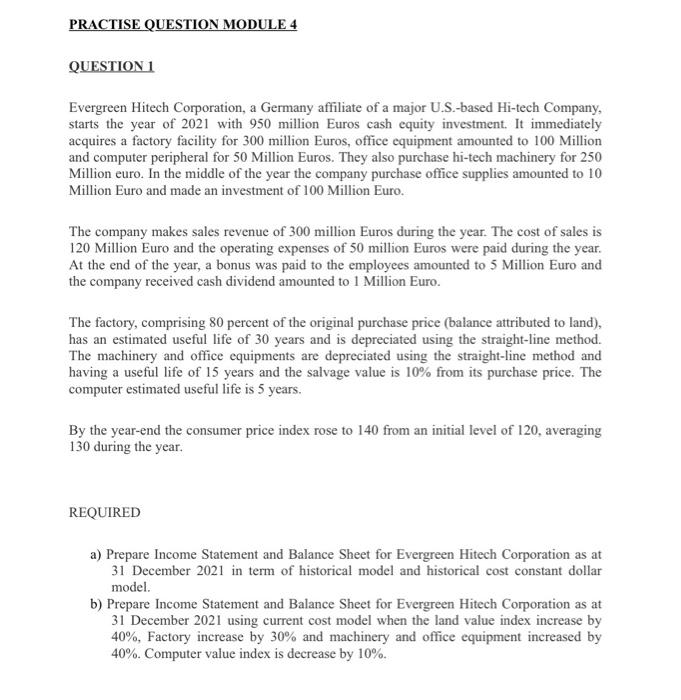

QUESTION 1 Evergreen Hitech Corporation, a Germany affiliate of a major U.S.-based Hi-tech Company, starts the year of 2021 with 950 million Euros cash equity investment. It immediately acquires a factory facility for 300 million Euros, office equipment amounted to 100 Million and computer peripheral for 50 Million Euros. They also purchase hi-tech machinery for 250 Million euro. In the middle of the year the company purchase office supplies amounted to 10 Million Euro and made an investment of 100 Million Euro. The company makes sales revenue of 300 million Euros during the year. The cost of sales is 120 Million Euro and the operating expenses of 50 million Euros were paid during the year. At the end of the year, a bonus was paid to the employees amounted to 5 Million Euro and the company received cash dividend amounted to 1 Million Euro. The factory, comprising 80 percent of the original purchase price (balance attributed to land), has an estimated useful life of 30 years and is depreciated using the straight-line method. The machinery and office equipments are depreciated using the straight-line method and having a useful life of 15 years and the salvage value is 10% from its purchase price. The computer estimated useful life is 5 years. By the year-end the consumer price index rose to 140 from an initial level of 120 , averaging 130 during the year. REQUIRED a) Prepare Income Statement and Balance Sheet for Evergreen Hitech Corporation as at 31 December 2021 in term of historical model and historical cost constant dollar model. b) Prepare Income Statement and Balance Sheet for Evergreen Hitech Corporation as at 31 December 2021 using current cost model when the land value index increase by 40%, Factory increase by 30% and machinery and office equipment increased by 40%. Computer value index is decrease by 10%. QUESTION 1 Evergreen Hitech Corporation, a Germany affiliate of a major U.S.-based Hi-tech Company, starts the year of 2021 with 950 million Euros cash equity investment. It immediately acquires a factory facility for 300 million Euros, office equipment amounted to 100 Million and computer peripheral for 50 Million Euros. They also purchase hi-tech machinery for 250 Million euro. In the middle of the year the company purchase office supplies amounted to 10 Million Euro and made an investment of 100 Million Euro. The company makes sales revenue of 300 million Euros during the year. The cost of sales is 120 Million Euro and the operating expenses of 50 million Euros were paid during the year. At the end of the year, a bonus was paid to the employees amounted to 5 Million Euro and the company received cash dividend amounted to 1 Million Euro. The factory, comprising 80 percent of the original purchase price (balance attributed to land), has an estimated useful life of 30 years and is depreciated using the straight-line method. The machinery and office equipments are depreciated using the straight-line method and having a useful life of 15 years and the salvage value is 10% from its purchase price. The computer estimated useful life is 5 years. By the year-end the consumer price index rose to 140 from an initial level of 120 , averaging 130 during the year. REQUIRED a) Prepare Income Statement and Balance Sheet for Evergreen Hitech Corporation as at 31 December 2021 in term of historical model and historical cost constant dollar model. b) Prepare Income Statement and Balance Sheet for Evergreen Hitech Corporation as at 31 December 2021 using current cost model when the land value index increase by 40%, Factory increase by 30% and machinery and office equipment increased by 40%. Computer value index is decrease by 10%