Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 fully explained Answer each of the following questions. Your answers should be brief-i.e., about one to three sentences in length. If the question

question 1 fully explained

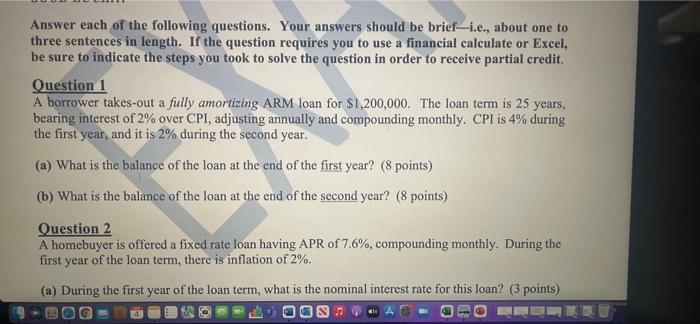

Answer each of the following questions. Your answers should be brief-i.e., about one to three sentences in length. If the question requires you to use a financial calculate or Excel, be sure to indicate the steps you took to solve the question in order to receive partial credit. Question 1 A borrower takes-out a fully amortizing ARM loan for $1,200,000. The loan term is 25 years, bearing interest of 2% over CPI, adjusting annually and compounding monthly. CPI is 4% during the first year, and it is 2% during the second year. (a) What is the balance of the loan at the end of the first year? (8 points) (b) What is the balance of the loan at the end of the second year? (8 points) Question 2 A homebuyer is offered a fixed rate loan having APR of 7.6%, compounding monthly. During the first year of the loan term, there is inflation of 2%. (a) During the first year of the loan term, what is the nominal interest rate for this loan? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started