Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Full Question ASSIGNMENTI FINANCIAL ACCOUNTING IFA260US QUESTION 1 The partnership of A. Ashipala, B. Mbanguta and C. Tjatindindi are in partnership sharing profits

Question 1 Full Question

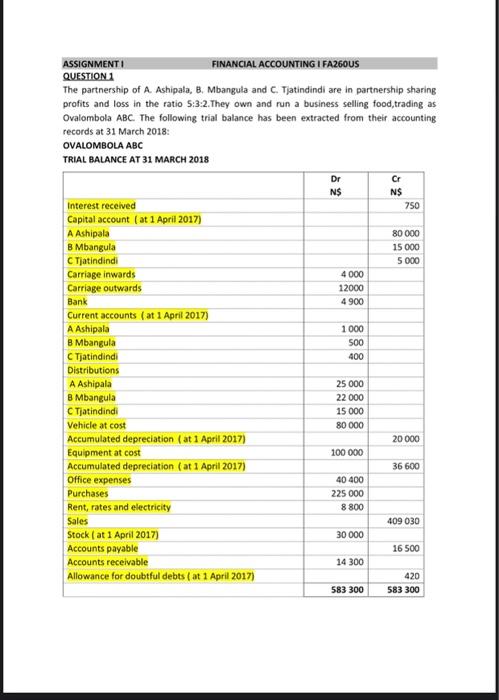

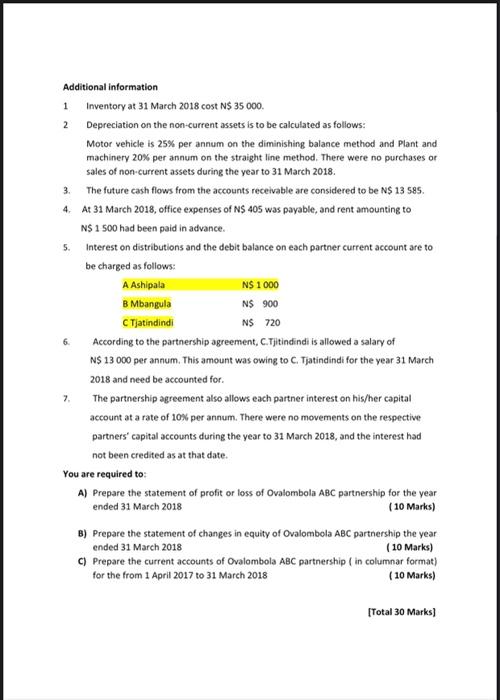

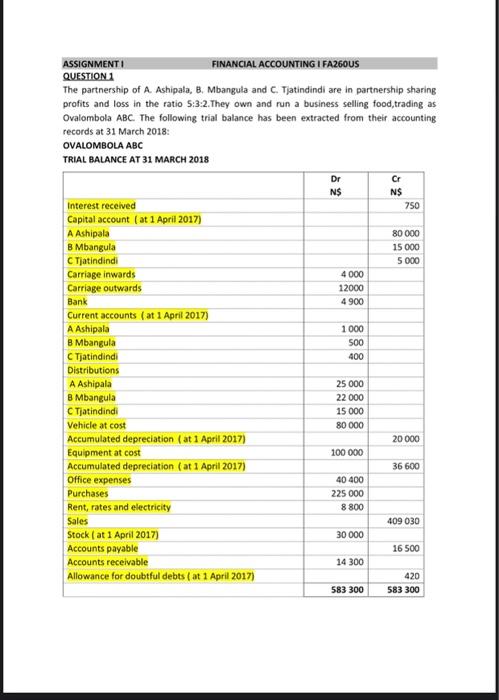

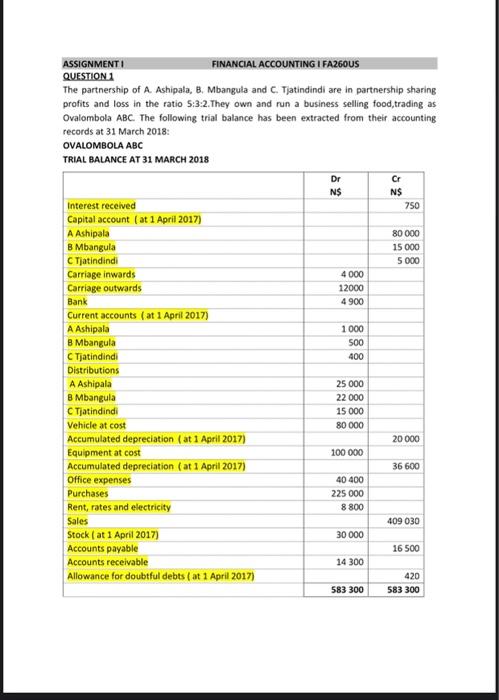

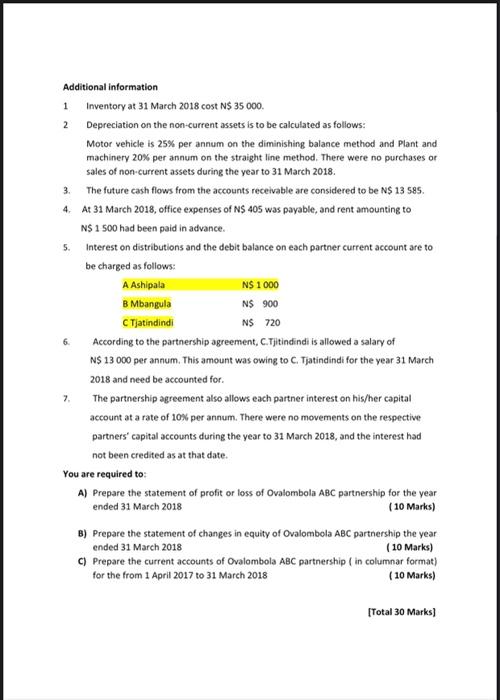

ASSIGNMENTI FINANCIAL ACCOUNTING IFA260US QUESTION 1 The partnership of A. Ashipala, B. Mbanguta and C. Tjatindindi are in partnership sharing profits and loss in the ratio 5:3:2. They own and run a business selling food, trading as Ovalombola ABC. The following trial balance has been extracted from their accounting records at 31 March 2018 OVALOMBOLA ABC TRIAL BALANCE AT 31 MARCH 2018 Dr N$ Cr N$ 750 80 000 15 000 5 000 4000 12000 4 900 1 000 500 400 Interest received Capital account ( at 1 April 2017) A Ashipala B Mbangula C Tjatindindi Carriage inwards Carriage outwards Bank Current accounts (at 1 April 2017) A Ashipala B Mbangula C Tjatindindi Distributions A Ashipala B Mbangula C Tjatindindi Vehicle at cost Accumulated depreciation (at 1 April 2017) Equipment at cost Accumulated depreciation (at 1 April 2017) Office expenses Purchases Rent, rates and electricity Sales Stock ( at 1 April 2017) Accounts payable Accounts receivable Allowance for doubtful debts ( at 1 April 2017) 25 000 22 000 15 000 80 000 20 000 100 000 36 600 40 400 225 000 8 800 409 030 30 000 16 500 14 300 420 583 300 583 300 5. Additional information 1 Inventory at 31 March 2018 cost N$ 35 000. 2 Depreciation on the non-current assets is to be calculated as follows: Motor vehicle is 25% per annum on the diminishing balance method and Plant and machinery 20% per annum on the straight line method. There were no purchases or sales of non-current assets during ng the year to 3 0 31 March 2018 3. The future cash flows from the accounts receivable are considered to be N$ 13 585. 4. At 31 March 2018, office expenses of N$ 405 was payable, and rent amounting to N$ 1500 had been paid in advance. Interest on distributions and the debit balance on each partner current account are to be charged as follows: A Ashipala N$ 1000 B Mbangula N$ 900 C Tjatindindi NS 720 According to the partnership agreement, C.Tjitindindi is allowed a salary of N$ 13 000 per annum. This amount was owing to C. Tjatindindi for the year 31 March 2018 and need be accounted for. The partnership agreement also altows each partner interest on his/her capital account at a rate of 10% per annum. There were no movements on the respective partners' capital accounts during the year to 31 March 2018, and the interest had not been credited as at that date. You are required to: A) Prepare the statement of profit or loss of Ovatombola ABC partnership for the year ended 31 March 2018 (10 Marks) B) Prepare the statement of changes in equity of Ovalombola A8C partnership the year ended 31 March 2018 (10 Marks) Prepare the current accounts of Ovalombola ABC partnership (in columnar format) for the from 1 April 2017 to 31 March 2018 (10 Marks) [Total 30 Marks) ASSIGNMENTI FINANCIAL ACCOUNTING IFA260US QUESTION 1 The partnership of A. Ashipala, B. Mbanguta and C. Tjatindindi are in partnership sharing profits and loss in the ratio 5:3:2. They own and run a business selling food, trading as Ovalombola ABC. The following trial balance has been extracted from their accounting records at 31 March 2018 OVALOMBOLA ABC TRIAL BALANCE AT 31 MARCH 2018 Dr N$ Cr N$ 750 80 000 15 000 5 000 4000 12000 4 900 1 000 500 400 Interest received Capital account ( at 1 April 2017) A Ashipala B Mbangula C Tjatindindi Carriage inwards Carriage outwards Bank Current accounts (at 1 April 2017) A Ashipala B Mbangula C Tjatindindi Distributions A Ashipala B Mbangula C Tjatindindi Vehicle at cost Accumulated depreciation (at 1 April 2017) Equipment at cost Accumulated depreciation (at 1 April 2017) Office expenses Purchases Rent, rates and electricity Sales Stock ( at 1 April 2017) Accounts payable Accounts receivable Allowance for doubtful debts ( at 1 April 2017) 25 000 22 000 15 000 80 000 20 000 100 000 36 600 40 400 225 000 8 800 409 030 30 000 16 500 14 300 420 583 300 583 300 5. Additional information 1 Inventory at 31 March 2018 cost N$ 35 000. 2 Depreciation on the non-current assets is to be calculated as follows: Motor vehicle is 25% per annum on the diminishing balance method and Plant and machinery 20% per annum on the straight line method. There were no purchases or sales of non-current assets during ng the year to 3 0 31 March 2018 3. The future cash flows from the accounts receivable are considered to be N$ 13 585. 4. At 31 March 2018, office expenses of N$ 405 was payable, and rent amounting to N$ 1500 had been paid in advance. Interest on distributions and the debit balance on each partner current account are to be charged as follows: A Ashipala N$ 1000 B Mbangula N$ 900 C Tjatindindi NS 720 According to the partnership agreement, C.Tjitindindi is allowed a salary of N$ 13 000 per annum. This amount was owing to C. Tjatindindi for the year 31 March 2018 and need be accounted for. The partnership agreement also altows each partner interest on his/her capital account at a rate of 10% per annum. There were no movements on the respective partners' capital accounts during the year to 31 March 2018, and the interest had not been credited as at that date. You are required to: A) Prepare the statement of profit or loss of Ovatombola ABC partnership for the year ended 31 March 2018 (10 Marks) B) Prepare the statement of changes in equity of Ovalombola A8C partnership the year ended 31 March 2018 (10 Marks) Prepare the current accounts of Ovalombola ABC partnership (in columnar format) for the from 1 April 2017 to 31 March 2018 (10 Marks) [Total 30 Marks)

ASSIGNMENTI FINANCIAL ACCOUNTING IFA260US QUESTION 1 The partnership of A. Ashipala, B. Mbanguta and C. Tjatindindi are in partnership sharing profits and loss in the ratio 5:3:2. They own and run a business selling food, trading as Ovalombola ABC. The following trial balance has been extracted from their accounting records at 31 March 2018 OVALOMBOLA ABC TRIAL BALANCE AT 31 MARCH 2018 Dr N$ Cr N$ 750 80 000 15 000 5 000 4000 12000 4 900 1 000 500 400 Interest received Capital account ( at 1 April 2017) A Ashipala B Mbangula C Tjatindindi Carriage inwards Carriage outwards Bank Current accounts (at 1 April 2017) A Ashipala B Mbangula C Tjatindindi Distributions A Ashipala B Mbangula C Tjatindindi Vehicle at cost Accumulated depreciation (at 1 April 2017) Equipment at cost Accumulated depreciation (at 1 April 2017) Office expenses Purchases Rent, rates and electricity Sales Stock ( at 1 April 2017) Accounts payable Accounts receivable Allowance for doubtful debts ( at 1 April 2017) 25 000 22 000 15 000 80 000 20 000 100 000 36 600 40 400 225 000 8 800 409 030 30 000 16 500 14 300 420 583 300 583 300 5. Additional information 1 Inventory at 31 March 2018 cost N$ 35 000. 2 Depreciation on the non-current assets is to be calculated as follows: Motor vehicle is 25% per annum on the diminishing balance method and Plant and machinery 20% per annum on the straight line method. There were no purchases or sales of non-current assets during ng the year to 3 0 31 March 2018 3. The future cash flows from the accounts receivable are considered to be N$ 13 585. 4. At 31 March 2018, office expenses of N$ 405 was payable, and rent amounting to N$ 1500 had been paid in advance. Interest on distributions and the debit balance on each partner current account are to be charged as follows: A Ashipala N$ 1000 B Mbangula N$ 900 C Tjatindindi NS 720 According to the partnership agreement, C.Tjitindindi is allowed a salary of N$ 13 000 per annum. This amount was owing to C. Tjatindindi for the year 31 March 2018 and need be accounted for. The partnership agreement also altows each partner interest on his/her capital account at a rate of 10% per annum. There were no movements on the respective partners' capital accounts during the year to 31 March 2018, and the interest had not been credited as at that date. You are required to: A) Prepare the statement of profit or loss of Ovatombola ABC partnership for the year ended 31 March 2018 (10 Marks) B) Prepare the statement of changes in equity of Ovalombola A8C partnership the year ended 31 March 2018 (10 Marks) Prepare the current accounts of Ovalombola ABC partnership (in columnar format) for the from 1 April 2017 to 31 March 2018 (10 Marks) [Total 30 Marks) ASSIGNMENTI FINANCIAL ACCOUNTING IFA260US QUESTION 1 The partnership of A. Ashipala, B. Mbanguta and C. Tjatindindi are in partnership sharing profits and loss in the ratio 5:3:2. They own and run a business selling food, trading as Ovalombola ABC. The following trial balance has been extracted from their accounting records at 31 March 2018 OVALOMBOLA ABC TRIAL BALANCE AT 31 MARCH 2018 Dr N$ Cr N$ 750 80 000 15 000 5 000 4000 12000 4 900 1 000 500 400 Interest received Capital account ( at 1 April 2017) A Ashipala B Mbangula C Tjatindindi Carriage inwards Carriage outwards Bank Current accounts (at 1 April 2017) A Ashipala B Mbangula C Tjatindindi Distributions A Ashipala B Mbangula C Tjatindindi Vehicle at cost Accumulated depreciation (at 1 April 2017) Equipment at cost Accumulated depreciation (at 1 April 2017) Office expenses Purchases Rent, rates and electricity Sales Stock ( at 1 April 2017) Accounts payable Accounts receivable Allowance for doubtful debts ( at 1 April 2017) 25 000 22 000 15 000 80 000 20 000 100 000 36 600 40 400 225 000 8 800 409 030 30 000 16 500 14 300 420 583 300 583 300 5. Additional information 1 Inventory at 31 March 2018 cost N$ 35 000. 2 Depreciation on the non-current assets is to be calculated as follows: Motor vehicle is 25% per annum on the diminishing balance method and Plant and machinery 20% per annum on the straight line method. There were no purchases or sales of non-current assets during ng the year to 3 0 31 March 2018 3. The future cash flows from the accounts receivable are considered to be N$ 13 585. 4. At 31 March 2018, office expenses of N$ 405 was payable, and rent amounting to N$ 1500 had been paid in advance. Interest on distributions and the debit balance on each partner current account are to be charged as follows: A Ashipala N$ 1000 B Mbangula N$ 900 C Tjatindindi NS 720 According to the partnership agreement, C.Tjitindindi is allowed a salary of N$ 13 000 per annum. This amount was owing to C. Tjatindindi for the year 31 March 2018 and need be accounted for. The partnership agreement also altows each partner interest on his/her capital account at a rate of 10% per annum. There were no movements on the respective partners' capital accounts during the year to 31 March 2018, and the interest had not been credited as at that date. You are required to: A) Prepare the statement of profit or loss of Ovatombola ABC partnership for the year ended 31 March 2018 (10 Marks) B) Prepare the statement of changes in equity of Ovalombola A8C partnership the year ended 31 March 2018 (10 Marks) Prepare the current accounts of Ovalombola ABC partnership (in columnar format) for the from 1 April 2017 to 31 March 2018 (10 Marks) [Total 30 Marks)

Question 1 Full Question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started