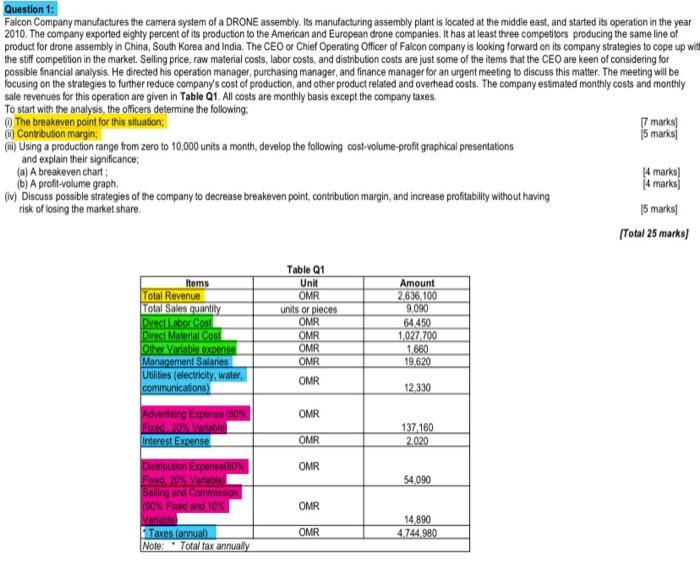

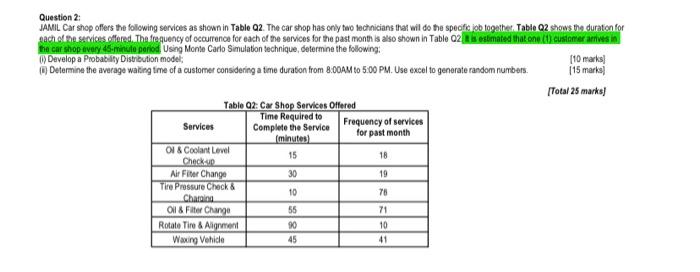

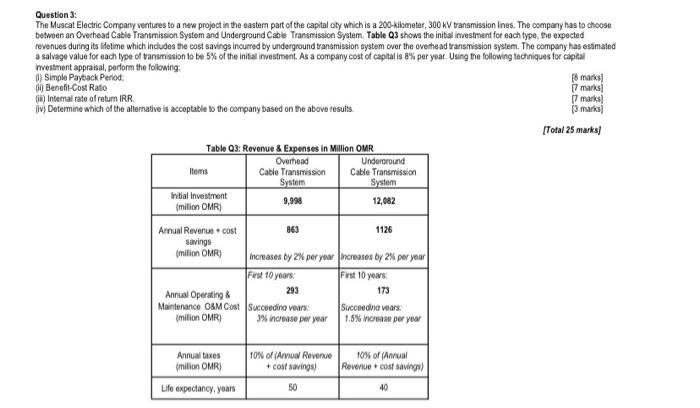

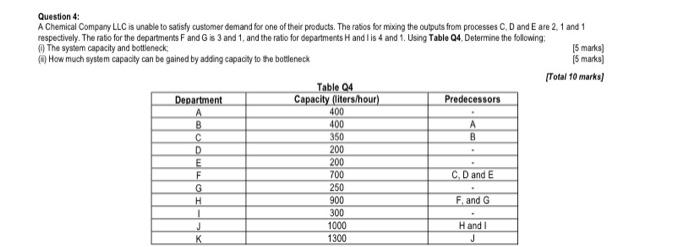

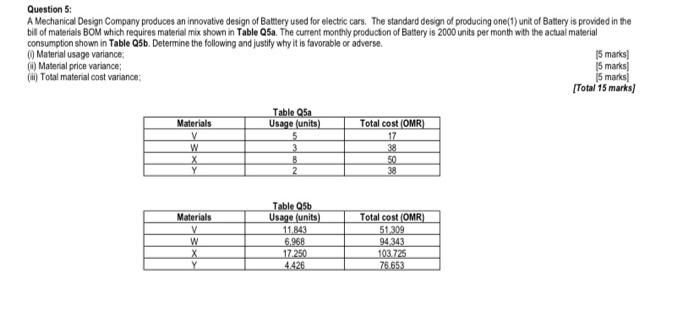

Question 1: Falcon Company manufactures the camera system of a DRONE assembly. Its manufacturing assembly plant is located at the middle east, and started its operation in the year 2010. The company exported eighty percent of its production to the American and European drone companies. It has at least three competitors producing the same line of product for drone assembly in China, South Korea and India. The CEO or Chief Operating Officer of Falcon company is looking forward on its company strategies to cope up with the stiff competition in the market. Selling price, raw material costs, labor costs, and distribution costs are just some of the items that the CEO are keen of considering for possible financial analysis. He directed his operation manager, purchasing manager, and finance manager for an urgent meeting to discuss this matter. The meeting will be focusing on the strategies to further reduce company's cost of production and other product related and overhead costs. The company estimated monthly costs and monthly sale revenues for this operation are given in Table 01. All costs are monthly basis except the company taxes. To start with the analysis, the officers determine the following: The breakeven point for this situation 17 marks! () Contribution margin: 15 marks ) Using a production range from zero to 10,000 units a month, develop the following cost-volume-profit graphical presentations and explain their significance (a) A breakeven chart: [4 marks! b) A profit-volume graph (4 marks (iv) Discuss possible strategies of the company to decrease breakeven point, contribution margin, and increase profitability without having risk of losing the market share. 15 marks) [Total 25 marks) Items Total Revenue Total Sales quantity Direct Labor Cout Direct Material Coll Other Variable expense Management Salaries Utilities (electricity, water, communications) Table 1 Unit OMR units or places OMR OMR OMR OMR OMR Amount 2,636,100 9,090 64 450 1027700 1660 19.620 12,330 OMR Advertising Expense (BO Fixed 2 Variable Interest Expense 137 160 2020 OMR OMR 54 090 Distribution Expense(BO Fixed, 20. Vanadie Selling and Commission (90% Found and 10% Make Taxes fannual Note: Total tax annually OMR 14.890 4.744 980 OMR Question 2: JAMIL Car Shop offers the following services as shown in Table 02. The car shop has only two technicians that will do the specific is together Tablo 2 shows the duration for gach the services offered. The frequency of occurrence for each of the services for the past month is also shown in Table 2. estimated that one (1) customer arrives in the car shop every 45 minuto period Using Monte Carlo Simulation technique determine the following: Develop a Probability Distribution model [10 marks Determine the average wating time of a customer considering a time duration from 8:00AM to 5:00 PM. Use excel to generate random numbers 115 marks [Total 25 marks! Table 02: Car Shop Services Offered Time Required to Frequency of services Services Complete the Service for past month minutes) Ol & Coolant Level 15 18 Check up Air Filter Change 30 19 Tire Pressure Check & 10 78 Charging Oil & Fiter Change 55 71 Rotato Tire & Algement 90 10 Waxing Vehide 41 45 Question 3: The Muscat Electric Company ventures to a new project in the eastern part of the capital city which is a 200-kilometer, 300 kV transmission lines. The company has to choose between an Overhead Cable Transmission System and Underground Cable Transmission System. Tablo Q3 shows the initial investment for each type, the expected revenues during its lifetime which includes the cost savings incurred by underground transmission system over the overhead transmission system. The company has estimated a salvage value for each type of tansmission to be 5% of the initial investment. As a company cost of capital is 8% per year. Using the following techniques for capital investment appraisal, perform the following 0) Simple Payback Period 18 marks] 0 Benefit-Cost Ratio 17 marks) Intemal rate of return IRR. 17 marks) Determine which of the alternative is acceptable to the company based on the above results. 13 marks [Total 25 marks Table 03: Revenue & Expenses in Million OMR Overhead Underground Items Cable Transmission Cable Transmission System System Initial Investment 9,998 12,082 milion OMR) Annual Revenue + cost 863 1126 savings (milion OMR) increases by 2% per year increases by 2% per your First 10 years: Fest 10 years Annual Operating & 293 173 Maintenance O&M Cost Succeedino vars Succeedino vars: milion OMR 3% increase per year 1.5% increase per your Annual taxes milion OMR) 10% of (Anual Revenue + cost savings 10% of (Anual Revenue cost saving Life expectancy, years 50 40 A Question 4: A Chemical Company LLC is unable to satisfy customer demand for one of their products. The ratios for mixing the outputs from processes CD and E are 2.1 and 1 respectively. The ratio for the departments F and Gis 3 and 1, and the ratio for departments H and lis 4 and 1. Using Table 04. Determine the following, The system capacity and bottleneck 15 marks) How much system capacity can be gained by adding capacity to the botteneck is marks Total 10 marks Table 04 Department Capacity (liters/hour) Predecessors 400 B A 350 B 200 E 200 700 CD and E G 250 900 F and G 300 J 1000 Handi 1300 400 D F H 1 K J Question 5: A Mechanical Design Company produces an innovative design of Battery used for electric cars. The standard design of producing one(t) unit of Battery is provided in the bill of materiais BOM which requires material mix shown in Table Q5a. The current monthly production of Battery is 2000 units per month with the actual material consumption shown in Table 05b. Determine the following and justity why it is favorable or adverse. Material usage variance 15 marks ) Material price variance; 15 marks (Total material cost variance: 5 marks [Total 15 marks) Table Q5a Usage units) Materials V w Y Total cost (OMR) 17 38 50 38 B 2 Materials V w X Y Table Q5b Usage units) 11.843 6.968 17.250 4426 Total cost (OMR) 51309 94343 103725 78653 Question 1: Falcon Company manufactures the camera system of a DRONE assembly. Its manufacturing assembly plant is located at the middle east, and started its operation in the year 2010. The company exported eighty percent of its production to the American and European drone companies. It has at least three competitors producing the same line of product for drone assembly in China, South Korea and India. The CEO or Chief Operating Officer of Falcon company is looking forward on its company strategies to cope up with the stiff competition in the market. Selling price, raw material costs, labor costs, and distribution costs are just some of the items that the CEO are keen of considering for possible financial analysis. He directed his operation manager, purchasing manager, and finance manager for an urgent meeting to discuss this matter. The meeting will be focusing on the strategies to further reduce company's cost of production and other product related and overhead costs. The company estimated monthly costs and monthly sale revenues for this operation are given in Table 01. All costs are monthly basis except the company taxes. To start with the analysis, the officers determine the following: The breakeven point for this situation 17 marks! () Contribution margin: 15 marks ) Using a production range from zero to 10,000 units a month, develop the following cost-volume-profit graphical presentations and explain their significance (a) A breakeven chart: [4 marks! b) A profit-volume graph (4 marks (iv) Discuss possible strategies of the company to decrease breakeven point, contribution margin, and increase profitability without having risk of losing the market share. 15 marks) [Total 25 marks) Items Total Revenue Total Sales quantity Direct Labor Cout Direct Material Coll Other Variable expense Management Salaries Utilities (electricity, water, communications) Table 1 Unit OMR units or places OMR OMR OMR OMR OMR Amount 2,636,100 9,090 64 450 1027700 1660 19.620 12,330 OMR Advertising Expense (BO Fixed 2 Variable Interest Expense 137 160 2020 OMR OMR 54 090 Distribution Expense(BO Fixed, 20. Vanadie Selling and Commission (90% Found and 10% Make Taxes fannual Note: Total tax annually OMR 14.890 4.744 980 OMR Question 2: JAMIL Car Shop offers the following services as shown in Table 02. The car shop has only two technicians that will do the specific is together Tablo 2 shows the duration for gach the services offered. The frequency of occurrence for each of the services for the past month is also shown in Table 2. estimated that one (1) customer arrives in the car shop every 45 minuto period Using Monte Carlo Simulation technique determine the following: Develop a Probability Distribution model [10 marks Determine the average wating time of a customer considering a time duration from 8:00AM to 5:00 PM. Use excel to generate random numbers 115 marks [Total 25 marks! Table 02: Car Shop Services Offered Time Required to Frequency of services Services Complete the Service for past month minutes) Ol & Coolant Level 15 18 Check up Air Filter Change 30 19 Tire Pressure Check & 10 78 Charging Oil & Fiter Change 55 71 Rotato Tire & Algement 90 10 Waxing Vehide 41 45 Question 3: The Muscat Electric Company ventures to a new project in the eastern part of the capital city which is a 200-kilometer, 300 kV transmission lines. The company has to choose between an Overhead Cable Transmission System and Underground Cable Transmission System. Tablo Q3 shows the initial investment for each type, the expected revenues during its lifetime which includes the cost savings incurred by underground transmission system over the overhead transmission system. The company has estimated a salvage value for each type of tansmission to be 5% of the initial investment. As a company cost of capital is 8% per year. Using the following techniques for capital investment appraisal, perform the following 0) Simple Payback Period 18 marks] 0 Benefit-Cost Ratio 17 marks) Intemal rate of return IRR. 17 marks) Determine which of the alternative is acceptable to the company based on the above results. 13 marks [Total 25 marks Table 03: Revenue & Expenses in Million OMR Overhead Underground Items Cable Transmission Cable Transmission System System Initial Investment 9,998 12,082 milion OMR) Annual Revenue + cost 863 1126 savings (milion OMR) increases by 2% per year increases by 2% per your First 10 years: Fest 10 years Annual Operating & 293 173 Maintenance O&M Cost Succeedino vars Succeedino vars: milion OMR 3% increase per year 1.5% increase per your Annual taxes milion OMR) 10% of (Anual Revenue + cost savings 10% of (Anual Revenue cost saving Life expectancy, years 50 40 A Question 4: A Chemical Company LLC is unable to satisfy customer demand for one of their products. The ratios for mixing the outputs from processes CD and E are 2.1 and 1 respectively. The ratio for the departments F and Gis 3 and 1, and the ratio for departments H and lis 4 and 1. Using Table 04. Determine the following, The system capacity and bottleneck 15 marks) How much system capacity can be gained by adding capacity to the botteneck is marks Total 10 marks Table 04 Department Capacity (liters/hour) Predecessors 400 B A 350 B 200 E 200 700 CD and E G 250 900 F and G 300 J 1000 Handi 1300 400 D F H 1 K J Question 5: A Mechanical Design Company produces an innovative design of Battery used for electric cars. The standard design of producing one(t) unit of Battery is provided in the bill of materiais BOM which requires material mix shown in Table Q5a. The current monthly production of Battery is 2000 units per month with the actual material consumption shown in Table 05b. Determine the following and justity why it is favorable or adverse. Material usage variance 15 marks ) Material price variance; 15 marks (Total material cost variance: 5 marks [Total 15 marks) Table Q5a Usage units) Materials V w Y Total cost (OMR) 17 38 50 38 B 2 Materials V w X Y Table Q5b Usage units) 11.843 6.968 17.250 4426 Total cost (OMR) 51309 94343 103725 78653