Answered step by step

Verified Expert Solution

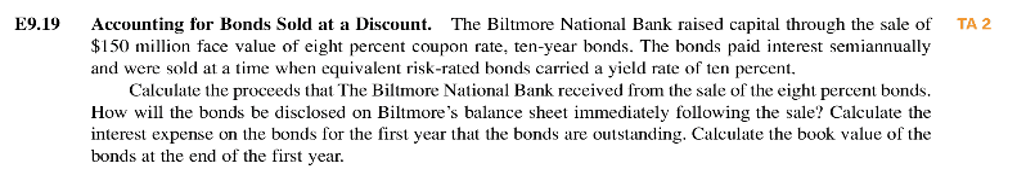

Question

1 Approved Answer

Question 1: Fill in the Bond Amortization Table and the highlighted cells using the information from E9.19 in the Data Tab. Show only positive numbers

| Question 1: Fill in the Bond Amortization Table and the highlighted cells using the information from E9.19 in the Data Tab. Show only positive numbers in the first table. Use Excel to do the calculations and don't round. | ||||||

| Period | Cash Payments | Interest Expense | Amortized Discount | Discount Balance | Face Value | Book Value |

| 0 | 150,000,000 | |||||

| 1 | ||||||

| 2 | ||||||

| Proceeds at Issuance | ||||||

| Total Interest Expense for 1st Year | ||||||

| Balance Sheet Disclosure | At Issuance or Sale | End of Year 1 | ||||

| Bonds Payable (aka Face Value) | ||||||

| Discount (show as a negative number) | ||||||

| Bonds Payable, Net (aka Book Value) | ||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started