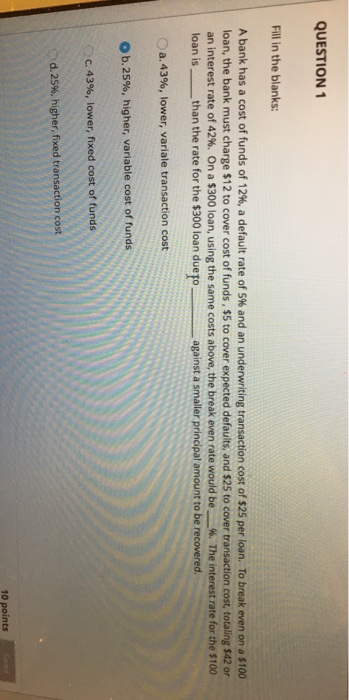

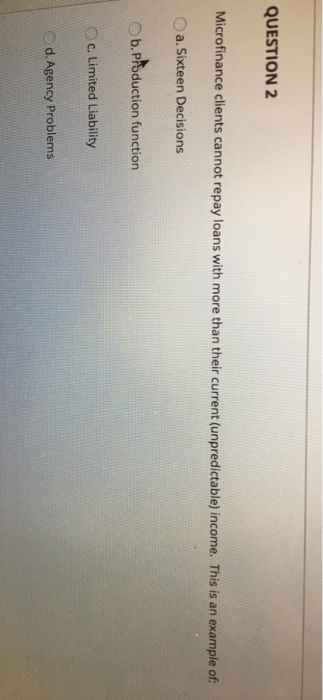

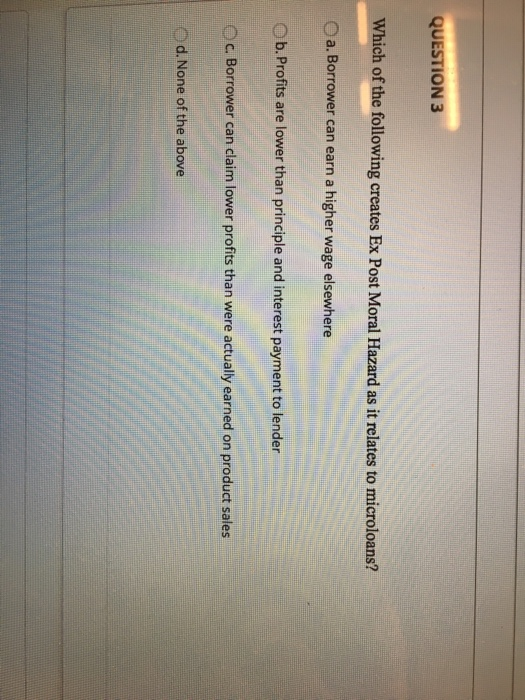

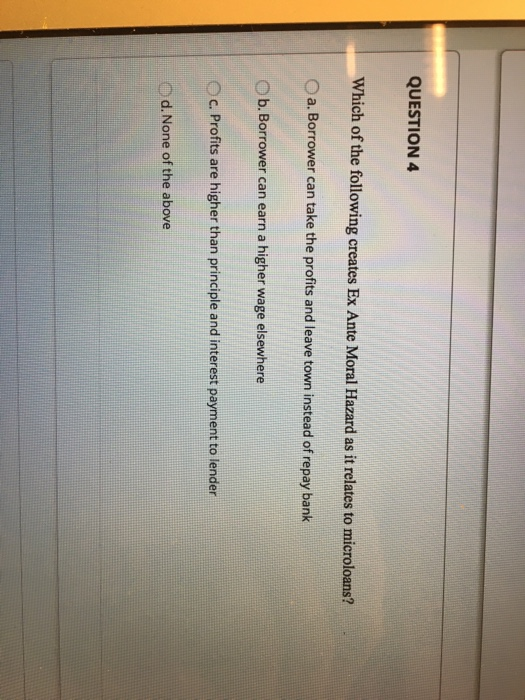

QUESTION 1 Fill in the blanks: A bank has a cost of funds of 12%, a default rate of 5% and an underwriting transaction cost of $25 per loan. To break even on a $100 loan, the bank must charge $12 to cover cost of funds, $5 to cover expected defaults, and $25 to cover transaction cost, totaling $42 or an interest rate of 42%. On a $300 loan, using the same costs above, the break even rate would be--%. The interest rate for the $100 loan is than the rate for the $300 loan duetoagainst a smaller principal amount to be recovered a, 43%, lower, variale transaction cost Ob. 25%, higher, variable cost of funds . 43%, lower, fixed cost of funds -, d, 25%, higher, fixed transaction cost 10 points QUESTION 2 Microfinance clients cannot repay loans with more than their current (unpredictable) income. This is an example of O a. Sixteen Decisions O b. PPoduction function Oc. Limited Liability d. Agency Problems QUESTION 3 Which of the following creates Ex Post Moral Hazard as it relates to microloans? O a. Borrower can earn a higher wage elsewhere O b. Profits are lower than principle and interest payment to lender c. Borrower can claim lower profits than were actually earned on product sales d. None of the above QUESTION 4 Which of the following creates Ex Ante Moral Hazard as it relates to microloans? O a. Borrower can take the profits and leave town instead of repay bank O b. Borrower can earn a higher wage elsewhere c. Profits are higher than principle and interest payment to lender d. None of the above ..ON 5 In lending, the agency problem causes moral hazard. . True False Questoh Completion Status QUESTION 6 1) A banks break even interest rate is determined by the following equation from the reading: k - gross cost of bank q - percentage of safe borrower R bank rate p probability of obtaining revenue (0*p-1) What would cause the overall bank rate R to increase? a. None of the above b. A increase in k, gross cost of capital to the bank c. A decrease in (1-q), percentage of risky borrowers d. An increase in q. percentate of safe borrowers Question Completion Status: QUESTION 7 In a recent Farming Times article, a new online lending platform called MicroGrain was reviewed. The founder and CEO commented, "...Our capital and operating costs are traditional microfinance companies, because we are not dependent on banks for and do not have a brick and mortar structure. .." MicroGrain lends money to rural entrepreneurs at interest rates ranging between 10 per cent and 15 per cent as compared to traditional microfinance rates of 24 per cent to 36 per cent. Repayment rate among borrowers is 96% and increasing over time. Using the break even R formula we discussed in class, how can you explain the lower rates charged by MicroGrain compared to other organizations? k gross cost of bank q- percentage of safe borrower R bank rate P-probablily of otaining revenue Cocpy a. R is higher because k is higher b. R is lower because k is lower O c. k is higher and q is lower d. k is lower and q is lower 1) A banks break even interest rate is determined by the following equation from the reading k -gross cost of bank R bank rate p probability of obtaining revenue (0xpe1) What would cause the overall bank rate R to decrease? O a. A decrease in q, percentage of safe borrowers b. None of the above c. A increase in k, gross cost of capital to the bank d. An increase in q, percentate of safe borrowers to save all answers Click Save and Submit to save and submit. Click Save AllA QUESTION 9 Grameen's five person group lending approach addresses the bank's problems of. 0 a. Adverse selection O b. Moral hazard Oc. Both Od. Neither QUESTION 10 Grameen Bank was incorporated in 1983 as a 100% borrower owned cooperative. True False