt 2) Equity 3) Lease) 2) Estimate the required return for each component of the capital structure 3) Estimate WACC for Wal-Mart 207 Lotarred incomes taxes Shareholders equity: Common stock 230 Capital in excess of par 527 Roinvested earnings 8,003 Total liabilities and stockholder's equity $20,565 Questions: 1) Estimate the market value of each component of the capital structure (Hint: 3 components - 1) Debt 2) Equity 3) Lease) 2) Estimate the required return for each component of the capital structure 3) Estimate WACC for Wal-Mart Hints: 3 components - 1) Debt 2) Equity 3) Lease - When calculating Lease obligations, follow this format: Year PVIF @8% Lease Payment 5486,000,000 Present Value 450,000,000 1993 0.9259 1994 1995 1996 1997 1998 to 2009 Total PV of futuro loasos payment + Capital lasos due within 1 year Total value of leases In order to find market value of debt uso: market value of long term debt current portion of long term debt + revolving commercial paper - long term debt USO CAPM to determine Cost of Equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started