Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 is based on extracts from the 2019 published consolidated financial statements of Burger Fuel Worldwide Limited (BFWL). This question is to be

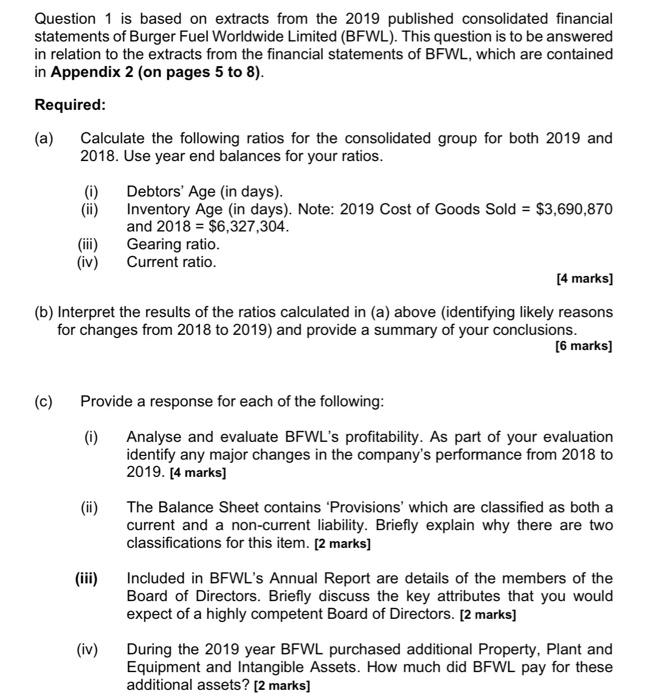

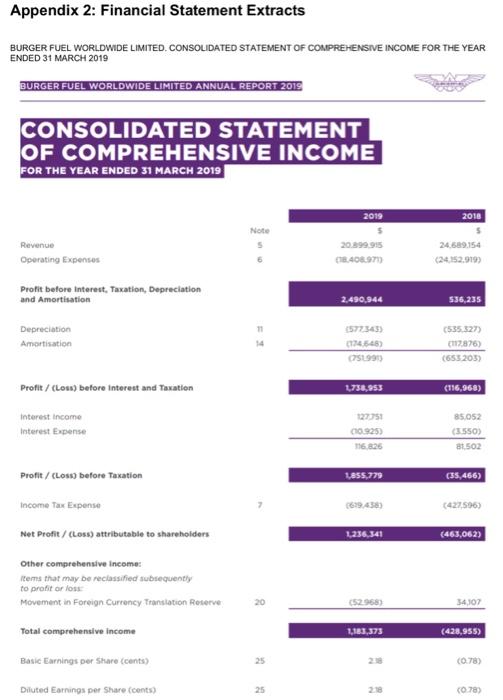

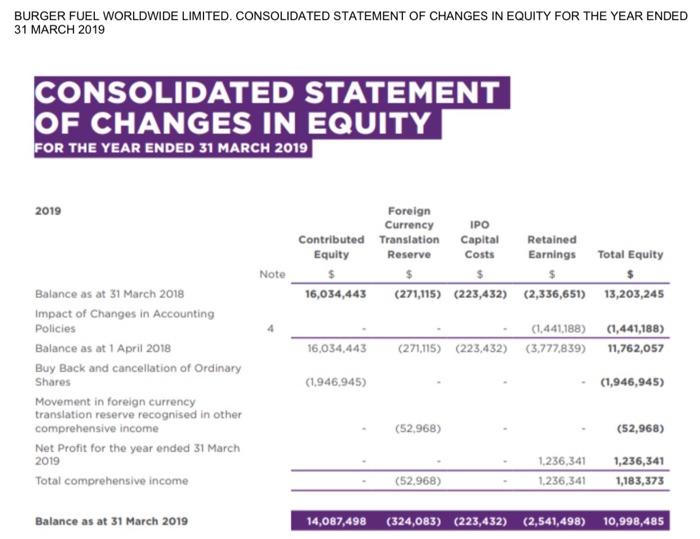

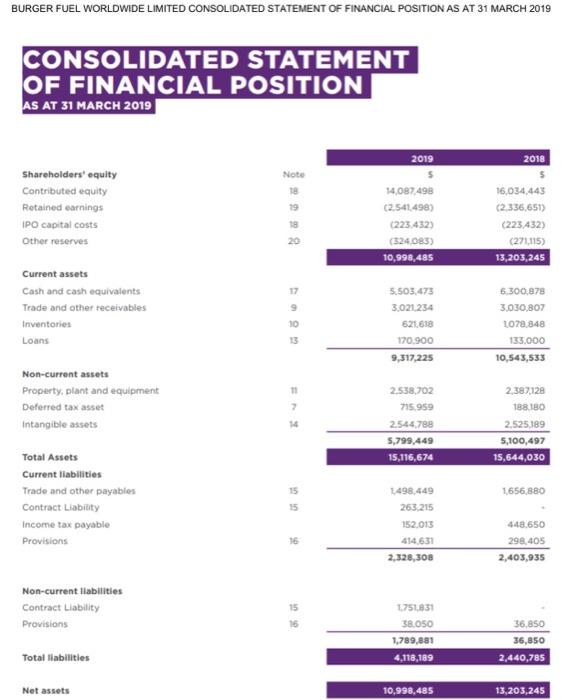

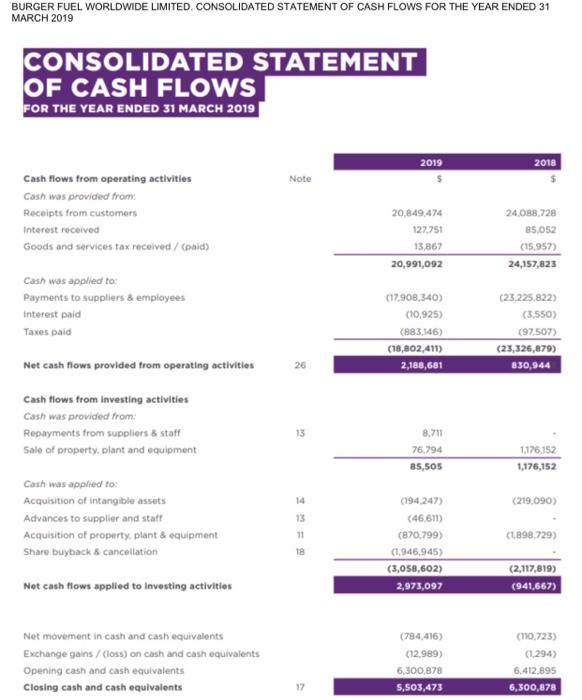

Question 1 is based on extracts from the 2019 published consolidated financial statements of Burger Fuel Worldwide Limited (BFWL). This question is to be answered in relation to the extracts from the financial statements of BFWL, which are contained in Appendix 2 (on pages 5 to 8). Required: (a) Calculate the following ratios for the consolidated group for both 2019 and 2018. Use year end balances for your ratios. (c) (i) Debtors' Age (in days). Inventory Age (in days). Note: 2019 Cost of Goods Sold = $3,690,870 and 2018 $6,327,304. (iii) (iv) [4 marks] (b) Interpret the results of the ratios calculated in (a) above (identifying likely reasons for changes from 2018 to 2019) and provide a summary of your conclusions. [6 marks] Provide a response for each of the following: (i) Analyse and evaluate BFWL's profitability. As part of your evaluation identify any major changes in the company's performance from 2018 to 2019. [4 marks] (ii) Gearing ratio. Current ratio. (iii) (iv) The Balance Sheet contains 'Provisions' which are classified as both a current and a non-current liability. Briefly explain why there are two classifications for this item. [2 marks] Included in BFWL's Annual Report are details of the members of the Board of Directors. Briefly discuss the key attributes that you would expect of a highly competent Board of Directors. [2 marks] During the 2019 year BFWL purchased additional Property, Plant and Equipment and Intangible Assets. How much did BFWL pay for these additional assets? [2 marks] Appendix 2: Financial Statement Extracts BURGER FUEL WORLDWIDE LIMITED. CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 MARCH 2019 BURGER FUEL WORLDWIDE LIMITED ANNUAL REPORT 2019 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 MARCH 2019 Revenue Operating Expenses Profit before Interest, Taxation, Depreciation and Amortisation Depreciation Amortisation Profit/ (Loss) before interest and Taxation Interest Income Interest Expense Profit/ (Loss) before Taxation Income Tax Expense Net Profit/ (Loss) attributable to shareholders Other comprehensive income: Items that may be reclassified subsequently to profit or loss: Movement in Foreign Currency Translation Reserve Total comprehensive income Basic Earnings per Share (cents) Diluted Earnings per Share (cents) Note 5 6 11 14 C 25 2019 20.899,915 (18.408.971) 2,490,944 (577.343) (174,648) (751991) 1,738,953 127,751 (10.925) 116.826 1,855,779 (619,438) 1,236,341 (52.968) 1,183,373 2:18 2018 24.689.154 (24,152.919) 536,235 (535,327) (117,876) (653,203) (116,968) 85,052 (3.550) 81.502 (35,466) (427,596) (463,062) 34,107 (428,955) (0.78) (0.78) BURGER FUEL WORLDWIDE LIMITED. CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 MARCH 2019 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 MARCH 2019 2019 Balance as at 31 March 2018 Impact of Changes in Accounting Policies Balance as at 1 April 2018 Buy Back and cancellation of Ordinary Shares Movement in foreign currency translation reserve recognised in other comprehensive income Net Profit for the year ended 31 March 2019 Total comprehensive income Balance as at 31 March 2019 Note Contributed Equity $ 16,034,443 16,034,443 (1,946,945) Foreign Currency Translation Capital IPO Reserve Costs $ $ (271,115) (223,432) (2,336,651) 13,203,245 (52,968) Retained Earnings (271,115) (223,432) (3,777,839) (52,968) (1,441,188) (1,441,188) 11,762,057 1,236,341 1,236,341 Total Equity 14,087,498 (324,083) (223,432) (2,541,498) (1,946,945) (52,968) 1,236,341 1,183,373 10,998,485 BURGER FUEL WORLDWIDE LIMITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH 2019 CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH 2019 Shareholders' equity Contributed equity Retained earnings IPO capital costs Other reserves Current assets Cash and cash equivalents Trade and other receivables Inventories Loans Non-current assets Property, plant and equipment Deferred tax asset Intangible assets Total Assets Current liabilities Trade and other payables Contract Liability Income tax payable Provisions Non-current liabilities Contract Liability Provisions Total liabilities Net assets Note 18 19 18 20 17 9 10 13 11 7 14 15 15 15 16 2019 14,087,498 (2,541,498) (223,432) (324,083) 10,998,485 5,503,473 3,021.234 621,618 170.900 9,317,225 2,538,702 715.959 2,544,788 5,799,449 15,116,674 1,498,449 263,215 152,013 414,631 2,328,308 1,751,831 38.050 1,789,881 4,118,189 10,998,485 2018 $ 16,034,443 (2,336,651) (223,432) (271,115) 13,203,245 6,300,878 3,030,807 1078,848 133,000 10,543,533 2,387,128 188.180 2,525,189 5,100,497 15,644,030 1,656,880 448.650 298,405 2,403,935 36,850 36,850 2,440,785 13,203,245 BURGER FUEL WORLDWIDE LIMITED. CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 MARCH 2019 CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 MARCH 2019 Cash flows from operating activities Cash was provided from: Receipts from customers Interest received Goods and services tax received/ (paid) Cash was applied to: Payments to suppliers & employees Interest paid Taxes paid Net cash flows provided from operating activities Cash flows from investing activities Cash was provided from: Repayments from suppliers & staff Sale of property, plant and equipment Cash was applied to: Acquisition of intangible assets Advances to supplier and staff Acquisition of property, plant & equipment Share buyback & cancellation Net cash flows applied to investing activities Net movement in cash and cash equivalents Exchange gains / (loss) on cash and cash equivalents Opening cash and cash equivalents Closing cash and cash equivalents Note 26 13 14 13 11 18 17 2019 $ 20,849,474 127,751 13,867 20,991,092 (17,908,340) (10,925) (883,146) (18,802,411) 2,188,681 8,711 76,794 85,505 (194,247) (46,611) (870,799) (1,946,945) (3,058,602) 2,973,097 (784,416) (12,989) 6,300,878 5,503,473 2018 $ 24,088,728 85,052 (15,957) 24,157,823 (23,225,822) (3,550) (97,507) (23,326,879) 830,944 1,176,152 1,176,152 (219,090) (1,898,729) (2,117,819) (941,667) (110,723) (1,294) 6,412,895 6,300,878

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A Debtors age 365SalesDebtors 2019 2018 Sales 20899915 24689154 Debtors 3021234 3030...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started