Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Felix Corp has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average

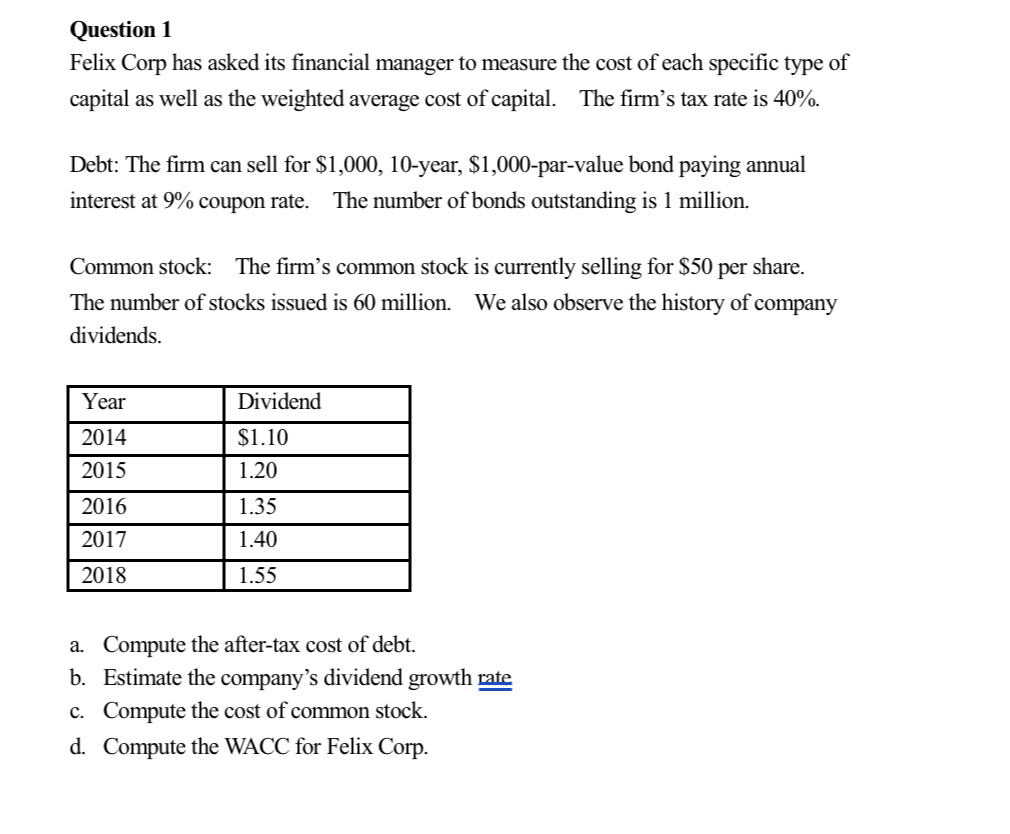

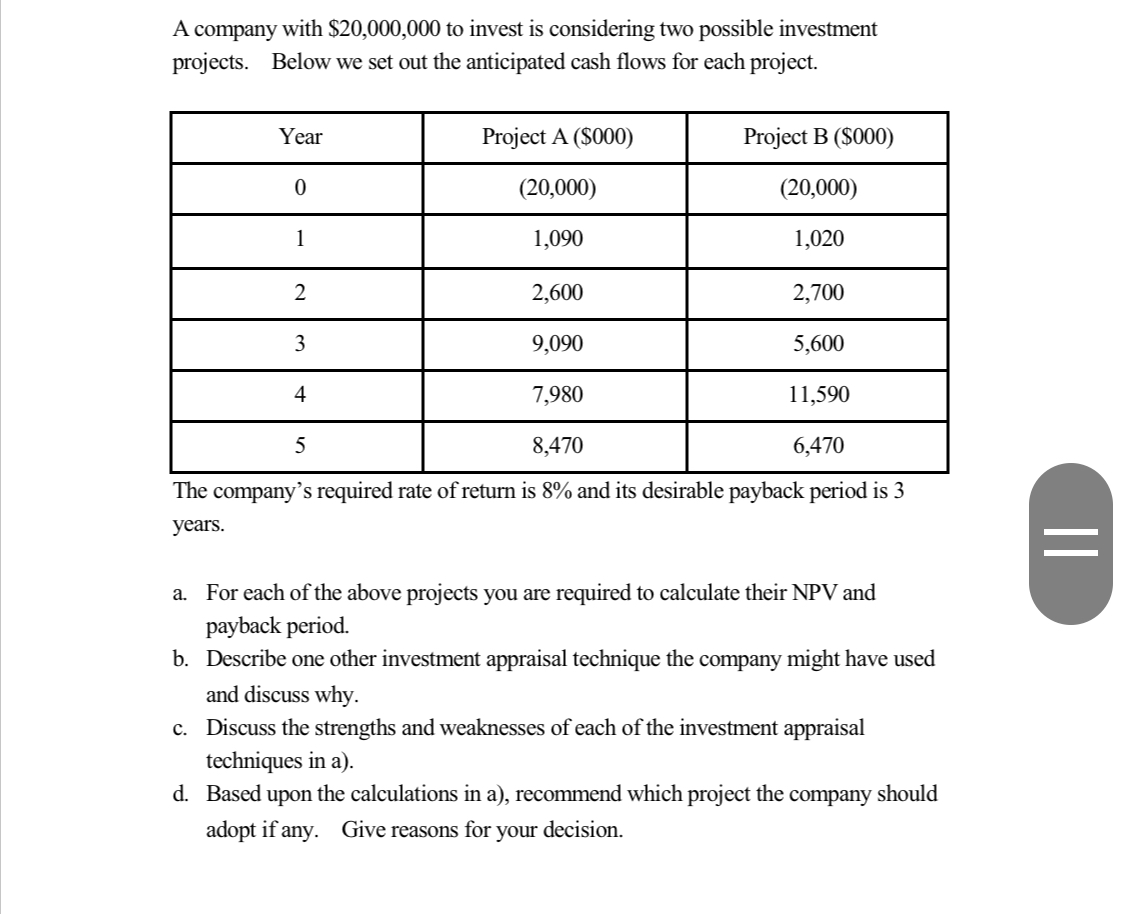

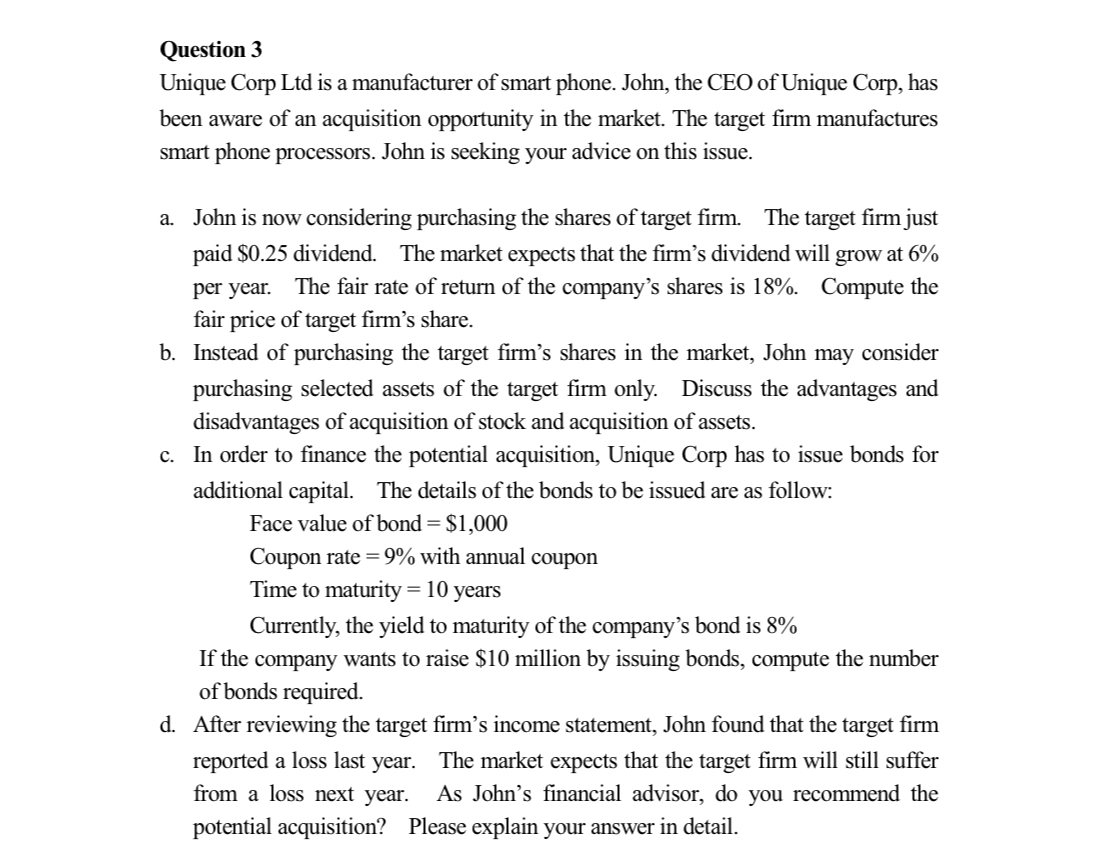

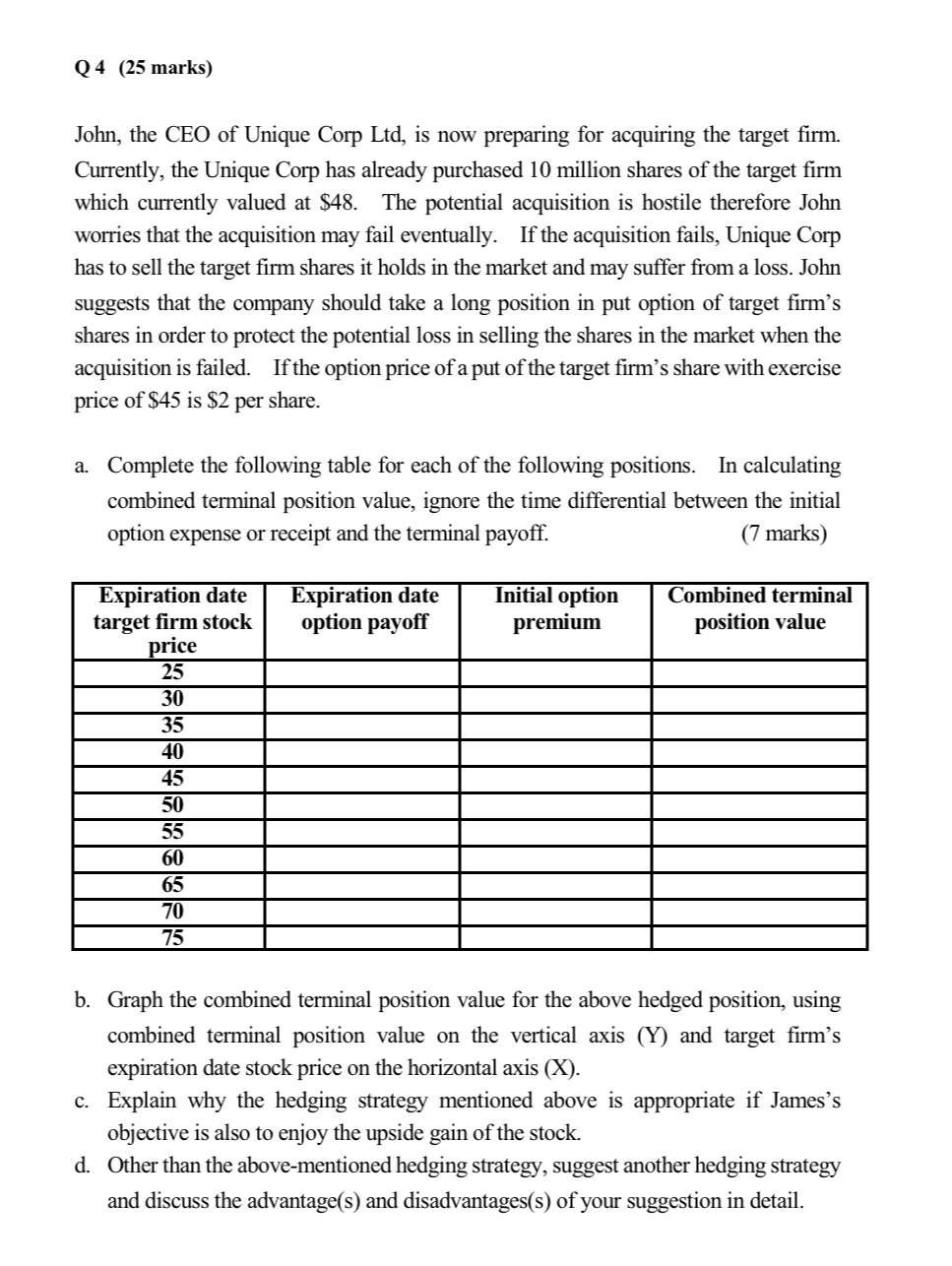

Question 1 Felix Corp has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The firm's tax rate is 40%. Debt: The firm can sell for $1,000,10-year, $1,000-par-value bond paying annual interest at 9% coupon rate. The number of bonds outstanding is 1 million. Common stock: The firm's common stock is currently selling for $50 per share. The number of stocks issued is 60 million. We also observe the history of company dividends. a. Compute the after-tax cost of debt. b. Estimate the company's dividend growth rate c. Compute the cost of common stock. d. Compute the WACC for Felix Corp. A company with $20,000,000 to invest is considering two possible investment projects. Below we set out the anticipated cash flows for each project. The company's required rate of return is 8% and its desirable payback period is 3 years. a. For each of the above projects you are required to calculate their NPV and payback period. b. Describe one other investment appraisal technique the company might have used and discuss why. c. Discuss the strengths and weaknesses of each of the investment appraisal techniques in a). d. Based upon the calculations in a), recommend which project the company should adopt if any. Give reasons for your decision. Question 3 Unique Corp Ltd is a manufacturer of smart phone. John, the CEO of Unique Corp, has been aware of an acquisition opportunity in the market. The target firm manufactures smart phone processors. John is seeking your advice on this issue. a. John is now considering purchasing the shares of target firm. The target firm just paid $0.25 dividend. The market expects that the firm's dividend will grow at 6% per year. The fair rate of return of the company's shares is 18%. Compute the fair price of target firm's share. b. Instead of purchasing the target firm's shares in the market, John may consider purchasing selected assets of the target firm only. Discuss the advantages and disadvantages of acquisition of stock and acquisition of assets. c. In order to finance the potential acquisition, Unique Corp has to issue bonds for additional capital. The details of the bonds to be issued are as follow: Face value of bond =$1,000 Coupon rate =9% with annual coupon Time to maturity =10 years Currently, the yield to maturity of the company's bond is 8% If the company wants to raise $10 million by issuing bonds, compute the number of bonds required. d. After reviewing the target firm's income statement, John found that the target firm reported a loss last year. The market expects that the target firm will still suffer from a loss next year. As John's financial advisor, do you recommend the potential acquisition? Please explain your answer in detail. Q 4 (25 marks) John, the CEO of Unique Corp Ltd, is now preparing for acquiring the target firm. Currently, the Unique Corp has already purchased 10 million shares of the target firm which currently valued at $48. The potential acquisition is hostile therefore John worries that the acquisition may fail eventually. If the acquisition fails, Unique Corp has to sell the target firm shares it holds in the market and may suffer from a loss. John suggests that the company should take a long position in put option of target firm's shares in order to protect the potential loss in selling the shares in the market when the acquisition is failed. If the option price of a put of the target firm's share with exercise price of $45 is $2 per share. a. Complete the following table for each of the following positions. In calculating combined terminal position value, ignore the time differential between the initial option expense or receipt and the terminal payoff. (7 marks) b. Graph the combined terminal position value for the above hedged position, using combined terminal position value on the vertical axis (Y) and target firm's expiration date stock price on the horizontal axis (X). c. Explain why the hedging strategy mentioned above is appropriate if James's objective is also to enjoy the upside gain of the stock. d. Other than the above-mentioned hedging strategy, suggest another hedging strategy and discuss the advantage(s) and disadvantages(s) of your suggestion in detail

Question 1 Felix Corp has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The firm's tax rate is 40%. Debt: The firm can sell for $1,000,10-year, $1,000-par-value bond paying annual interest at 9% coupon rate. The number of bonds outstanding is 1 million. Common stock: The firm's common stock is currently selling for $50 per share. The number of stocks issued is 60 million. We also observe the history of company dividends. a. Compute the after-tax cost of debt. b. Estimate the company's dividend growth rate c. Compute the cost of common stock. d. Compute the WACC for Felix Corp. A company with $20,000,000 to invest is considering two possible investment projects. Below we set out the anticipated cash flows for each project. The company's required rate of return is 8% and its desirable payback period is 3 years. a. For each of the above projects you are required to calculate their NPV and payback period. b. Describe one other investment appraisal technique the company might have used and discuss why. c. Discuss the strengths and weaknesses of each of the investment appraisal techniques in a). d. Based upon the calculations in a), recommend which project the company should adopt if any. Give reasons for your decision. Question 3 Unique Corp Ltd is a manufacturer of smart phone. John, the CEO of Unique Corp, has been aware of an acquisition opportunity in the market. The target firm manufactures smart phone processors. John is seeking your advice on this issue. a. John is now considering purchasing the shares of target firm. The target firm just paid $0.25 dividend. The market expects that the firm's dividend will grow at 6% per year. The fair rate of return of the company's shares is 18%. Compute the fair price of target firm's share. b. Instead of purchasing the target firm's shares in the market, John may consider purchasing selected assets of the target firm only. Discuss the advantages and disadvantages of acquisition of stock and acquisition of assets. c. In order to finance the potential acquisition, Unique Corp has to issue bonds for additional capital. The details of the bonds to be issued are as follow: Face value of bond =$1,000 Coupon rate =9% with annual coupon Time to maturity =10 years Currently, the yield to maturity of the company's bond is 8% If the company wants to raise $10 million by issuing bonds, compute the number of bonds required. d. After reviewing the target firm's income statement, John found that the target firm reported a loss last year. The market expects that the target firm will still suffer from a loss next year. As John's financial advisor, do you recommend the potential acquisition? Please explain your answer in detail. Q 4 (25 marks) John, the CEO of Unique Corp Ltd, is now preparing for acquiring the target firm. Currently, the Unique Corp has already purchased 10 million shares of the target firm which currently valued at $48. The potential acquisition is hostile therefore John worries that the acquisition may fail eventually. If the acquisition fails, Unique Corp has to sell the target firm shares it holds in the market and may suffer from a loss. John suggests that the company should take a long position in put option of target firm's shares in order to protect the potential loss in selling the shares in the market when the acquisition is failed. If the option price of a put of the target firm's share with exercise price of $45 is $2 per share. a. Complete the following table for each of the following positions. In calculating combined terminal position value, ignore the time differential between the initial option expense or receipt and the terminal payoff. (7 marks) b. Graph the combined terminal position value for the above hedged position, using combined terminal position value on the vertical axis (Y) and target firm's expiration date stock price on the horizontal axis (X). c. Explain why the hedging strategy mentioned above is appropriate if James's objective is also to enjoy the upside gain of the stock. d. Other than the above-mentioned hedging strategy, suggest another hedging strategy and discuss the advantage(s) and disadvantages(s) of your suggestion in detail Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started