Question: Question 1: How could this market be segmented? Discuss multiple options for segmenting the market, not just target markets for Green Ox. From Green Oxs

Question 1: How could this market be segmented? Discuss multiple options for segmenting the market, not just target markets for Green Ox. From Green Oxs perspective, what are the pros and cons of each alternative way to segment the market?

Question 2: Which target market do you recommend Green Ox focus on? Why?

Question 3: Provide and defend a positioning statement for the target segment you recommend. The positioning statement should complete the following: For (target market), Green Ox is the brand of (frame of reference/competitive set) that has (point of difference) because (reason to believe).

Question 4: Using the data from Table 1, compute the retailer and manufacturer margins for Croc-Ade, Sport-Ade and Power Boost. Explain why the retailer margins differ. (please so wrok show all work).

Question 5: Assume that Green Ox will have a manufacturer cost of $0.20 per 20oz bottle and that the retail margin will be 35%. The product will be direct shipped to the retailer (no wholesale margin to worry about). For a retail price of $0.72 per 20oz bottle, compute the manufacturers price and $ margin for Green Ox. Using this figure, estimate the break-even unit sales for a $10,000,000 marketing investment. (please show all work)

Question 6: Assume that Green Ox will have a manufacturer cost of $0.20 per 20oz bottle and that the retail margin will be 35% (i.e., for every $1 of sales, the retailer keeps $0.35). For each price in the first Column of Table 2 (sports drinks), compute the $ margin for Green Ox (show all work). Using this information, determine the retail price that maximizes profits for Green Ox (show all work).

Question 7: Using the data in the case and assuming an average retail price of $0.72 per 20oz bottle, estimate the size of the sports drink market in the US in terms of units (20oz bottles) and $ sold per year (please show work)

Question 8: Based on your STP analysis and insights from Questions 5-7, describe and defend your go-to-market strategy. You should limit your discussion of the go-to-market strategy to the following issues: retail price, number of flavors introduced, and channel strategy. You do not have to worry about promotions/communications.

Notes:

1. There is a minor error in Table 3. The total is 105, not 100. Here is a re-normalized table 3.

Flavor

Sports-Drink Consumers

Yellowknife

32%

Jasper Mountain

29%

Whistler

24%

Alberta Bound

10%

Yukon Gold

5%

\

Question 1: How could this market be segmented? Discuss multiple options for segmenting the market, not just target markets for Green Ox. From Green Oxs perspective, what are the pros and cons of each alternative way to segment the market?

Question 2: Which target market do you recommend Green Ox focus on? Why?

Question 3: Provide and defend a positioning statement for the target segment you recommend. The positioning statement should complete the following: For (target market), Green Ox is the brand of (frame of reference/competitive set) that has (point of difference) because (reason to believe).

Question 4: Using the data from Table 1, compute the retailer and manufacturer margins for Croc-Ade, Sport-Ade and Power Boost. Explain why the retailer margins differ. (please so wrok show all work).

Question 5: Assume that Green Ox will have a manufacturer cost of $0.20 per 20oz bottle and that the retail margin will be 35%. The product will be direct shipped to the retailer (no wholesale margin to worry about). For a retail price of $0.72 per 20oz bottle, compute the manufacturers price and $ margin for Green Ox. Using this figure, estimate the break-even unit sales for a $10,000,000 marketing investment. (please show all work)

Question 6: Assume that Green Ox will have a manufacturer cost of $0.20 per 20oz bottle and that the retail margin will be 35% (i.e., for every $1 of sales, the retailer keeps $0.35). For each price in the first Column of Table 2 (sports drinks), compute the $ margin for Green Ox (show all work). Using this information, determine the retail price that maximizes profits for Green Ox (show all work).

Question 7: Using the data in the case and assuming an average retail price of $0.72 per 20oz bottle, estimate the size of the sports drink market in the US in terms of units (20oz bottles) and $ sold per year (please show work)

Question 8: Based on your STP analysis and insights from Questions 5-7, describe and defend your go-to-market strategy. You should limit your discussion of the go-to-market strategy to the following issues: retail price, number of flavors introduced, and channel strategy. You do not have to worry about promotions/communications.

Notes:

1. There is a minor error in Table 3. The total is 105, not 100. Here is a re-normalized table 3.

Flavor

Sports-Drink Consumers

Yellowknife

32%

Jasper Mountain

29%

Whistler

24%

Alberta Bound

10%

Yukon Gold

5%

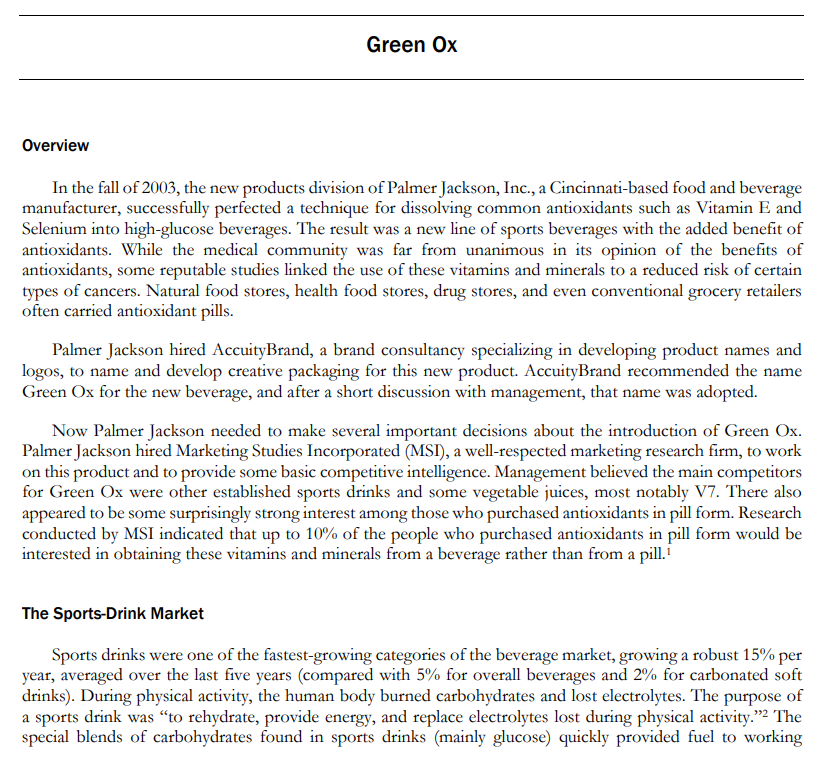

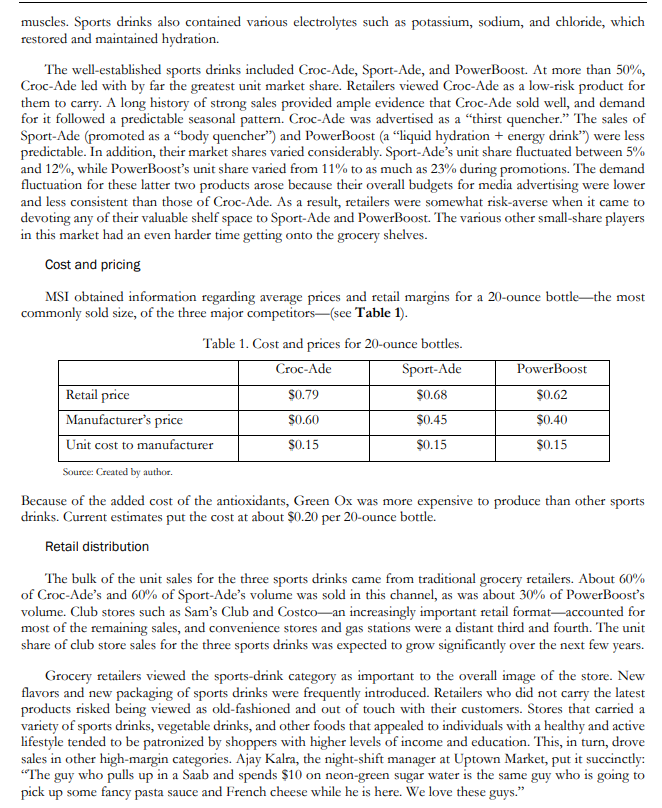

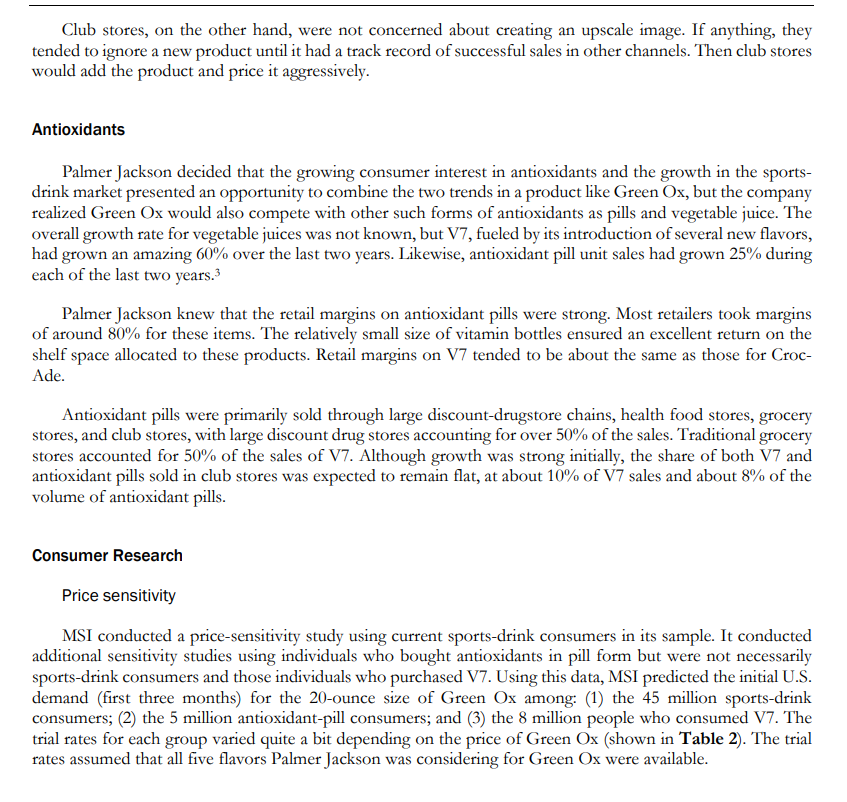

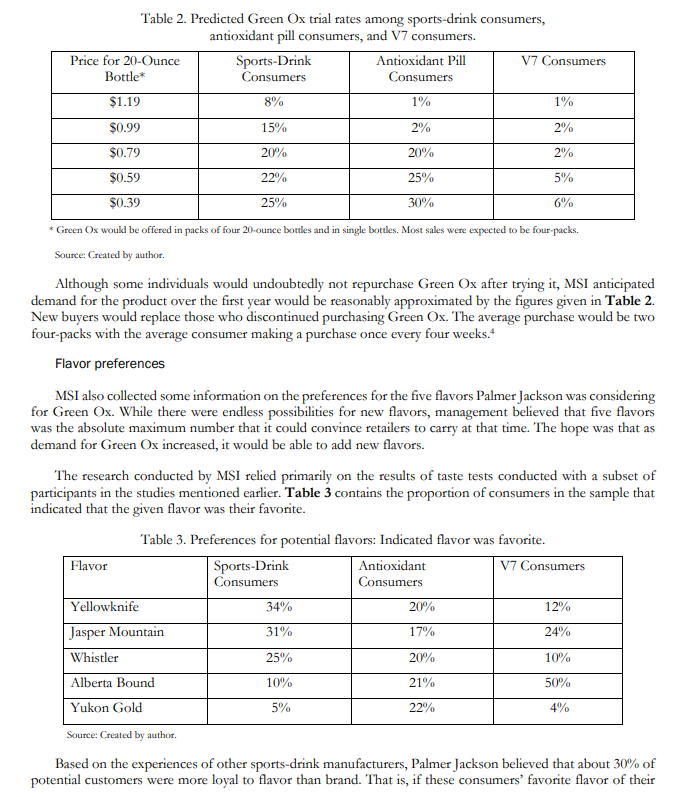

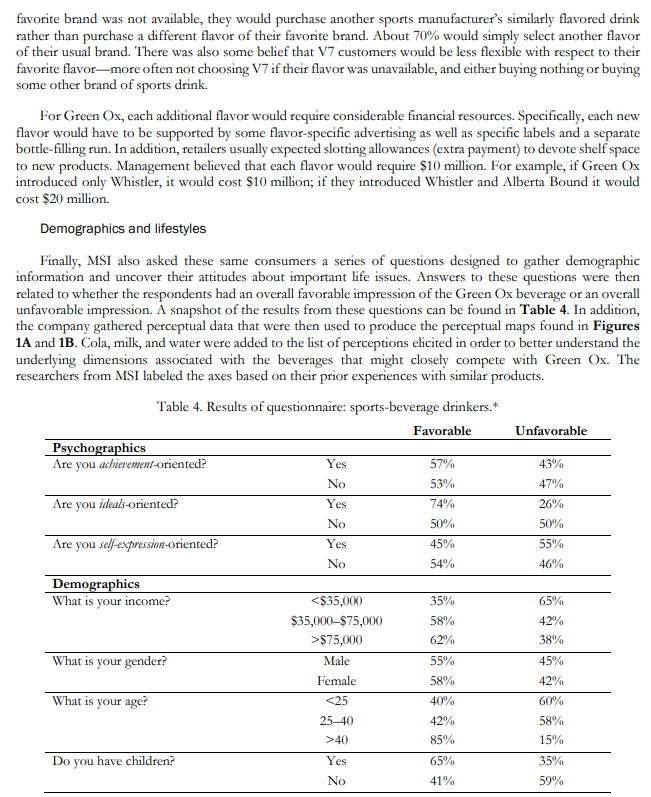

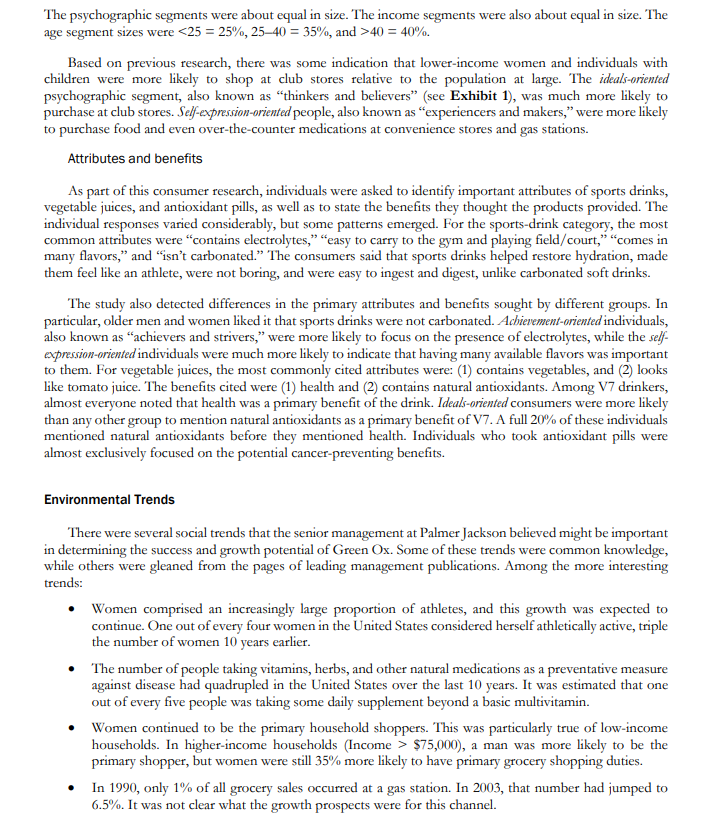

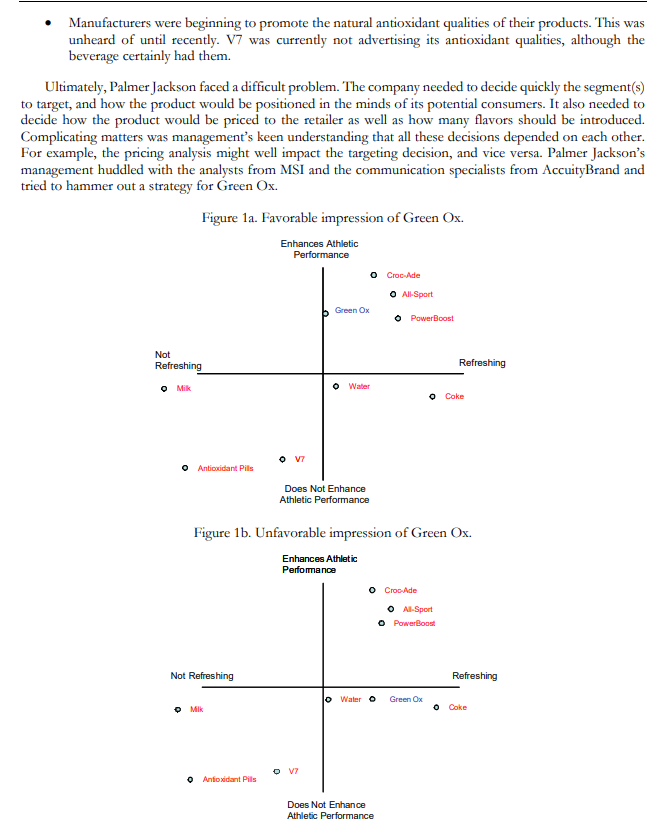

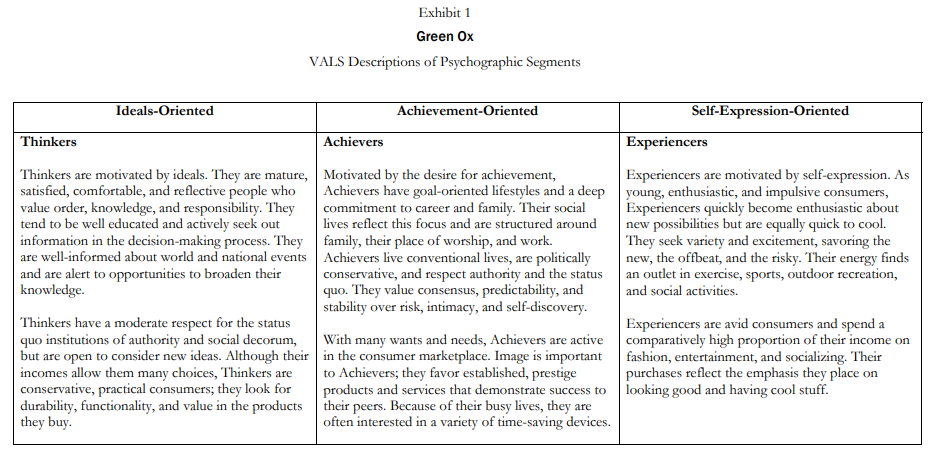

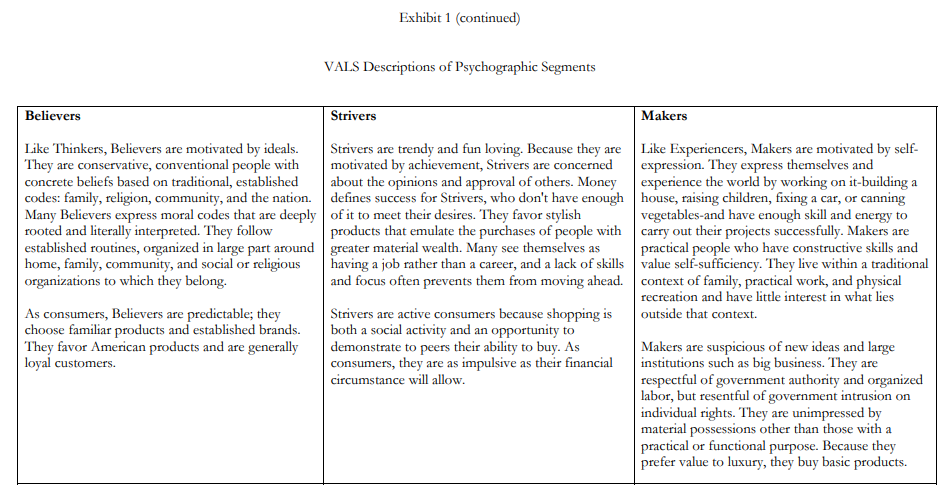

In the fall of 2003 , the new products division of Palmer Jackson, Inc., a Cincinnati-based food and beverage manufacturer, successfully perfected a technique for dissolving common antioxidants such as Vitamin E and Selenium into high-glucose beverages. The result was a new line of sports beverages with the added benefit of antioxidants. While the medical community was far from unanimous in its opinion of the benefits of antioxidants, some reputable studies linked the use of these vitamins and minerals to a reduced risk of certain types of cancers. Natural food stores, health food stores, drug stores, and even conventional grocery retailers often carried antioxidant pills. Palmer Jackson hired AccuityBrand, a brand consultancy specializing in developing product names and logos, to name and develop creative packaging for this new product. AccuityBrand recommended the name Green Ox for the new beverage, and after a short discussion with management, that name was adopted. Now Palmer Jackson needed to make several important decisions about the introduction of Green Ox. Palmer Jackson hired Marketing Studies Incorporated (MSI), a well-respected marketing research firm, to work on this product and to provide some basic competitive intelligence. Management believed the main competitors for Green Ox were other established sports drinks and some vegetable juices, most notably V7. There also appeared to be some surprisingly strong interest among those who purchased antioxidants in pill form. Research conducted by MSI indicated that up to 10% of the people who purchased antioxidants in pill form would be interested in obtaining these vitamins and minerals from a beverage rather than from a pill. 1 The Sports-Drink Market Sports drinks were one of the fastest-growing categories of the beverage market, growing a robust 15% per year, averaged over the last five years (compared with 5% for overall beverages and 2% for carbonated soft drinks). During physical activity, the human body burned carbohydrates and lost electrolytes. The purpose of a sports drink was "to rehydrate, provide energy, and replace electrolytes lost during physical activity."' The special blends of carbohydrates found in sports drinks (mainly glucose) quickly provided fuel to working muscles. Sports drinks also contained various electrolytes such as potassium, sodium, and chloride, which restored and maintained hydration. The well-established sports drinks included Croc-Ade, Sport-Ade, and PowerBoost. At more than 50%, Croc-Ade led with by far the greatest unit market share. Retailers viewed Croc-Ade as a low-risk product for them to carry. A long history of strong sales provided ample evidence that Croc-Ade sold well, and demand for it followed a predictable seasonal pattern. Croc-Ade was advertised as a "thirst quencher." The sales of Sport-Ade (promoted as a "body quencher") and PowerBoost (a "liquid hydration + energy drink") were less predictable. In addition, their market shares varied considerably. Sport-Ade's unit share fluctuated between 5% and 12%, while PowerBoost's unit share varied from 11% to as much as 23% during promotions. The demand fluctuation for these latter two products arose because their overall budgets for media advertising were lower and less consistent than those of Croc-Ade. As a result, retailers were somewhat risk-averse when it came to devoting any of their valuable shelf space to Sport-Ade and PowerBoost. The various other small-share players in this market had an even harder time getting onto the grocery shelves. Cost and pricing MSI obtained information regarding average prices and retail margins for a 20 -ounce bottle-the most commonly sold size, of the three major competitors-(see Table 1). Table 1. Cost and prices for 20 -ounce bottles. Source: Created by author. Because of the added cost of the antioxidants, Green Ox was more expensive to produce than other sports drinks. Current estimates put the cost at about $0.20 per 20 -ounce bottle. Retail distribution The bulk of the unit sales for the three sports drinks came from traditional grocery retailers. About 60% of Croc-Ade's and 60\% of Sport-Ade's volume was sold in this channel, as was about 30% of PowerBoost's volume. Club stores such as Sam's Club and Costco - an increasingly important retail format-accounted for most of the remaining sales, and convenience stores and gas stations were a distant third and fourth. The unit share of club store sales for the three sports drinks was expected to grow significantly over the next few years. Grocery retailers viewed the sports-drink category as important to the overall image of the store. New flavors and new packaging of sports drinks were frequently introduced. Retailers who did not carry the latest products risked being viewed as old-fashioned and out of touch with their customers. Stores that carried a variety of sports drinks, vegetable drinks, and other foods that appealed to individuals with a healthy and active lifestyle tended to be patronized by shoppers with higher levels of income and education. This, in turn, drove sales in other high-margin categories. Ajay Kalra, the night-shift manager at Uptown Market, put it succinctly: "The guy who pulls up in a Saab and spends $10 on neon-green sugar water is the same guy who is going to pick up some fancy pasta sauce and French cheese while he is here. We love these guys." Club stores, on the other hand, were not concerned about creating an upscale image. If anything, they tended to ignore a new product until it had a track record of successful sales in other channels. Then club stores would add the product and price it aggressively. Antioxidants Palmer Jackson decided that the growing consumer interest in antioxidants and the growth in the sportsdrink market presented an opportunity to combine the two trends in a product like Green Ox, but the company realized Green Ox would also compete with other such forms of antioxidants as pills and vegetable juice. The overall growth rate for vegetable juices was not known, but V7, fueled by its introduction of several new flavors, had grown an amazing 60% over the last two years. Likewise, antioxidant pill unit sales had grown 25% during each of the last two years. 3 Palmer Jackson knew that the retail margins on antioxidant pills were strong. Most retailers took margins of around 80% for these items. The relatively small size of vitamin bottles ensured an excellent return on the shelf space allocated to these products. Retail margins on V7 tended to be about the same as those for CrocAde. Antioxidant pills were primarily sold through large discount-drugstore chains, health food stores, grocery stores, and club stores, with large discount drug stores accounting for over 50% of the sales. Traditional grocery stores accounted for 50% of the sales of V7. Although growth was strong initially, the share of both V7 and antioxidant pills sold in club stores was expected to remain flat, at about 10% of V7 sales and about 8% of the volume of antioxidant pills. Consumer Research Price sensitivity MSI conducted a price-sensitivity study using current sports-drink consumers in its sample. It conducted additional sensitivity studies using individuals who bought antioxidants in pill form but were not necessarily sports-drink consumers and those individuals who purchased V7. Using this data, MSI predicted the initial U.S. demand (first three months) for the 20-ounce size of Green Ox among: (1) the 45 million sports-drink consumers; (2) the 5 million antioxidant-pill consumers; and (3) the 8 million people who consumed V7. The trial rates for each group varied quite a bit depending on the price of Green Ox (shown in Table 2). The trial rates assumed that all five flavors Palmer Jackson was considering for Green Ox were available. Table 2. Predicted Green Ox trial rates among sports-drink consumers, antioxidant pill consumers, and V7 consumers. * Green Ox would be offered in packs of four 20 -ounce bottles and in single bottles. Most sales were expected to be four-packs. Source: Created by author. Although some individuals would undoubtedly not repurchase Green Ox after trying it, MSI anticipated demand for the product over the first year would be reasonably approximated by the figures given in Table 2 . New buyers would replace those who discontinued purchasing Green Ox. The average purchase would be two four-packs with the average consumer making a purchase once every four weeks. 4 Flavor preferences MSI also collected some information on the preferences for the five flavors Palmer Jackson was considering for Green Ox. While there were endless possibilities for new flavors, management believed that five flavors was the absolute maximum number that it could convince retailers to carry at that time. The hope was that as demand for Green Ox increased, it would be able to add new flavors. The research conducted by MSI relied primarily on the results of taste tests conducted with a subset of participants in the studies mentioned earlier. Table 3 contains the proportion of consumers in the sample that indicated that the given flavor was their favorite. Table 3. Preferences for potential flavors: Indicated flavor was favorite. Based on the experiences of other sports-drink manufacturers, Palmer Jackson believed that about 30% of potential customers were more loyal to flavor than brand. That is, if these consumers' favorite flavor of their favorite brand was not available, they would purchase another sports manufacturer's similarly flavored drink rather than purchase a different flavor of their favorite brand. About 70% would simply select another flavor of their usual brand. There was also some belief that V7 customers would be less flexible with respect to their favorite flavor - more often not choosing V7 if their flavor was unavailable, and either buying nothing or buying some other brand of sports drink. For Green Ox, each additional flavor would require considerable financial resources. Specifically, each new flavor would have to be supported by some flavor-specific advertising as well as specific labels and a separate bottle-filling run. In addition, retailers usually expected slotting allowances (extra payment) to devote shelf space to new products. Management believed that each flavor would require $10 million. For example, if Green Ox introduced only Whistler, it would cost \$10 million; if they introduced Whistler and Alberta Bound it would cost $20 million. Demographics and lifestyles Finally, MSI also asked these same consumers a series of questions designed to gather demographic information and uncover their attitudes about important life issues. Answers to these questions were then related to whether the respondents had an overall favorable impression of the Green Ox beverage or an overall unfavorable impression. A snapshot of the results from these questions can be found in Table 4 . In addition, the company gathered perceptual data that were then used to produce the perceptual maps found in Figures 1A and 1B. Cola, milk, and water were added to the list of perceptions elicited in order to better understand the underlying dimensions associated with the beverages that might closely compete with Green Ox. The researchers from MSI labeled the axes based on their prior experiences with similar products. Table 4. Results of questionnaire: sports-beverage drinkers.* age segment sizes were 40=40%. Based on previous research, there was some indication that lower-income women and individuals with children were more likely to shop at club stores relative to the population at large. The ideals-oriented psychographic segment, also known as "thinkers and believers" (see Exhibit 1), was much more likely to purchase at club stores. Self-expression-oriented people, also known as "experiencers and makers," were more likely to purchase food and even over-the-counter medications at convenience stores and gas stations. Attributes and benefits As part of this consumer research, individuals were asked to identify important attributes of sports drinks, vegetable juices, and antioxidant pills, as well as to state the benefits they thought the products provided. The individual responses varied considerably, but some patterns emerged. For the sports-drink category, the most common attributes were "contains electrolytes," "easy to carry to the gym and playing field/court," "comes in many flavors," and "isn't carbonated." The consumers said that sports drinks helped restore hydration, made them feel like an athlete, were not boring, and were easy to ingest and digest, unlike carbonated soft drinks. The study also detected differences in the primary attributes and benefits sought by different groups. In particular, older men and women liked it that sports drinks were not carbonated. Acbievement-oriented individuals, also known as "achievers and strivers," were more likely to focus on the presence of electrolytes, while the selfexpression-oriented individuals were much more likely to indicate that having many available flavors was important to them. For vegetable juices, the most commonly cited attributes were: (1) contains vegetables, and (2) looks like tomato juice. The benefits cited were (1) health and (2) contains natural antioxidants. Among V7 drinkers, almost everyone noted that health was a primary benefit of the drink. Ideals-oriented consumers were more likely than any other group to mention natural antioxidants as a primary benefit of V7. A full 20% of these individuals mentioned natural antioxidants before they mentioned health. Individuals who took antioxidant pills were almost exclusively focused on the potential cancer-preventing benefits. Environmental Trends There were several social trends that the senior management at Palmer Jackson believed might be important in determining the success and growth potential of Green Ox. Some of these trends were common knowledge, while others were gleaned from the pages of leading management publications. Among the more interesting trends: - Women comprised an increasingly large proportion of athletes, and this growth was expected to continue. One out of every four women in the United States considered herself athletically active, triple the number of women 10 years earlier. - The number of people taking vitamins, herbs, and other natural medications as a preventative measure against disease had quadrupled in the United States over the last 10 years. It was estimated that one out of every five people was taking some daily supplement beyond a basic multivitamin. - Women continued to be the primary household shoppers. This was particularly true of low-income households. In higher-income households (Income >$75,000 ), a man was more likely to be the primary shopper, but women were still 35% more likely to have primary grocery shopping duties. - In 1990, only 1\% of all grocery sales occurred at a gas station. In 2003, that number had jumped to 6.5%. It was not clear what the growth prospects were for this channel. - Manufacturers were beginning to promote the natural antioxidant qualities of their products. This was unheard of until recently. V7 was currently not advertising its antioxidant qualities, although the beverage certainly had them. Ultimately, Palmer Jackson faced a difficult problem. The company needed to decide quickly the segment(s) to target, and how the product would be positioned in the minds of its potential consumers. It also needed to decide how the product would be priced to the retailer as well as how many flavors should be introduced. Complicating matters was management's keen understanding that all these decisions depended on each other. For example, the pricing analysis might well impact the targeting decision, and vice versa. Palmer Jackson's management huddled with the analysts from MSI and the communication specialists from AccuityBrand and tried to hammer out a strategy for Green Ox. Figure 1a. Favorable impression of Green Ox. Figure 1b. Unfavorable impression of Green Ox. VALS Descriptions of Psychographic Segments Exhibit 1 (continued) VALS Descriptions of Psychographic Segments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts