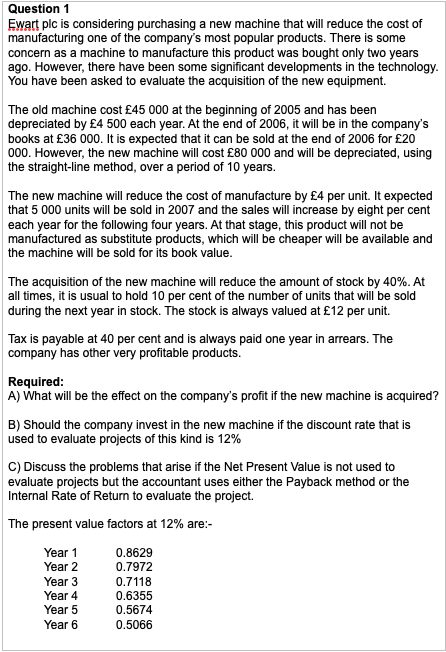

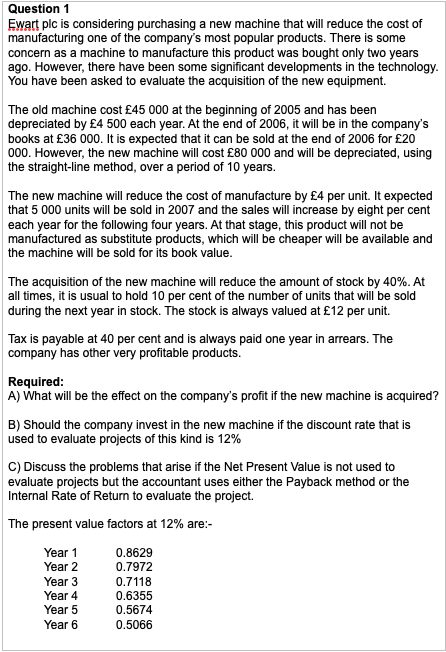

Question 1 Ewart plc is considering purchasing a new machine that will reduce the cost of manufacturing one of the company's most popular products. There is some concern as a machine to manufacture this product was bought only two years ago. However, there have been some significant developments in the technology. You have been asked to evaluate the acquisition of the new equipment. The old machine cost 45 000 at the beginning of 2005 and has been depreciated by 4 500 each year. At the end of 2006, it will be in the company s books at 36 000. It is expected that it can be sold at the end of 2006 for 20 000. However, the new machine will cost 80 000 and will be depreciated, using the straight-line method, over a period of 10 years. The new machine will reduce the cost of manufacture by 4 per unit. It expected that 5 000 units will be sold in 2007 and the sales will increase by eight per cent each year for the following four years. At that stage, this product will not be manufactured as substitute products, which will be cheaper will be available and the machine will be sold for its book value. The acquisition of the new machine will reduce the amount of stock by 40%. At all times, it is usual to hold 10 per cent of the number of units that will be sold during the next year in stock. The stock is always valued at 12 per unit. Tax is payable at 40 per cent and is always paid one year in arrears. The company has other very profitable products. Required: A) What will be the effect on the company's profit if the new machine is acquired? B) Should the company invest in the new machine if the discount rate that is used to evaluate projects of this kind is 12% C) Discuss the problems that arise if the Net Present Value is not used to evaluate projects but the accountant uses either the Payback method or the Internal Rate of Return to evaluate the project. The present value factors at 12% are:- Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 0.8629 0.7972 0.7118 0.6355 0.5674 0.5066 Question 1 Ewart plc is considering purchasing a new machine that will reduce the cost of manufacturing one of the company's most popular products. There is some concern as a machine to manufacture this product was bought only two years ago. However, there have been some significant developments in the technology. You have been asked to evaluate the acquisition of the new equipment. The old machine cost 45 000 at the beginning of 2005 and has been depreciated by 4 500 each year. At the end of 2006, it will be in the company s books at 36 000. It is expected that it can be sold at the end of 2006 for 20 000. However, the new machine will cost 80 000 and will be depreciated, using the straight-line method, over a period of 10 years. The new machine will reduce the cost of manufacture by 4 per unit. It expected that 5 000 units will be sold in 2007 and the sales will increase by eight per cent each year for the following four years. At that stage, this product will not be manufactured as substitute products, which will be cheaper will be available and the machine will be sold for its book value. The acquisition of the new machine will reduce the amount of stock by 40%. At all times, it is usual to hold 10 per cent of the number of units that will be sold during the next year in stock. The stock is always valued at 12 per unit. Tax is payable at 40 per cent and is always paid one year in arrears. The company has other very profitable products. Required: A) What will be the effect on the company's profit if the new machine is acquired? B) Should the company invest in the new machine if the discount rate that is used to evaluate projects of this kind is 12% C) Discuss the problems that arise if the Net Present Value is not used to evaluate projects but the accountant uses either the Payback method or the Internal Rate of Return to evaluate the project. The present value factors at 12% are:- Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 0.8629 0.7972 0.7118 0.6355 0.5674 0.5066