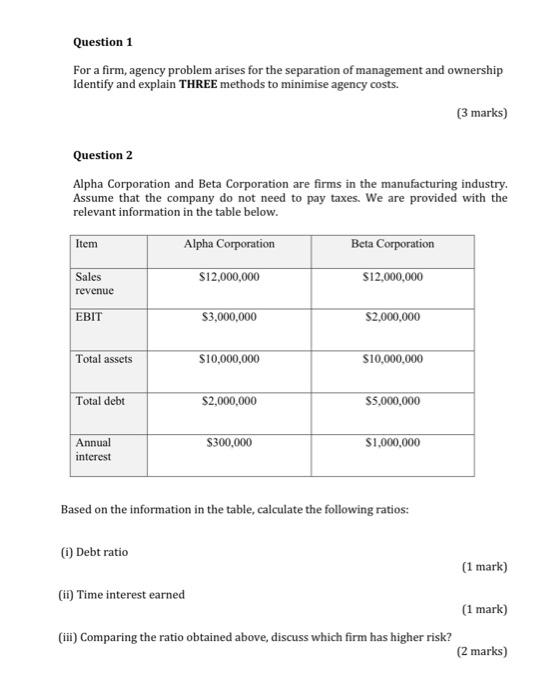

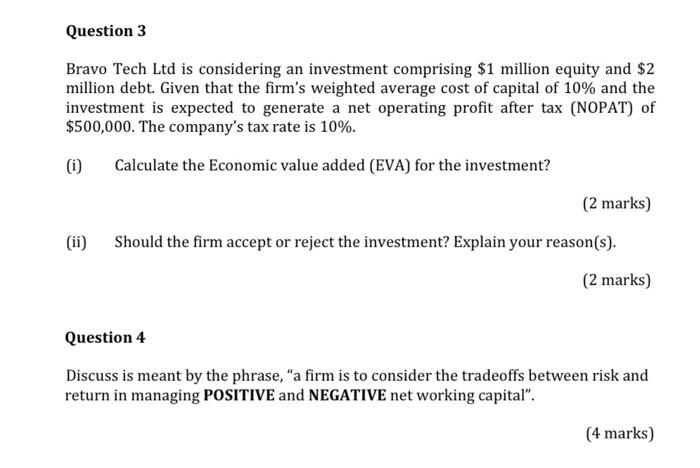

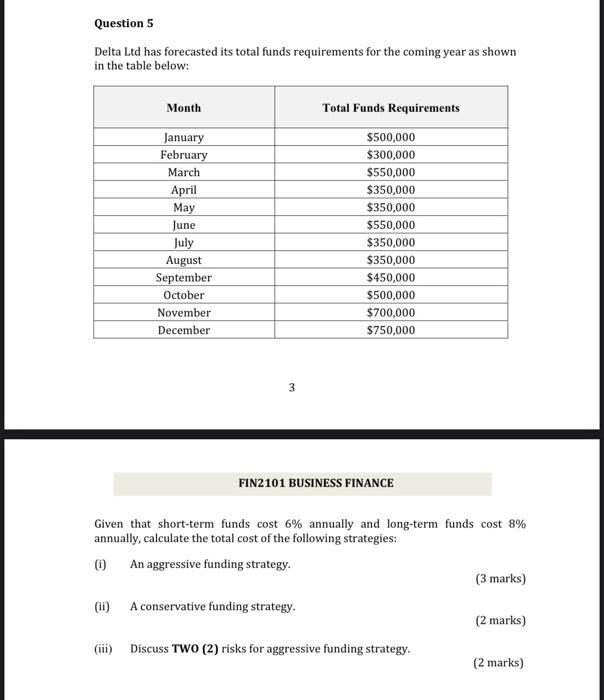

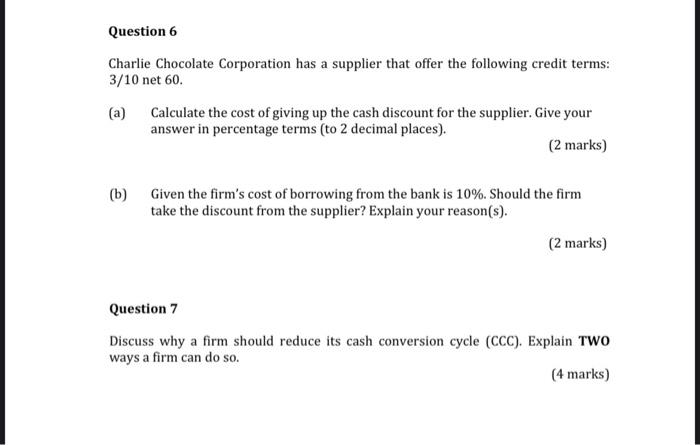

Question 1 For a firm, agency problem arises for the separation of management and ownership Identify and explain THREE methods to minimise agency costs. (3 marks) Question 2 Alpha Corporation and Beta Corporation are firms in the manufacturing industry. Assume that the company do not need to pay taxes. We are provided with the relevant information in the table below. Item Alpha Corporation Beta Corporation Sales revenue $12,000,000 S12,000,000 EBIT $3,000,000 $2,000,000 Total assets $10,000,000 $10,000,000 Total debt $2,000,000 $5,000,000 $300,000 $1,000,000 Annual interest Based on the information in the table, calculate the following ratios: Debt ratio (1 mark) (11) Time interest earned (1 mark) (iii) Comparing the ratio obtained above, discuss which firm has higher risk? (2 marks) Question 3 Bravo Tech Ltd is considering an investment comprising $1 million equity and $2 million debt. Given that the firm's weighted average cost of capital of 10% and the investment is expected to generate a net operating profit after tax (NOPAT) of $500,000. The company's tax rate is 10%. (i) Calculate the Economic value added (EVA) for the investment? (2 marks) Should the firm accept or reject the investment? Explain your reason(s). (ii) (2 marks) Question 4 Discuss is meant by the phrase, "a firm is to consider the tradeoffs between risk and return in managing POSITIVE and NEGATIVE net working capital". (4 marks) Question 5 Delta Ltd has forecasted its total funds requirements for the coming year as shown in the table below: Month Total Funds Requirements January February March April May June July August September October November December $500,000 $300,000 $550,000 $350,000 $350,000 $550,000 $350,000 $350,000 $450,000 $500,000 $700,000 $750,000 3 FIN2101 BUSINESS FINANCE Given that short-term funds cost 6% annually and long-term funds cost 8% annually, calculate the total cost of the following strategies: 0 An aggressive funding strategy. (3 marks) A conservative funding strategy. (2 marks) (iii) Discuss TWO (2) risks for aggressive funding strategy. (2 marks) Question 6 Charlie Chocolate Corporation has a supplier that offer the following credit terms: 3/10 net 60. (a) Calculate the cost of giving up the cash discount for the supplier. Give your answer in percentage terms (to 2 decimal places). (2 marks) (b) Given the firm's cost of borrowing from the bank is 10%. Should the firm take the discount from the supplier? Explain your reason(s). (2 marks) Question 7 Discuss why a firm should reduce its cash conversion cycle (CCC). Explain TWO ways a firm can do so. (4 marks)