Answered step by step

Verified Expert Solution

Question

1 Approved Answer

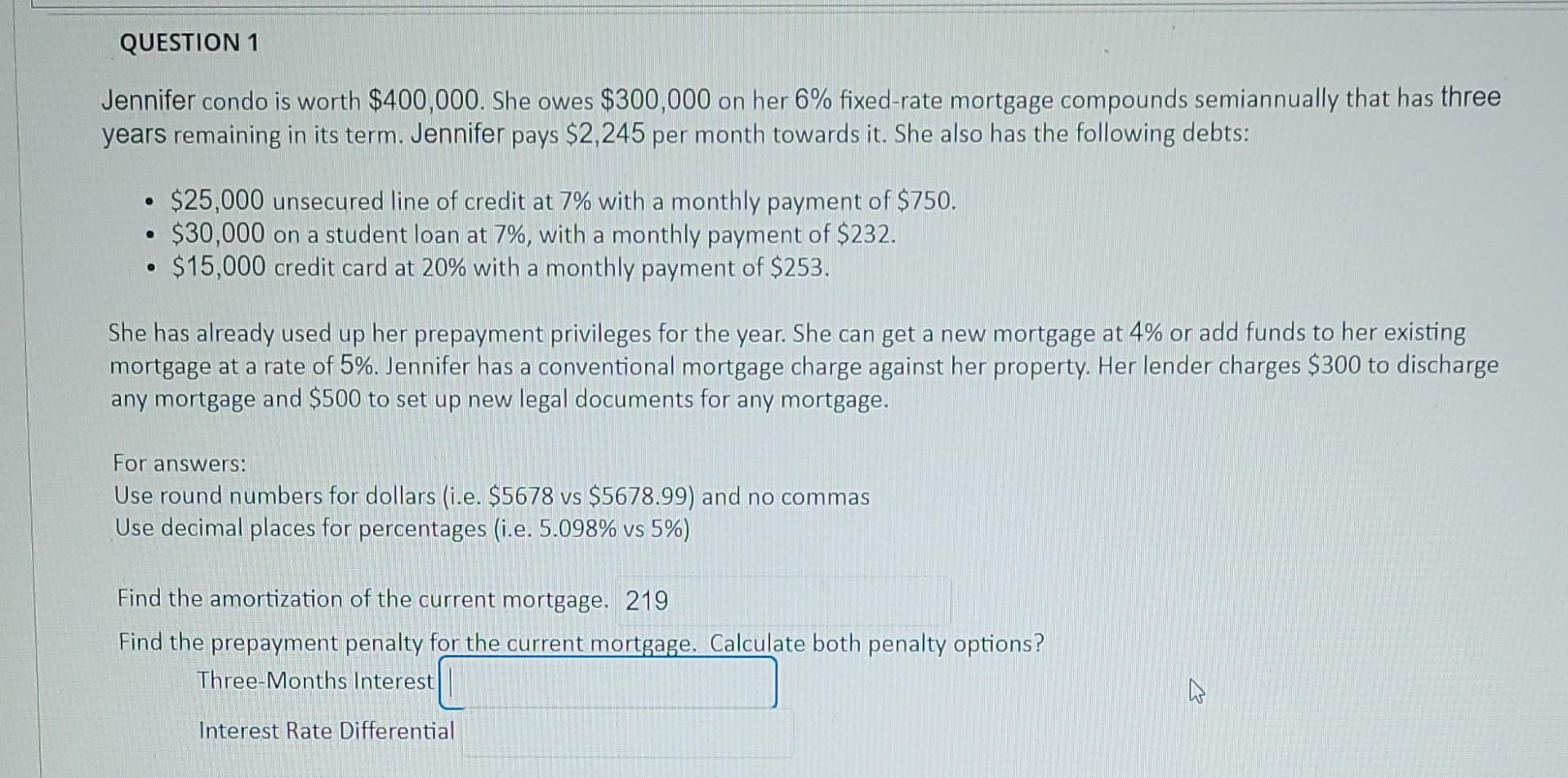

QUESTION 1 Jennifer condo is worth $400,000. She owes $300,000 on her 6% fixed-rate mortgage compounds semiannually that has three years remaining in its term.

QUESTION 1 Jennifer condo is worth $400,000. She owes $300,000 on her 6% fixed-rate mortgage compounds semiannually that has three years remaining in its term. Jennifer pays $2,245 per month towards it. She also has the following debts: . $25,000 unsecured line of credit at 7% with a monthly payment of $750. $30,000 on a student loan at 7%, with a monthly payment of $232. $15,000 credit card at 20% with a monthly payment of $253. a She has already used up her prepayment privileges for the year. She can get a new mortgage at 4% or add funds to her existing mortgage at a rate of 5%. Jennifer has a conventional mortgage charge against her property. Her lender charges $300 to discharge any mortgage and $500 to set up new legal documents for any mortgage. For answers: Use round numbers for dollars (i.e. $5678 vs $5678.99) and no commas Use decimal places for percentages (i.e. 5.098% vs 5%) Find the amortization of the current mortgage. 219 Find the prepayment penalty for the current mortgage. Calculate both penalty options? Three-Months Interest Interest Rate Differential w QUESTION 1 Jennifer condo is worth $400,000. She owes $300,000 on her 6% fixed-rate mortgage compounds semiannually that has three years remaining in its term. Jennifer pays $2,245 per month towards it. She also has the following debts: . $25,000 unsecured line of credit at 7% with a monthly payment of $750. $30,000 on a student loan at 7%, with a monthly payment of $232. $15,000 credit card at 20% with a monthly payment of $253. a She has already used up her prepayment privileges for the year. She can get a new mortgage at 4% or add funds to her existing mortgage at a rate of 5%. Jennifer has a conventional mortgage charge against her property. Her lender charges $300 to discharge any mortgage and $500 to set up new legal documents for any mortgage. For answers: Use round numbers for dollars (i.e. $5678 vs $5678.99) and no commas Use decimal places for percentages (i.e. 5.098% vs 5%) Find the amortization of the current mortgage. 219 Find the prepayment penalty for the current mortgage. Calculate both penalty options? Three-Months Interest Interest Rate Differential w

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started