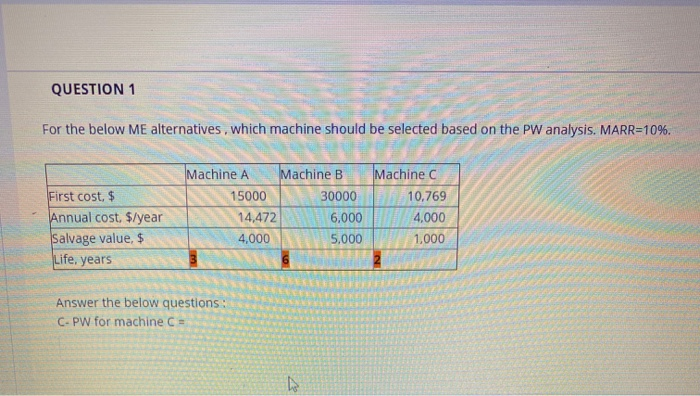

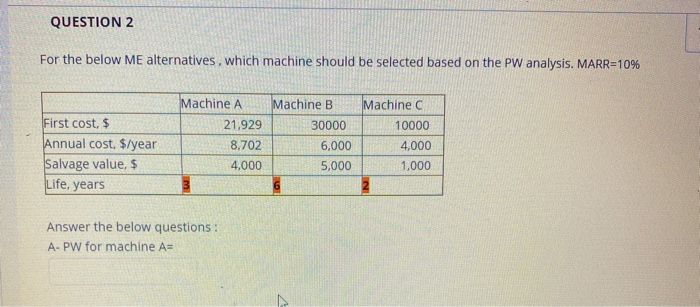

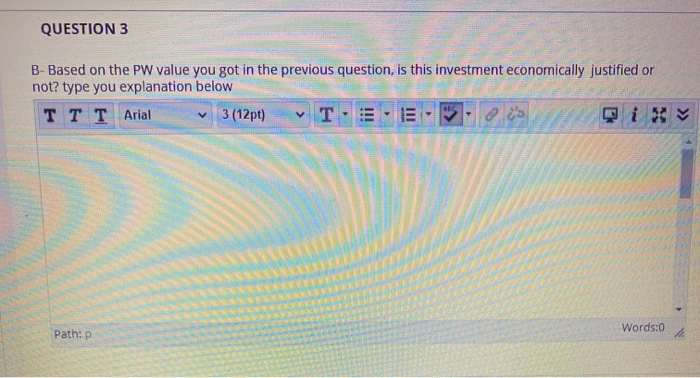

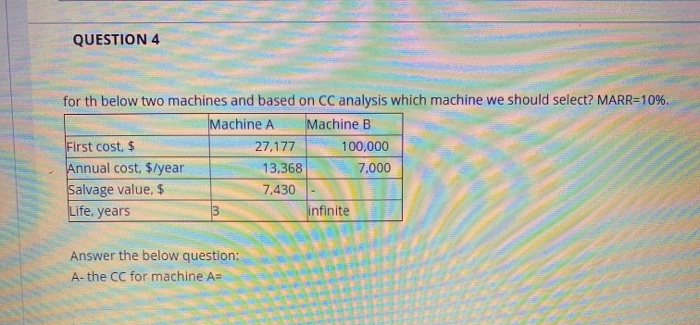

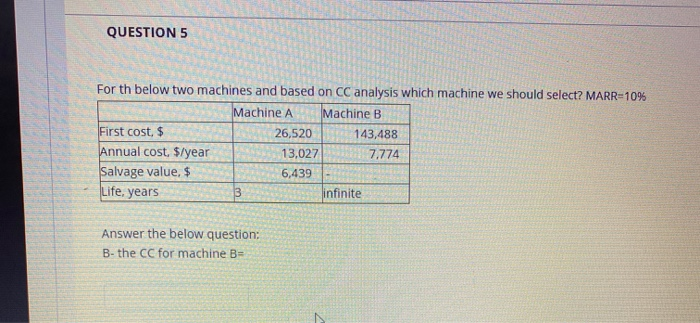

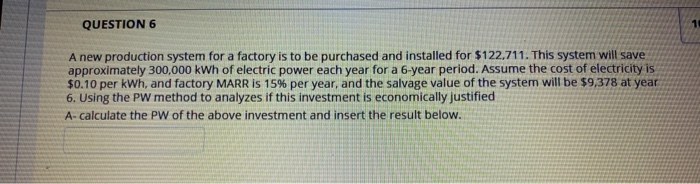

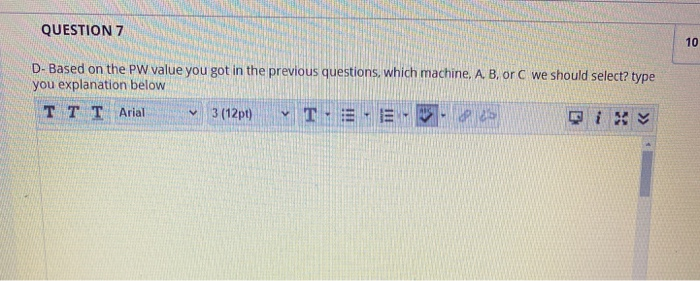

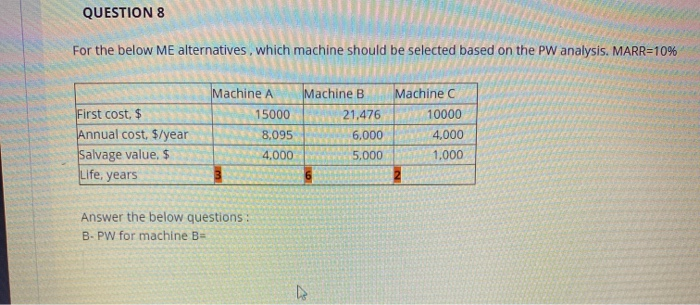

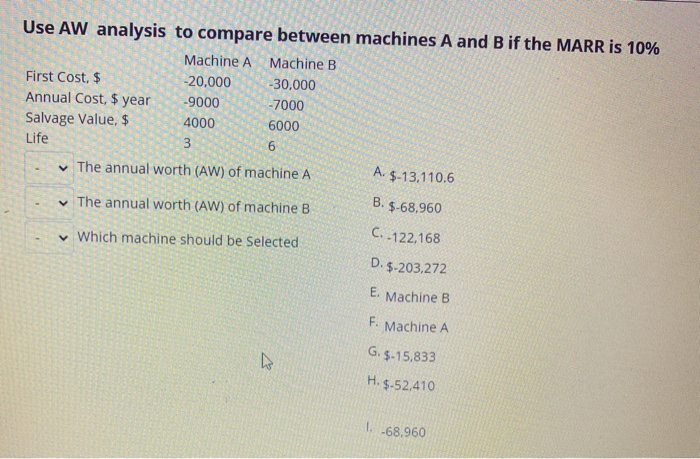

QUESTION 1 For the below ME alternatives, which machine should be selected based on the PW analysis. MARR=10%. First cost, $ Annual cost. $/year Salvage value, $ Life, years Machine A Machine B 15000 30000 14,472 6,000 4,000 5.000 Machine C 10,769 4,000 1,000 Answer the below questions: C-PW for machine C = N QUESTION 2 For the below ME alternatives, which machine should be selected based on the PW analysis. MARR=10% Machine C 10000 First cost, $ Annual cost, $/year Salvage value, $ Life, years Machine A 21,929 8,702 4,000 Machine B 30000 6,000 5,000 4,000 1,000 Answer the below questions: A- PW for machine A= QUESTION 3 B-Based on the PW value you got in the previous question, is this investment economically justified or not? type you explanation below TT T Arial 3 (12pt) T o's III Words:0 Path: P QUESTION 4 for th below two machines and based on CC analysis which machine we should select? MARR=10%. Machine A Machine B First cost, $ 27,177 100,000 Annual cost, $/year 13,368 7,000 Salvage value, $ 7,430 3 infinite Life, years Answer the below question: A-the CC for machine A= QUESTIONS For th below two machines and based on CC analysis which machine we should select? MARR=10% Machine A Machine B First cost, $ 26,520 143,488 Annual cost, $/year 13,027 7,774 Salvage value, $ 6,439 infinite Life, years Answer the below question: B-the CC for machine B- QUESTION 6 A new production system for a factory is to be purchased and installed for $122.711. This system will save approximately 300,000 kWh of electric power each year for a 6-year period. Assume the cost of electricity is $0.10 per kWh, and factory MARR IS 15% per year, and the salvage value of the system will be $9,378 at year 6. Using the PW method to analyzes if this investment is economically justified A-calculate the PW of the above investment and insert the result below. QUESTION 7 10 D- Based on the PW value you got in the previous questions, which machine. A. B, or we should select? type you explanation below TT T Arial 3 (12pt) VT 111 111 QUESTION 8 For the below Me alternatives, which machine should be selected based on the PW analysis. MARR=10% Machine A 15000 Machine B 21,476 6,000 5,000 First cost. $ Annual cost, $/year Salvage value, $ Life, years Machine C 10000 4,000 1,000 8,095 4.000 Answer the below questions: B-PW for machine B- Use AW analysis to compare between machines A and B if the MARR is 10% Machine A Machine B First Cost, $ -20,000 -30,000 Annual Cost, $ year -9000 -7000 Salvage Value, $ 4000 6000 Life 3 6 The annual worth (AW) of machine A A. $-13.110.6 The annual worth (AW) of machine B B. $-68,960 Which machine should be selected C. -122.168 D. $-203,272 E. Machine B F. Machine A G. $-15,833 a H. $-52,410 1.-68.960