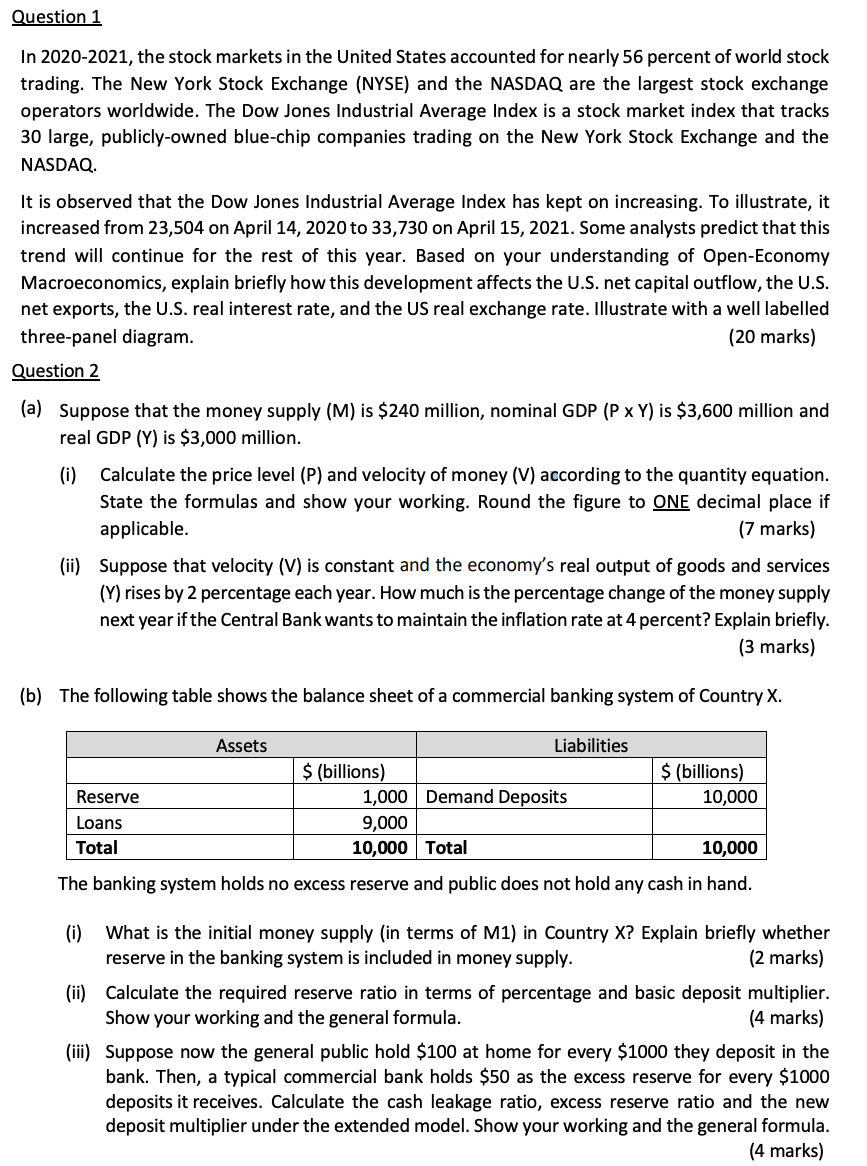

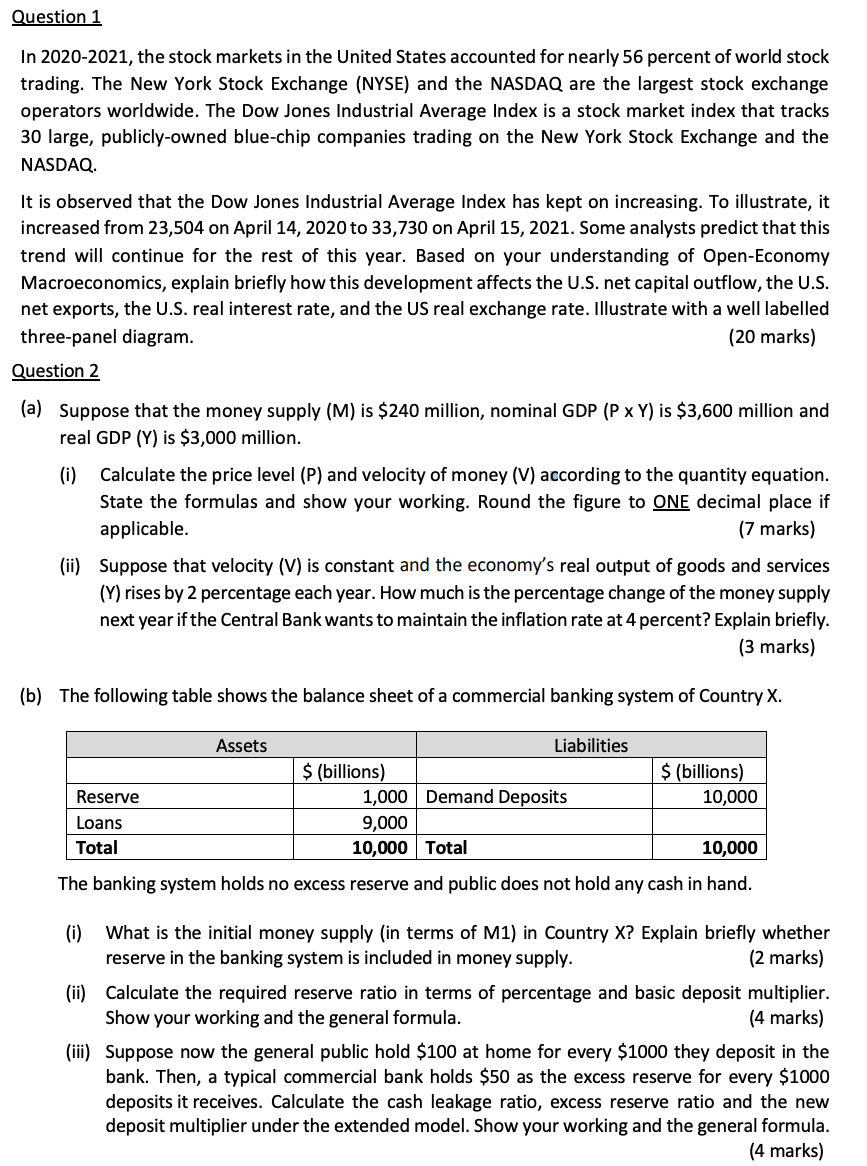

Question 1 In 2020-2021, the stock markets in the United States accounted for nearly 56 percent of world stock trading. The New York Stock Exchange (NYSE) and the NASDAQ are the largest stock exchange operators worldwide. The Dow Jones Industrial Average Index is a stock market index that tracks 30 large, publicly-owned blue-chip companies trading on the New York Stock Exchange and the NASDAQ. It is observed that the Dow Jones Industrial Average Index has kept on increasing. To illustrate, it increased from 23,504 on April 14, 2020 to 33,730 on April 15, 2021. Some analysts predict that this trend will continue for the rest of this year. Based on your understanding of Open-Economy Macroeconomics, explain briefly how this development affects the U.S. net capital outflow, the U.S. net exports, the U.S. real interest rate, and the US real exchange rate. Illustrate with a well labelled three-panel diagram. (20 marks) Question 2 (a) Suppose that the money supply (M) is $240 million, nominal GDP (P x Y) is $3,600 million and real GDP (Y) is $3,000 million. (i) Calculate the price level (P) and velocity of money (V) according to the quantity equation. State the formulas and show your working. Round the figure to ONE decimal place if applicable. (7 marks) (ii) Suppose that velocity (V) is constant and the economy's real output of goods and services (Y) rises by 2 percentage each year. How much is the percentage change of the money supply next year if the Central Bank wants to maintain the inflation rate at 4 percent? Explain briefly. (3 marks) (b) The following table shows the balance sheet of a commercial banking system of Country X. Assets Liabilities $ (billions) $ (billions) Reserve 1,000 Demand Deposits 10,000 Loans 9,000 Total 10,000 Total 10,000 The banking system holds no excess reserve and public does not hold any cash in hand. (i) What is the initial money supply in terms of M1) in Country X? Explain briefly whether reserve in the banking system is included in money supply. (2 marks) (ii) Calculate the required reserve ratio in terms of percentage and basic deposit multiplier. Show your working and the general formula. (4 marks) (iii) Suppose now the general public hold $100 at home for every $1000 they deposit in the bank. Then, a typical commercial bank holds $50 as the excess reserve for every $1000 deposits it receives. Calculate the cash leakage ratio, excess reserve ratio and the new deposit multiplier under the extended model. Show your working and the general formula. (4 marks) Question 1 In 2020-2021, the stock markets in the United States accounted for nearly 56 percent of world stock trading. The New York Stock Exchange (NYSE) and the NASDAQ are the largest stock exchange operators worldwide. The Dow Jones Industrial Average Index is a stock market index that tracks 30 large, publicly-owned blue-chip companies trading on the New York Stock Exchange and the NASDAQ. It is observed that the Dow Jones Industrial Average Index has kept on increasing. To illustrate, it increased from 23,504 on April 14, 2020 to 33,730 on April 15, 2021. Some analysts predict that this trend will continue for the rest of this year. Based on your understanding of Open-Economy Macroeconomics, explain briefly how this development affects the U.S. net capital outflow, the U.S. net exports, the U.S. real interest rate, and the US real exchange rate. Illustrate with a well labelled three-panel diagram. (20 marks) Question 2 (a) Suppose that the money supply (M) is $240 million, nominal GDP (P x Y) is $3,600 million and real GDP (Y) is $3,000 million. (i) Calculate the price level (P) and velocity of money (V) according to the quantity equation. State the formulas and show your working. Round the figure to ONE decimal place if applicable. (7 marks) (ii) Suppose that velocity (V) is constant and the economy's real output of goods and services (Y) rises by 2 percentage each year. How much is the percentage change of the money supply next year if the Central Bank wants to maintain the inflation rate at 4 percent? Explain briefly. (3 marks) (b) The following table shows the balance sheet of a commercial banking system of Country X. Assets Liabilities $ (billions) $ (billions) Reserve 1,000 Demand Deposits 10,000 Loans 9,000 Total 10,000 Total 10,000 The banking system holds no excess reserve and public does not hold any cash in hand. (i) What is the initial money supply in terms of M1) in Country X? Explain briefly whether reserve in the banking system is included in money supply. (2 marks) (ii) Calculate the required reserve ratio in terms of percentage and basic deposit multiplier. Show your working and the general formula. (4 marks) (iii) Suppose now the general public hold $100 at home for every $1000 they deposit in the bank. Then, a typical commercial bank holds $50 as the excess reserve for every $1000 deposits it receives. Calculate the cash leakage ratio, excess reserve ratio and the new deposit multiplier under the extended model. Show your working and the general formula. (4 marks)