Question

Explain the significance of having 'no spare capacity' in a supplying unit when transfer prices are set using the general transfer pricing rule Question 2:

Explain the significance of having 'no spare capacity' in a supplying unit when transfer prices are set using the general transfer pricing rule

Question 2: Spark Ltd has two divisions, assembly and electrical. The assembly division transfers partially completed components to the electrical division at a predetermined transfer price. The assembly division's standard variable production cost per unit is $550. This division has spare capacity, and it could sell all its components to outside buyers at $680 per unit in a perfectly competitive market

a) Determine a transfer price using the general rule

b) How would the transfer price change if the assembly division had no spare capacity?

c) What transfer price would you recommend if there was no outside market for the transferred component and the assembly division had spare capacity?

d) Explain how negotiation between the supplying and buying units may be used to set transfer prices. How does this relate to the general transfer pricing rule?

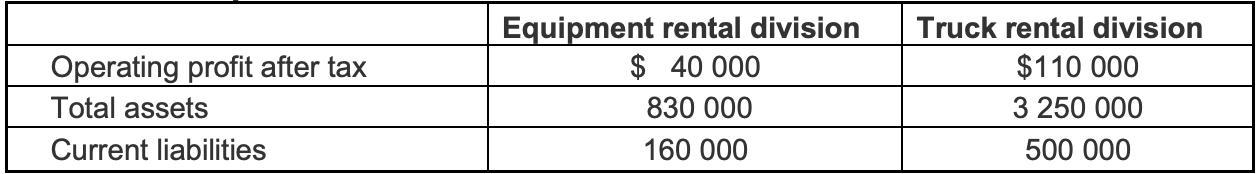

Question 3: Cooper Rentals Ltd consists of two divisions. The equipment rental division rents machinery, such as cement mixers and scissor lifts, to building contractors. The truck rental division rents forklift trucks and removal trucks. The financial results for the two divisions for the most recent year are as follows:

Cooper Rentals obtains its financing from long-term debt and shares, and the weighted average cost of capital is estimated to be 5 percent. To calculate ROI, invested capital is defined as total assets less current liabilities

a) Calculate the ROI for the two divisions

b) Calculate the EVA for each division

c) Which division has performed better? Explain

Equipment rental division $ 40 000 Truck rental division Operating profit after tax $110 000 Total assets 830 000 3 250 000 Current liabilities 160 000 500 000

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 When the supplying division does not have spare capacity the opportunity cost of producing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started