Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: In finance, we are generally more place more importance on cash flows than accounting profits. True False The days sales outstanding tells us

Question 1:

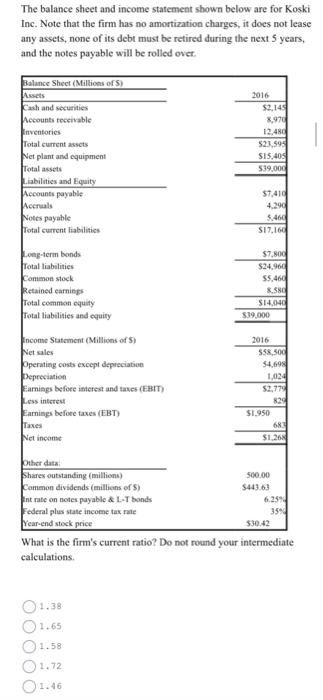

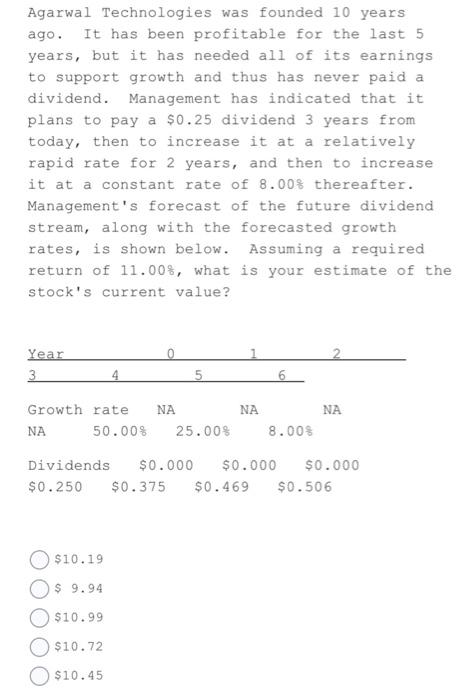

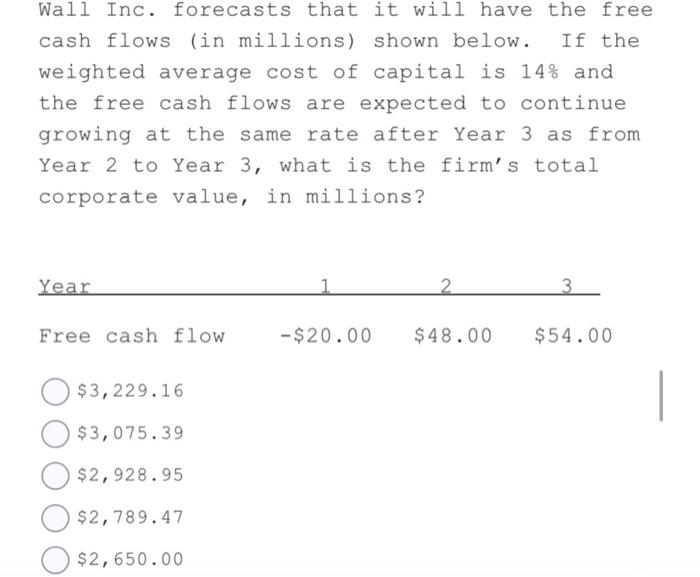

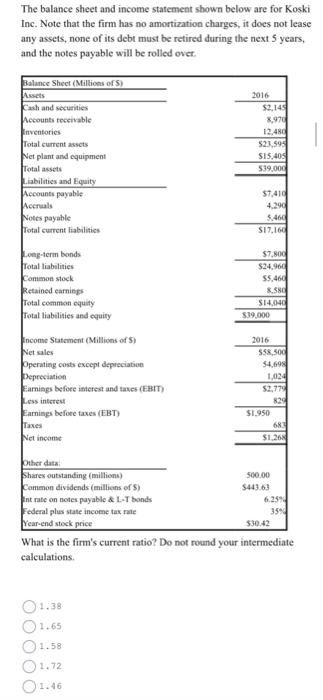

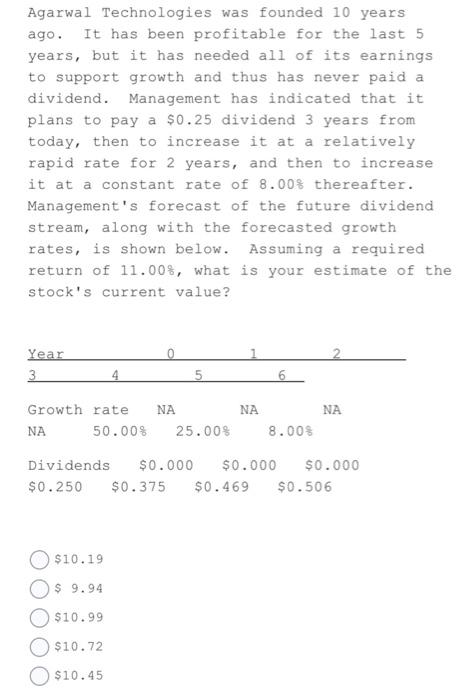

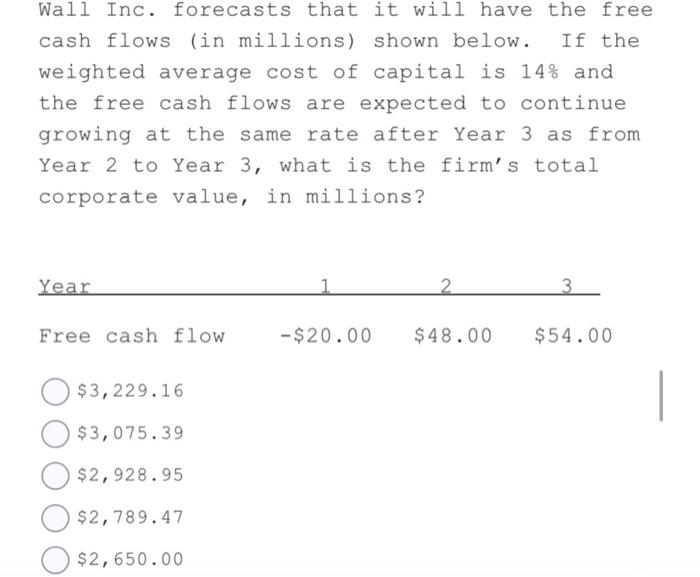

In finance, we are generally more place more importance on cash flows than accounting profits. True False The days sales outstanding tells us how long it takes, on average, to collect after a sale is made. The DSO can be compared with the firm's credit terms to get an idea of whether customers are paying on time. True False The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. What is the firm's current ratio? Do not round your intermediate calculations. Agarwal Technologies was founded 10 years ago. It has been profitable for the last 5 years, but it has needed a 11 of its earnings to support growth and thus has never paid a dividend. Management has indicated that it plans to pay a $0.25 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant rate of 8.00% thereafter. Management's forecast of the future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required return of 11.00%, what is your estimate of the stock's current value? $10.19$9.94$10.99$10.72$10.45 Wall Inc. forecasts that it will have the free cash flows (in millions) shown below. If the weighted average cost of capital is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the firm's total corporate value, in millions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started