Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION : 1. How much loan must be submitted to BCA to get the required amount of funds? 2. How much is the payment to

QUESTION : 1. How much loan must be submitted to BCA to get the required amount of funds? 2. How much is the payment to pay off the loan from Bank Mandiri? 3. How many pieces of Commercial Paper must be issued to get the maximum amount of working capital required and the cost of issuing the Commercial Paper? 4. How much is the payment to pay off the Commercial Paper? 5. Which alternative financing is the most profitable for the company?

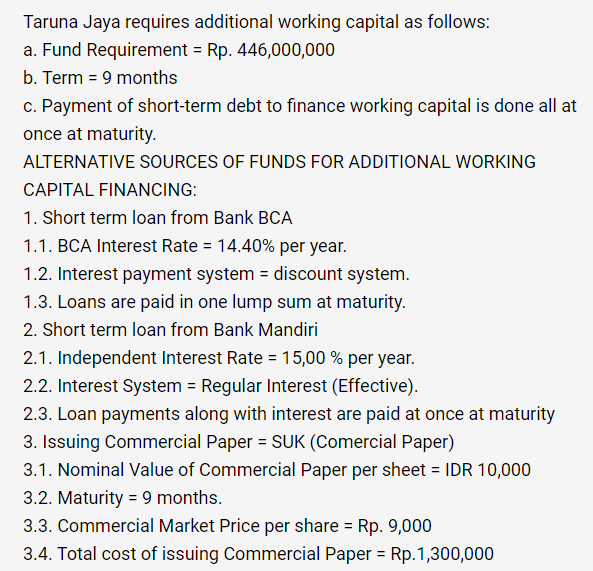

Taruna Jaya requires additional working capital as follows: a. Fund Requirement = Rp. 446,000,000 b. Term = 9 months c. Payment of short-term debt to finance working capital is done all at once at maturity. ALTERNATIVE SOURCES OF FUNDS FOR ADDITIONAL WORKING CAPITAL FINANCING: 1. Short term loan from Bank BCA 1.1. BCA Interest Rate = 14.40% per year. 1.2. Interest payment system = discount system. 1.3. Loans are paid in one lump sum at maturity. 2. Short term loan from Bank Mandiri 2.1. Independent Interest Rate = 15,00 % per year. 2.2. Interest System = Regular Interest (Effective). 2.3. Loan payments along with interest are paid at once at maturity 3. Issuing Commercial Paper = SUK (Comercial Paper) 3.1. Nominal Value of Commercial Paper per sheet = IDR 10,000 3.2. Maturity = 9 months. 3.3. Commercial Market Price per share= Rp. 9,000 3.4. Total cost of issuing Commercial Paper = Rp.1,300,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started