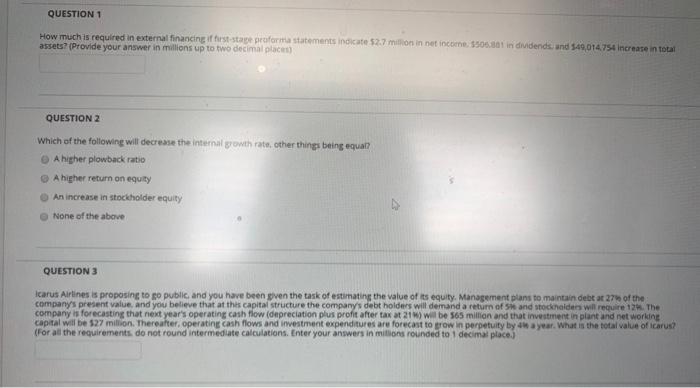

QUESTION 1 How much is required in external financing if first stage proforma statements indicate 52.7 million in net income $500.30 individends, and 549,014.754 increase in total assets? (Provide your answer in millions up to two decimal places QUESTION 2 Which of the following will decrease the internal growth rate, other things being equal? A higher plowback ratio A higher return on equity An increase in stockholder equity None of the above QUESTION 3 Icarus Airlines is proposing to go public and you have been gven the task of estimating the value of its equity Management plans to maintain debt at 27 of the company's present value and you believe that at this capital structure the company's debt holders will demand a return of and stockholders will require 12. The company is forecasting that next year's operating cash flow (depreciation plus profit after tax at 21) will be 565 million and that investment in plant and networking capital will be 527 million. Thereafter, operating cash flows and investment expenditures are forecast to grow in perpetuity by 4 year. What is the total value of Icarus? (For all the requirements do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.) QUESTION 1 How much is required in external financing if first stage proforma statements indicate 52.7 million in net income $500.30 individends, and 549,014.754 increase in total assets? (Provide your answer in millions up to two decimal places QUESTION 2 Which of the following will decrease the internal growth rate, other things being equal? A higher plowback ratio A higher return on equity An increase in stockholder equity None of the above QUESTION 3 Icarus Airlines is proposing to go public and you have been gven the task of estimating the value of its equity Management plans to maintain debt at 27 of the company's present value and you believe that at this capital structure the company's debt holders will demand a return of and stockholders will require 12. The company is forecasting that next year's operating cash flow (depreciation plus profit after tax at 21) will be 565 million and that investment in plant and networking capital will be 527 million. Thereafter, operating cash flows and investment expenditures are forecast to grow in perpetuity by 4 year. What is the total value of Icarus? (For all the requirements do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.)