Question

Question 1 Gutierrez Company reported net income of $193,400 for 2017. Gutierrez also reported depreciation expense of $45,600 and a loss of $6,000 on

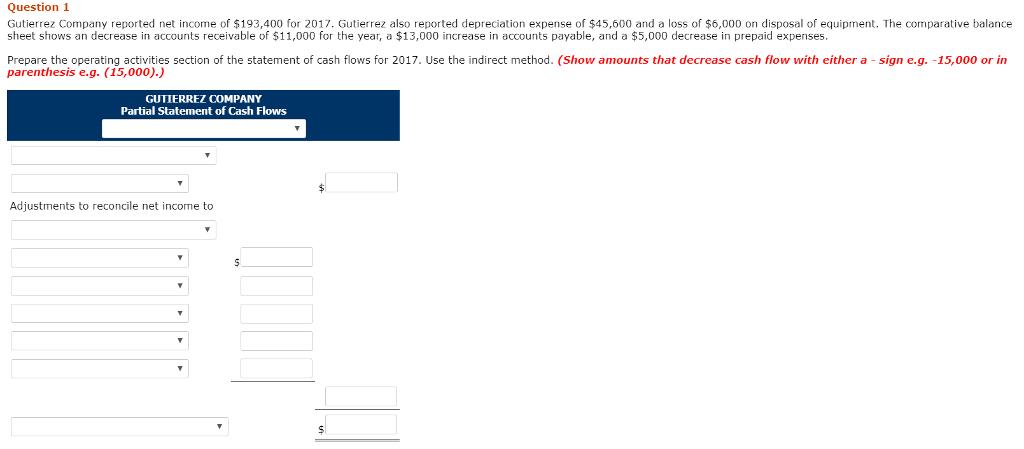

Question 1 Gutierrez Company reported net income of $193,400 for 2017. Gutierrez also reported depreciation expense of $45,600 and a loss of $6,000 on disposal of equipment. The comparative balance sheet shows an decrease in accounts receivable of $11,000 for the year, a $13,000 increase in accounts payable, and a $5,000 decrease in prepaid expenses. Prepare the operating activities section of the statement of cash flows for 2017. Use the indirect method. (Show amounts that decrease cash flow with either a sign e.g. -15,000 or in parenthesis e.g. (15,000).) GUTIERREZ COMPANY Partial Statement of Cash Flows Adjustments to reconcile net income to Y S

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

articulars Amount Amount Cash flow from operating activities ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso

11th Edition

111856667X, 978-1118566671

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App