Answered step by step

Verified Expert Solution

Question

1 Approved Answer

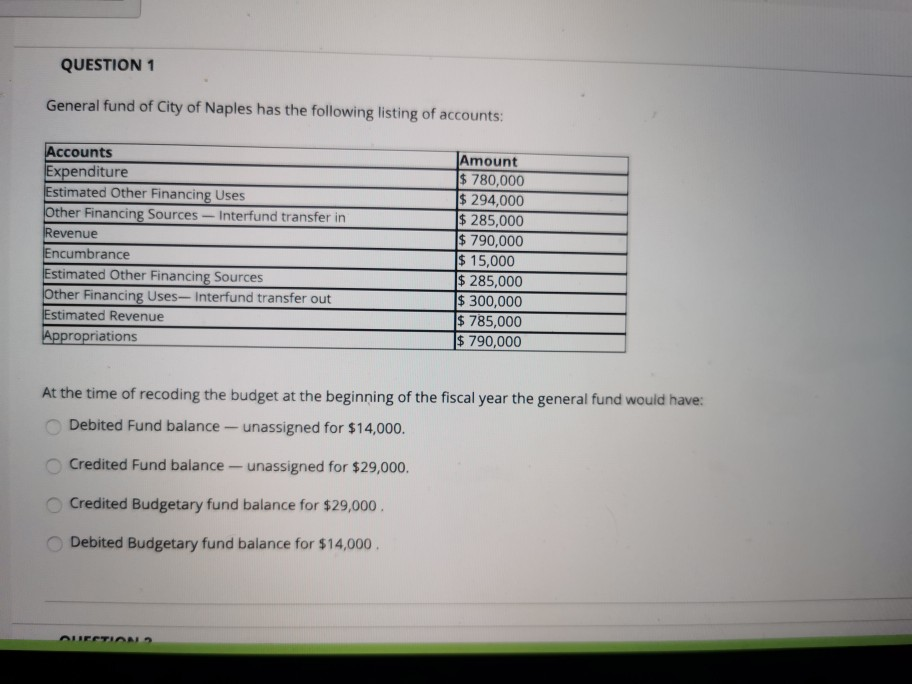

QUESTION 1 General fund of City of Naples has the following listing of accounts: Accounts Expenditure Estimated Other Financing Uses Other Financing Sources Interfund transfer

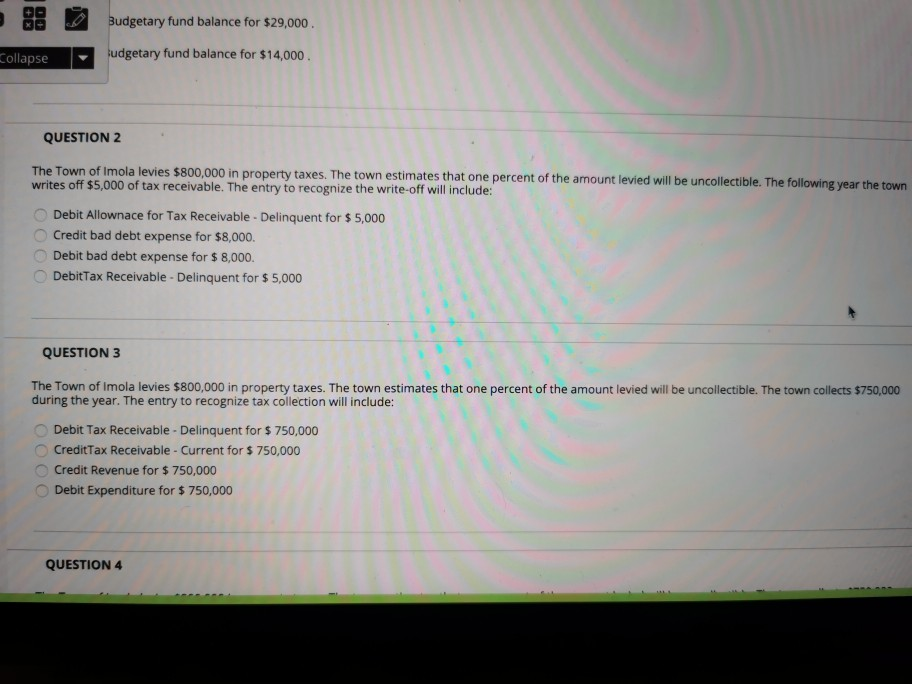

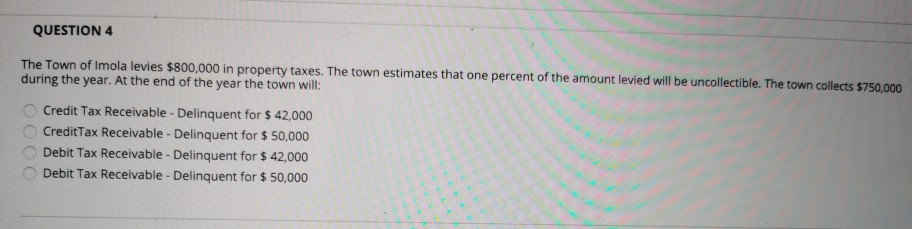

QUESTION 1 General fund of City of Naples has the following listing of accounts: Accounts Expenditure Estimated Other Financing Uses Other Financing Sources Interfund transfer in Revenue Encumbrance Estimated Other Financing Sources Other Financing Uses- Interfund transfer out Estimated Revenue Appropriations Amount $ 780,000 $ 294,000 $ 285,000 $ 790,000 $ 15,000 $285,000 $ 300,000 $ 785,000 $ 790,000 At the time of recoding the budget at the beginning of the fiscal year the general fund would have: Debited Fund balance - unassigned for $14,000. Credited Fund balance - unassigned for $29,000. Credited Budgetary fund balance for $29,000 Debited Budgetary fund balance for $14,000 Budgetary fund balance for $29,000 Collapse fudgetary fund balance for $14,000 QUESTION 2 The Town of Imola levies $800,000 in property taxes. The town estimates that one percent of the amount levied will be uncollectible. The following year the town writes off $5,000 of tax receivable. The entry to recognize the write-off will include: Debit Allownace for Tax Receivable - Delinquent for $5,000 Credit bad debt expense for $8,000. Debit bad debt expense for $ 8,000. DebitTax Receivable - Delinquent for $5,000 OOOO QUESTION 3 The Town of Imola levies $800,000 in property taxes. The town estimates that one percent of the amount levied will be uncollectible. The town collects $750,000 during the year. The entry to recognize tax collection will include: Debit Tax Receivable - Delinquent for $750,000 CreditTax Receivable - Current for $750,000 Credit Revenue for $750,000 Debit Expenditure for $750,000 Oooo QUESTION 4 QUESTION 4 The Town of Imola levies $800,000 in property taxes. The town estimates that one percent of the amount levied will be uncollectible. The town collects $750,000 during the year. At the end of the year the town will: Credit Tax Receivable - Delinquent for $ 42,000 CreditTax Receivable - Delinquent for $ 50,000 Debit Tax Receivable - Delinquent for $ 42,000 Debit Tax Receivable - Delinquent for $50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started