Answered step by step

Verified Expert Solution

Question

1 Approved Answer

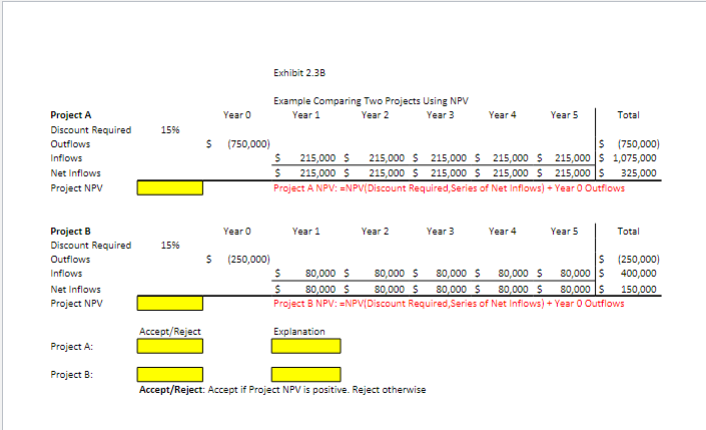

Question 1 From the NPV worksheet, would you Accept or Reject Project B? Group of answer choices Accept Reject Question 2 From the NPV worksheet,

Question 1

From the NPV worksheet, would you Accept or Reject Project B?

Group of answer choices

Accept

Reject

Question 2

From the NPV worksheet, What is the NPV of Project A?

Group of answer choices

-$29,287

$32,311

-$18,175

$325,000

Question 3

From the NPV worksheet, what is the NPV of Project B?

Group of answer choices

$29,287

$150,000

$18,172

$32,311

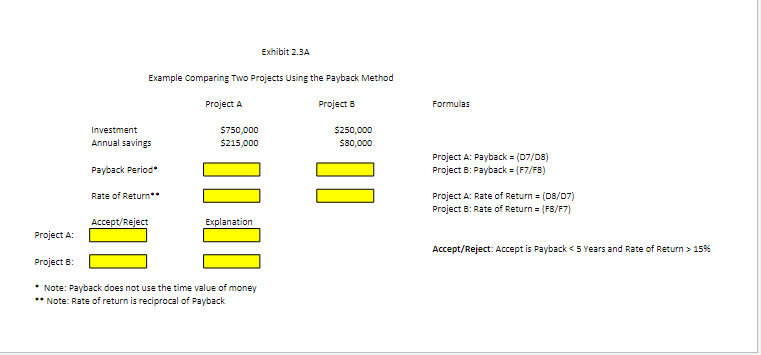

Year 4 15% Project A Discount Required Outflows Inflows Net Inflows Project NPV Exhibit 2.38 Example Comparing Two Projects Using NPV Year o Year 1 Year 2 Year 3 Year 5 Total 5 (750,000) $750,000) $ 215,000 $ 215,000 $ 215,000 $ 215,000 $ 215,000 1,075,000 S 215,000 $ 215,000 $ 215,000 $ 215,000 $ 215,000 325,000 Project A NPV: =NPV(Discount Required Series of Net Inflows) + Year 0 Outflows 15% Project B Discount Required Outflows Inflows Net Inflows Project NPV Year o Year 1 Year 2 Year 3 Year 4 Year 5 Total $ (250,000) S (250,000) $ 80,000 $ 80,000 $ 80,000 S 80,000 $ 80,000 $ 400,000 $ 80,000 $80,000 80,000 $80,000 $80,000 150,000 Project BNPV:=NPV/Discount Required, Series of Net Inflows) + Year O Outflows Accept/Reject Explanation Project A: Project B: Accept/Reject: Accept if Project NPV is positive. Reject otherwise Exhibit 2.3A Example Comparing Two Projects Using the Payback Method Project A Project B Formulas Investment Annual savings $750,000 $215,000 $250,000 $80,000 Project A: Payback = (07/08) Project B: Payback = (F7/FB) Payback Period Rate of Return** Project A: Rate of Return = (08/07) Project 8: Rate of Return = (FB/F7) Accept/Reject Explanation Project A: Accept/Reject: Accept is Payback 15% Project B: Note: Payback does not use the time value of money ** Note: Rate of return is reciprocal of Payback

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started