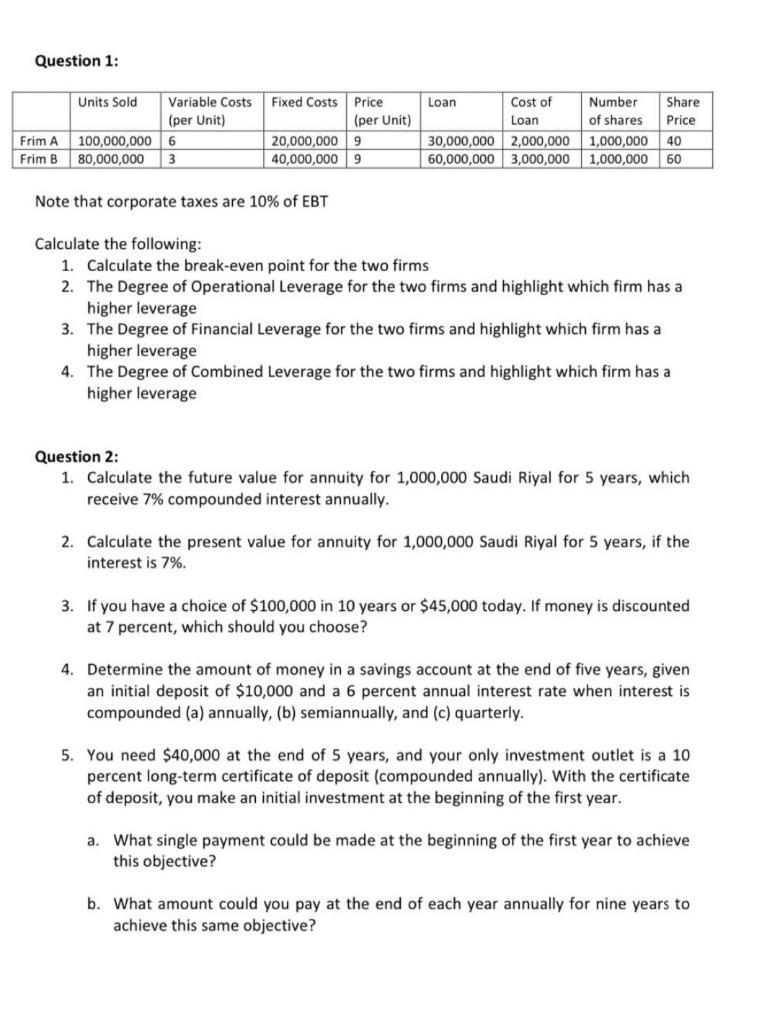

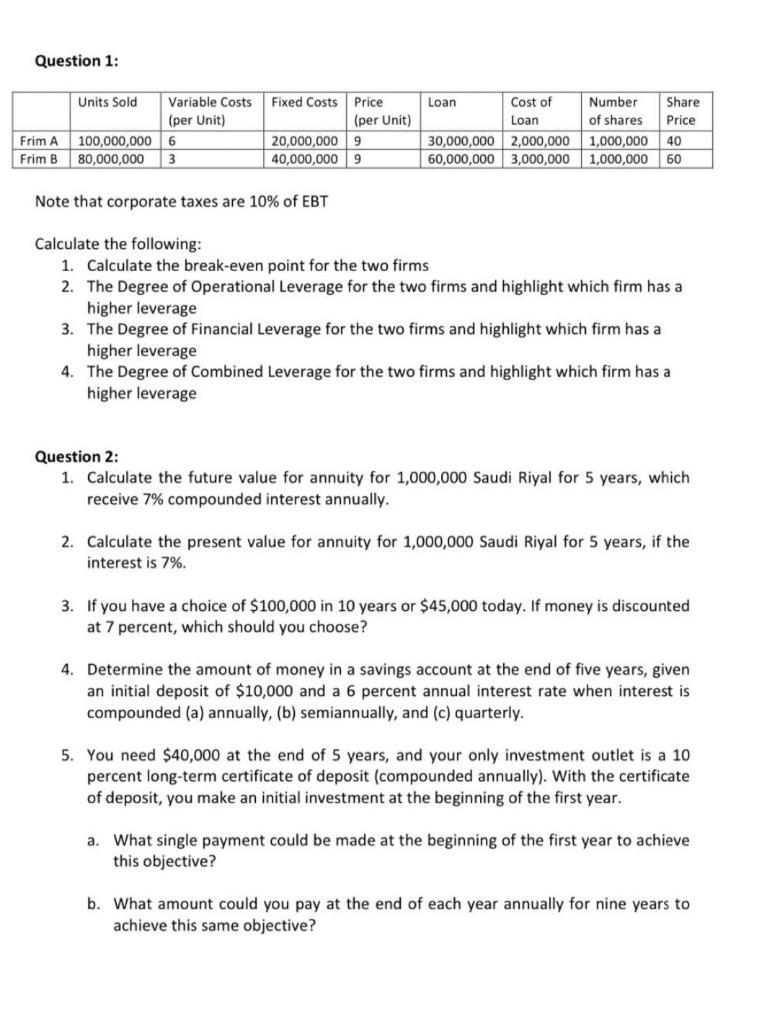

Question 1: Fixed Costs Price (per unit) Share Price Units Soid Variable Costs (per unit) 100,000,000 6 80,000,000 3 Loan Cost of Loan 30,000,000 2,000,000 60,000,000 3,000,000 Number of shares 1,000,000 1,000,000 40 Frim A Frim B 20,000,000 40,000,000 9 9 60 Note that corporate taxes are 10% of EBT Calculate the following: 1. Calculate the break-even point for the two firms 2. The Degree of Operational Leverage for the two firms and highlight which firm has a higher leverage 3. The Degree of Financial Leverage for the two firms and highlight which firm has a higher leverage 4. The Degree of Combined Leverage for the two firms and highlight which firm has a higher leverage Question 2: 1. Calculate the future value for annuity for 1,000,000 Saudi Riyal for 5 years, which receive 7% compounded interest annually. 2. Calculate the present value for annuity for 1,000,000 Saudi Riyal for 5 years, if the interest is 7%. 3. If you have a choice of $100,000 in 10 years or $45,000 today. If money is discounted at 7 percent, which should you choose? 4. Determine the amount of money in a savings account at the end of five years, given an initial deposit of $10,000 and a 6 percent annual interest rate when interest is compounded (a) annually, (b) semiannually, and (c) quarterly. 5. You need $40,000 at the end of 5 years, and your only investment outlet is a 10 percent long-term certificate of deposit (compounded annually). With the certificate of deposit, you make an initial investment at the beginning of the first year. a. What single payment could be made at the beginning of the first year to achieve this objective? b. What amount could you pay at the end of each year annually for nine years to achieve this same objective? Question 1: Fixed Costs Price (per unit) Share Price Units Soid Variable Costs (per unit) 100,000,000 6 80,000,000 3 Loan Cost of Loan 30,000,000 2,000,000 60,000,000 3,000,000 Number of shares 1,000,000 1,000,000 40 Frim A Frim B 20,000,000 40,000,000 9 9 60 Note that corporate taxes are 10% of EBT Calculate the following: 1. Calculate the break-even point for the two firms 2. The Degree of Operational Leverage for the two firms and highlight which firm has a higher leverage 3. The Degree of Financial Leverage for the two firms and highlight which firm has a higher leverage 4. The Degree of Combined Leverage for the two firms and highlight which firm has a higher leverage Question 2: 1. Calculate the future value for annuity for 1,000,000 Saudi Riyal for 5 years, which receive 7% compounded interest annually. 2. Calculate the present value for annuity for 1,000,000 Saudi Riyal for 5 years, if the interest is 7%. 3. If you have a choice of $100,000 in 10 years or $45,000 today. If money is discounted at 7 percent, which should you choose? 4. Determine the amount of money in a savings account at the end of five years, given an initial deposit of $10,000 and a 6 percent annual interest rate when interest is compounded (a) annually, (b) semiannually, and (c) quarterly. 5. You need $40,000 at the end of 5 years, and your only investment outlet is a 10 percent long-term certificate of deposit (compounded annually). With the certificate of deposit, you make an initial investment at the beginning of the first year. a. What single payment could be made at the beginning of the first year to achieve this objective? b. What amount could you pay at the end of each year annually for nine years to achieve this same objective