Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Ford Co is an investment company looking for takeover targets so as to expand its already diversified portfolio. Two companies are being considered.

QUESTION 1

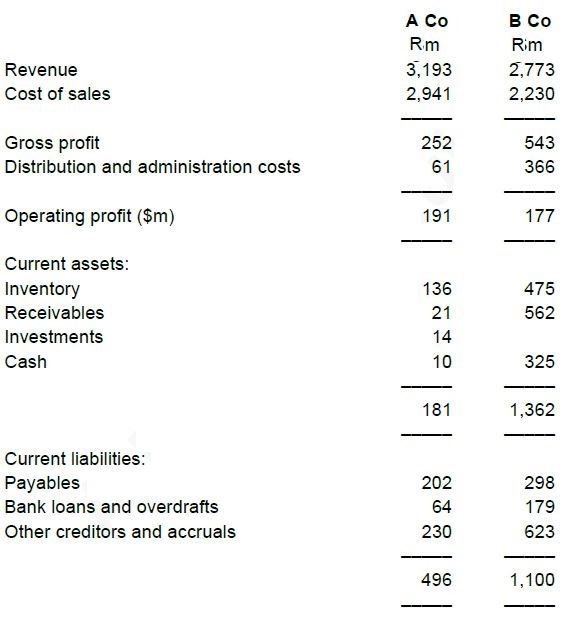

Ford Co is an investment company looking for takeover targets so as to expand its already diversified portfolio. Two companies are being considered. Extracts from their most recent accounts are summarised below.

The following additional points may be relevant.

- B Cos inventory consists of 28 days of finished goods inventory, 40 days of work in progress and 10 days of raw material inventory.

- B Cos receivables period is 74 days and payables period is 49 days.

- A Cos inventory was R134m at the end of the previous year and cost of sales was R2 674m.

- A Cos trade payables were R183m at the end of the previous year.

- What is the length of B Cos Cash Operating Cycle?

- What is the change in A Cos inventory period over the past year?

- A Cos sales were 90% cash and 10% made on account. The receivables figure consisted of 50% receivables and 50% prepayments. How long on average did A Cos receivables take to pay the amounts they owe?

- What is the most appropriate figure for the average time it takes A Co to pay its suppliers?

- Both A Co and B Co considered trying to improve the look of their statements of financial position towards the end of the last financial year by making uncharacteristically large payments to their payables.

What would have been the effect of such payments?

\begin{tabular}{|c|c|c|} \hline & \begin{tabular}{c} A Co \\ Rmm \end{tabular} & \begin{tabular}{l} B Co \\ Rim \end{tabular} \\ \hline Revenue & 3,193 & 2,773 \\ \hline Cost of sales & 2,941 & 2,230 \\ \hline Gross profit & 252 & 543 \\ \hline Distribution and administration costs & 61 & 366 \\ \hline Operating profit ($m) & 191 & 177 \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Inventory & 136 & 475 \\ \hline Receivables & 21 & 562 \\ \hline Investments & 14 & \\ \hline \multirow[t]{2}{*}{ Cash } & 10 & 325 \\ \hline & 181 & 1,362 \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Payables & 202 & 298 \\ \hline Bank loans and overdrafts & 64 & 179 \\ \hline \multirow[t]{2}{*}{ Other creditors and accruals } & 230 & 623 \\ \hline & 496 & 1,100 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started