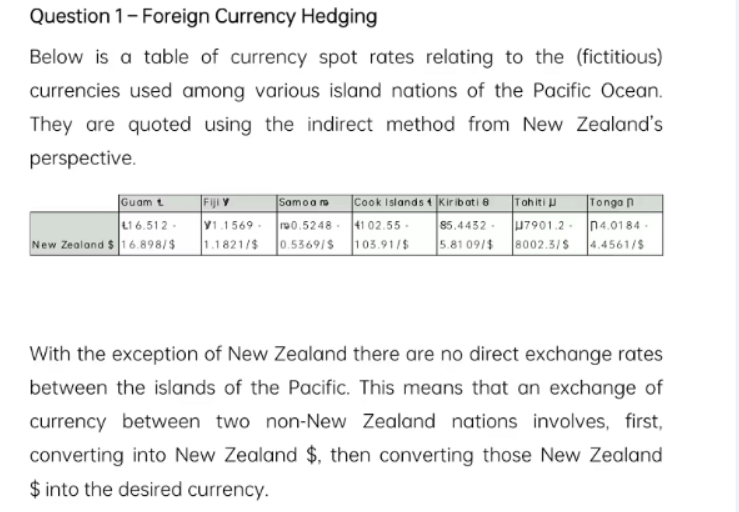

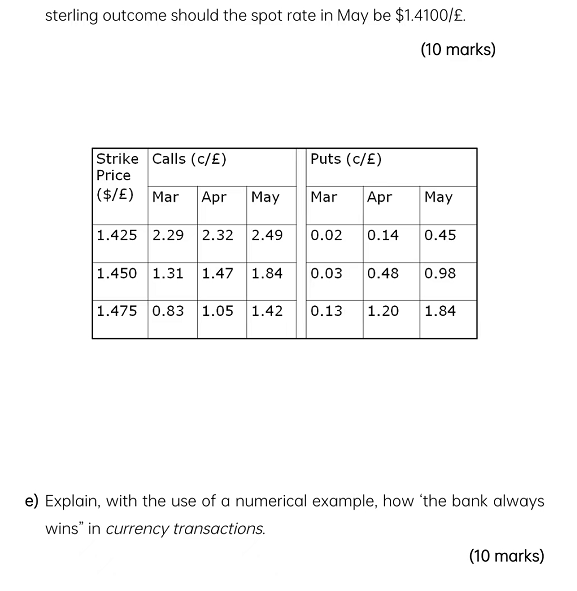

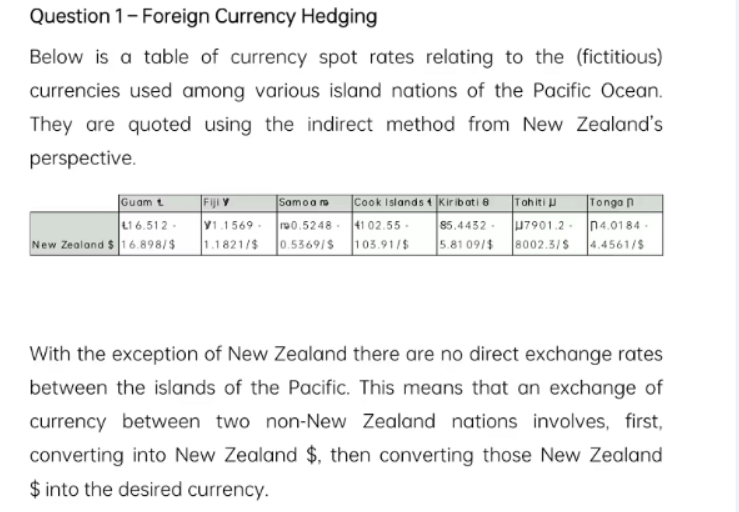

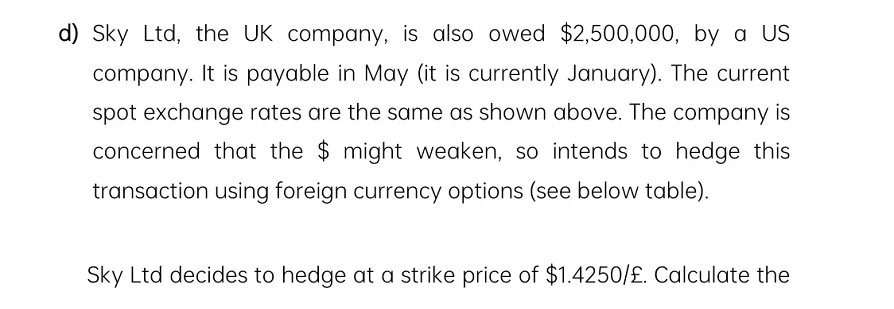

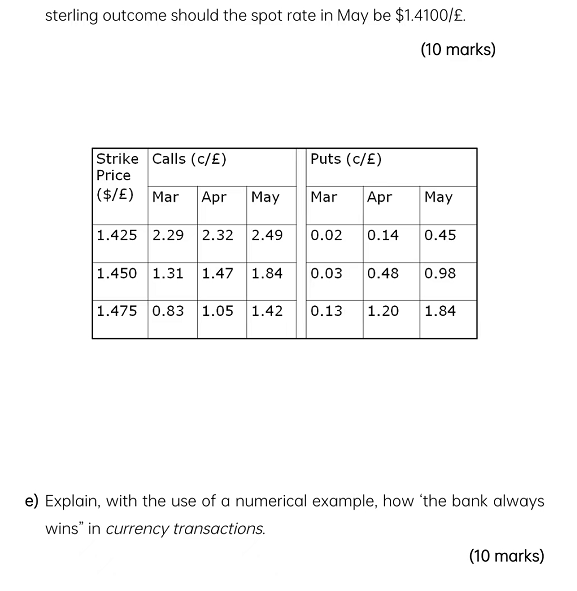

Question 1- Foreign Currency Hedging Below is a table of currency spot rates relating to the (fictitious) currencies used among various island nations of the Pacific Ocean. They are quoted using the indirect method from New Zealand's perspective. Guam t Fiji y 416.512- V1.1569- New Zealand $16.898/$ 1.1821/$ Tonga n Samoam Cook Islands 4 Kiribati 8 Tahiti 0.524841 02.55. 85.4432- U7901.2- n4.0184. 0.5369/$ 103.91/$ 5.81 09/$ 8002.3/$ 4.4561/$ With the exception of New Zealand there are no direct exchange rates between the islands of the Pacific. This means that an exchange of currency between two non-New Zealand nations involves, first, converting into New Zealand $, then converting those New Zealand $ into the desired currency. c) What type of hedge would you recommend to the company? Consider forward contract, money market and futures contract, and show all calculations. (21 marks) d) Sky Ltd, the UK company, is also owed $2,500,000, by a US company. It is payable in May (it is currently January). The current spot exchange rates are the same as shown above. The company is concerned that the $ might weaken, so intends to hedge this transaction using foreign currency options (see below table). Sky Ltd decides to hedge at a strike price of $1.4250/. Calculate the sterling outcome should the spot rate in May be $1.4100/. (10 marks) Strike Calls (c/) Price ($/E) Mar Apr May 1.425 2.29 2.32 2.49 Puts (c/) Mar Apr May 0.02 0.14 0.45 1.450 1.31 1.47 1.84 0.03 0.48 0.98 1.475 0.83 1.05 1.42 0.13 1.20 1.84 e) Explain, with the use of a numerical example, how the bank always wins" in currency transactions. (10 marks) Question 1- Foreign Currency Hedging Below is a table of currency spot rates relating to the (fictitious) currencies used among various island nations of the Pacific Ocean. They are quoted using the indirect method from New Zealand's perspective. Guam t Fiji y 416.512- V1.1569- New Zealand $16.898/$ 1.1821/$ Tonga n Samoam Cook Islands 4 Kiribati 8 Tahiti 0.524841 02.55. 85.4432- U7901.2- n4.0184. 0.5369/$ 103.91/$ 5.81 09/$ 8002.3/$ 4.4561/$ With the exception of New Zealand there are no direct exchange rates between the islands of the Pacific. This means that an exchange of currency between two non-New Zealand nations involves, first, converting into New Zealand $, then converting those New Zealand $ into the desired currency. c) What type of hedge would you recommend to the company? Consider forward contract, money market and futures contract, and show all calculations. (21 marks) d) Sky Ltd, the UK company, is also owed $2,500,000, by a US company. It is payable in May (it is currently January). The current spot exchange rates are the same as shown above. The company is concerned that the $ might weaken, so intends to hedge this transaction using foreign currency options (see below table). Sky Ltd decides to hedge at a strike price of $1.4250/. Calculate the sterling outcome should the spot rate in May be $1.4100/. (10 marks) Strike Calls (c/) Price ($/E) Mar Apr May 1.425 2.29 2.32 2.49 Puts (c/) Mar Apr May 0.02 0.14 0.45 1.450 1.31 1.47 1.84 0.03 0.48 0.98 1.475 0.83 1.05 1.42 0.13 1.20 1.84 e) Explain, with the use of a numerical example, how the bank always wins" in currency transactions. (10 marks)