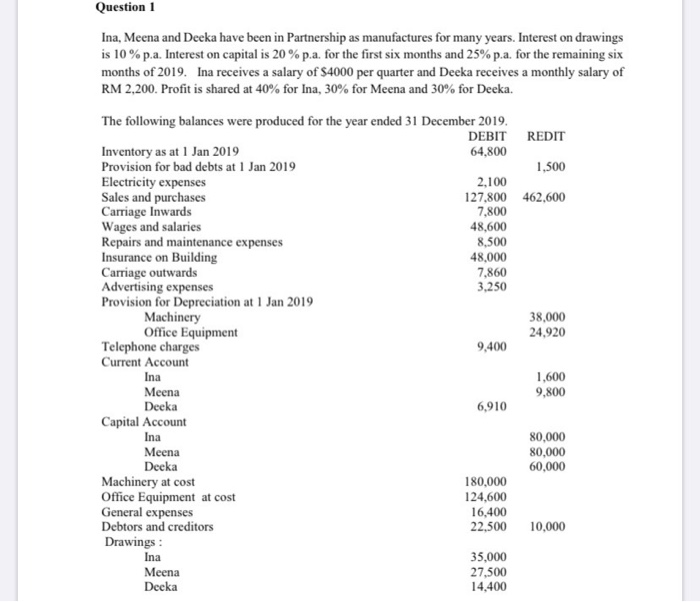

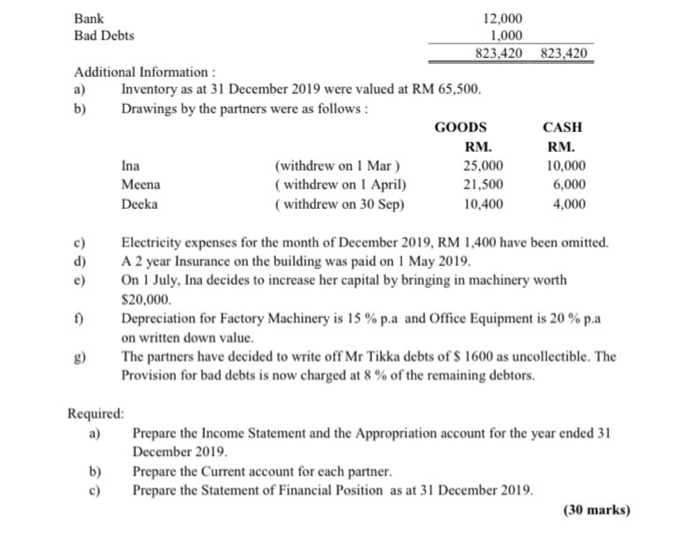

Question 1 Ina, Meena and Deeka have been in Partnership as manufactures for many years. Interest on drawings is 10%p.a. Interest on capital is 20% p.a. for the first six months and 25% p.a. for the remaining six months of 2019. Ina receives a salary of S4000 per quarter and Deeka receives a monthly salary of RM 2,200. Profit is shared at 40% for Ina, 30% for Meena and 30% for Deeka. The following balances were produced for the year ended 31 December 2019. DEBIT REDIT Inventory as at 1 Jan 2019 64,800 Provision for bad debts at 1 Jan 2019 1,500 Electricity expenses 2,100 Sales and purchases 127,800 462,600 Carriage Inwards 7,800 Wages and salaries 48,600 Repairs and maintenance expenses 8,500 Insurance on Building 48,000 Carriage outwards 7,860 Advertising expenses 3,250 Provision for Depreciation at 1 Jan 2019 Machinery 38.000 Office Equipment 24,920 Telephone charges 9,400 Current Account 1,600 Meena 9,800 Deeka 6,910 Capital Account Ina 80,000 Meena 80,000 Decka 60,000 Machinery at cost 180,000 Office Equipment at cost 124,600 General expenses 16,400 Debtors and creditors 22,500 10,000 Drawings: Ina 35,000 Meena 27,500 Decka 14,400 Ina Bank 12.000 Bad Debts 1,000 823,420 823,420 Additional Information: a) Inventory as at 31 December 2019 were valued at RM 65,500. b) Drawings by the partners were as follows: GOODS CASH RM. RM. Ina (withdrew on 1 Mar) 25,000 10,000 Meena (withdrew on 1 April) 21,500 6,000 Deeka (withdrew on 30 Sep) 10,400 4,000 Electricity expenses for the month of December 2019, RM 1,400 have been omitted. A 2 year Insurance on the building was paid on 1 May 2019. On 1 July, Ina decides to increase her capital by bringing in machinery worth $20,000 1) Depreciation for Factory Machinery is 15%p.a and Office Equipment is 20 % pa on written down value. The partners have decided to write off Mr Tikka debts of $ 1600 as uncollectible. The Provision for bad debts is now charged at 8 % of the remaining debtors. Required: a) Prepare the Income Statement and the Appropriation account for the year ended 31 December 2019 b) Prepare the Current account for each partner. c) Prepare the Statement of Financial Position as at 31 December 2019. (30 marks) Question 1 Ina, Meena and Deeka have been in Partnership as manufactures for many years. Interest on drawings is 10%p.a. Interest on capital is 20% p.a. for the first six months and 25% p.a. for the remaining six months of 2019. Ina receives a salary of S4000 per quarter and Deeka receives a monthly salary of RM 2,200. Profit is shared at 40% for Ina, 30% for Meena and 30% for Deeka. The following balances were produced for the year ended 31 December 2019. DEBIT REDIT Inventory as at 1 Jan 2019 64,800 Provision for bad debts at 1 Jan 2019 1,500 Electricity expenses 2,100 Sales and purchases 127,800 462,600 Carriage Inwards 7,800 Wages and salaries 48,600 Repairs and maintenance expenses 8,500 Insurance on Building 48,000 Carriage outwards 7,860 Advertising expenses 3,250 Provision for Depreciation at 1 Jan 2019 Machinery 38.000 Office Equipment 24,920 Telephone charges 9,400 Current Account 1,600 Meena 9,800 Deeka 6,910 Capital Account Ina 80,000 Meena 80,000 Decka 60,000 Machinery at cost 180,000 Office Equipment at cost 124,600 General expenses 16,400 Debtors and creditors 22,500 10,000 Drawings: Ina 35,000 Meena 27,500 Decka 14,400 Ina Bank 12.000 Bad Debts 1,000 823,420 823,420 Additional Information: a) Inventory as at 31 December 2019 were valued at RM 65,500. b) Drawings by the partners were as follows: GOODS CASH RM. RM. Ina (withdrew on 1 Mar) 25,000 10,000 Meena (withdrew on 1 April) 21,500 6,000 Deeka (withdrew on 30 Sep) 10,400 4,000 Electricity expenses for the month of December 2019, RM 1,400 have been omitted. A 2 year Insurance on the building was paid on 1 May 2019. On 1 July, Ina decides to increase her capital by bringing in machinery worth $20,000 1) Depreciation for Factory Machinery is 15%p.a and Office Equipment is 20 % pa on written down value. The partners have decided to write off Mr Tikka debts of $ 1600 as uncollectible. The Provision for bad debts is now charged at 8 % of the remaining debtors. Required: a) Prepare the Income Statement and the Appropriation account for the year ended 31 December 2019 b) Prepare the Current account for each partner. c) Prepare the Statement of Financial Position as at 31 December 2019. (30 marks)