Answered step by step

Verified Expert Solution

Question

1 Approved Answer

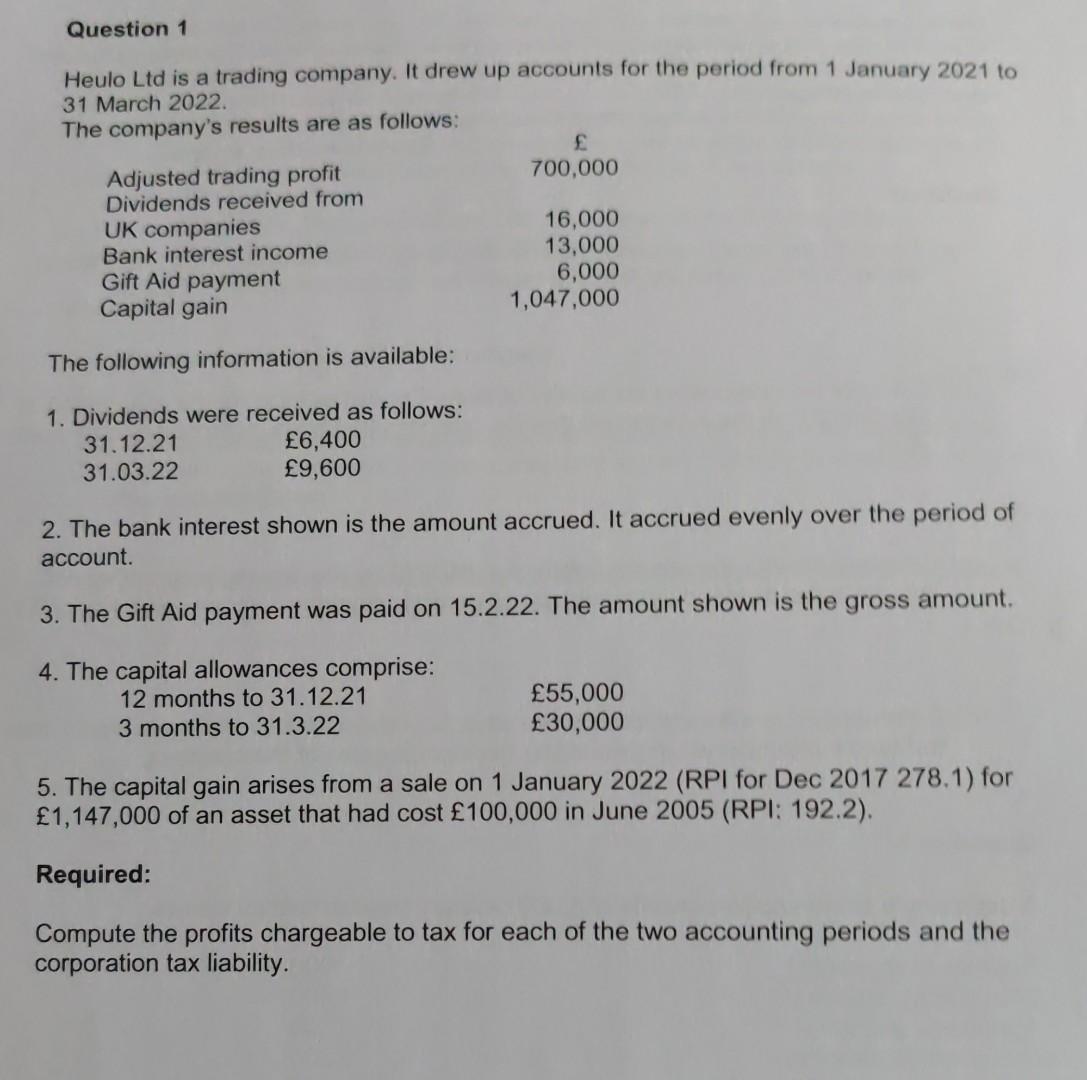

Question 1 Heulo Ltd is a trading company. It drew up accounts for the period from 1 January 2021 to 31 March 2022. The company's

Question 1 Heulo Ltd is a trading company. It drew up accounts for the period from 1 January 2021 to 31 March 2022. The company's results are as follows: Adjusted trading profit 700,000 Dividends received from UK companies 16,000 Bank interest income 13,000 Gift Aid payment 6,000 Capital gain 1,047,000 The following information is available: 1. Dividends were received as follows: 31.12.21 6,400 31.03.22 9,600 2. The bank interest shown is the amount accrued. It accrued evenly over the period of account. 3. The Gift Aid payment was paid on 15.2.22. The amount shown is the gross amount. 4. The capital allowances comprise: 12 months to 31.12.21 3 months to 31.3.22 55,000 30,000 5. The capital gain arises from a sale on 1 January 2022 (RPI for Dec 2017 278.1) for 1,147,000 of an asset that had cost 100,000 in June 2005 (RPI: 192.2). Required: Compute the profits chargeable to tax for each of the two accounting periods and the corporation tax liability

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started