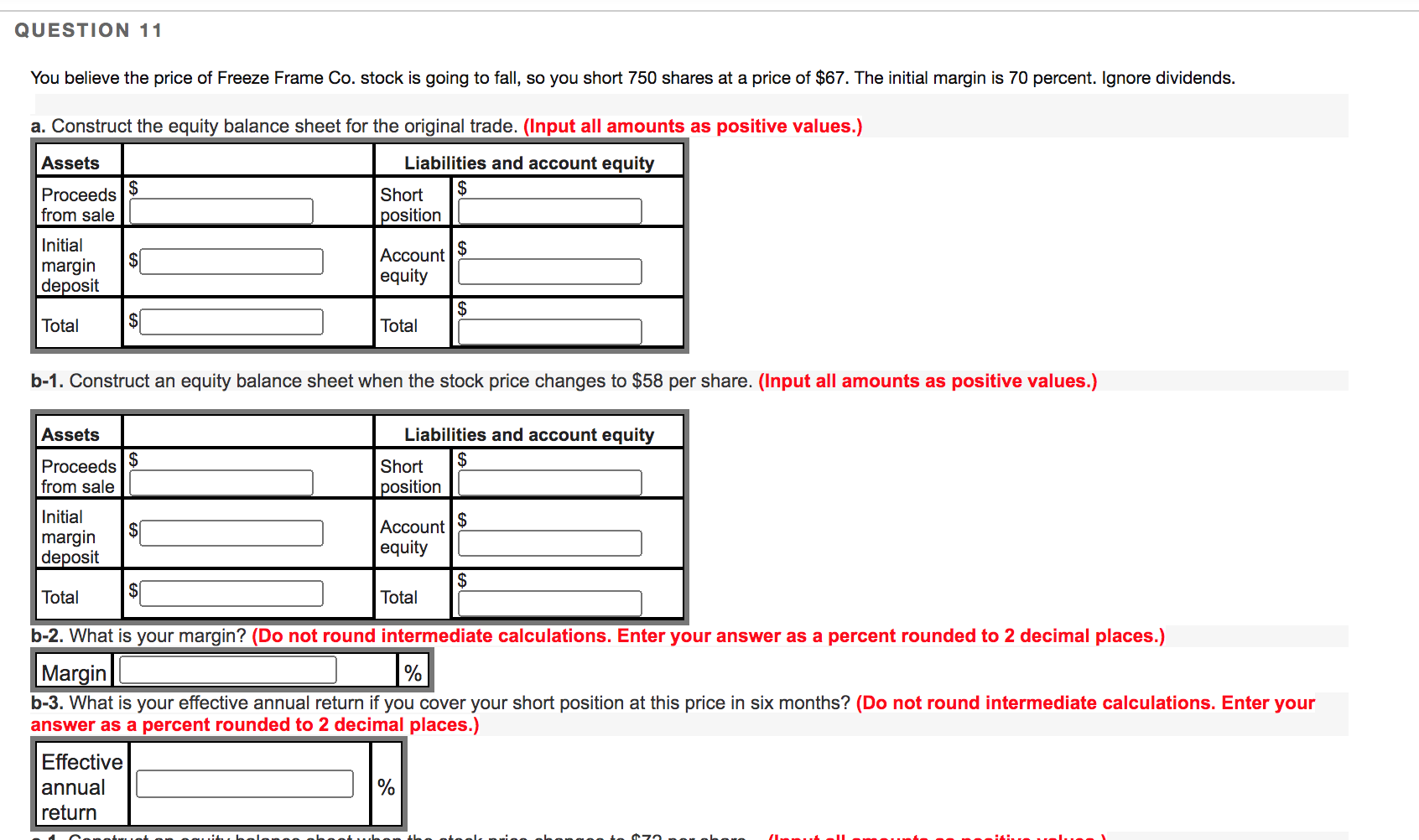

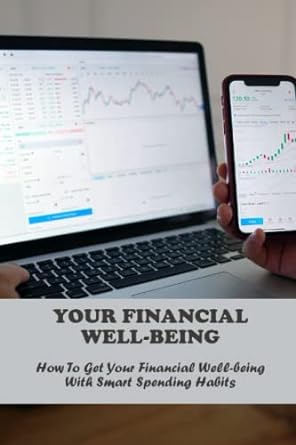

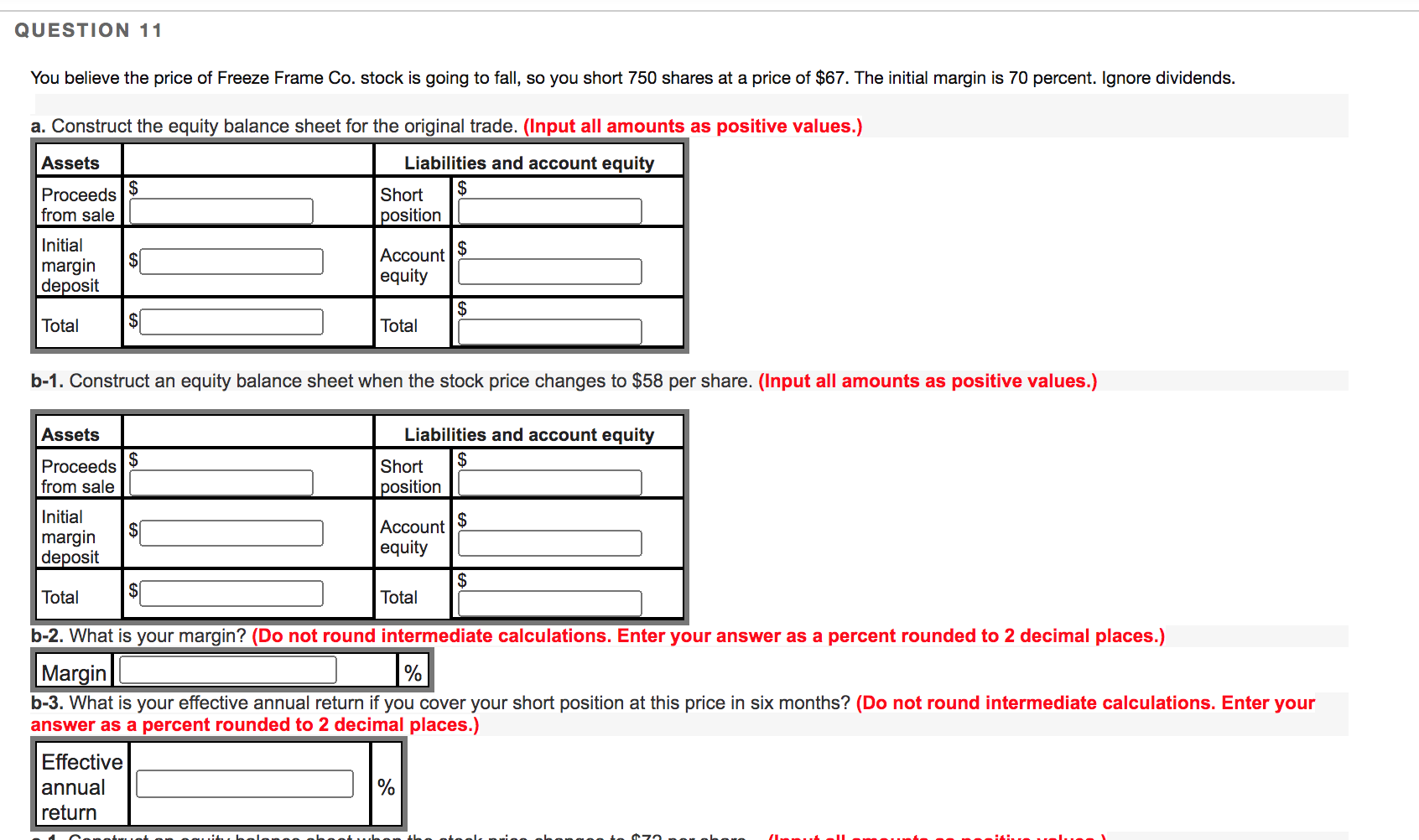

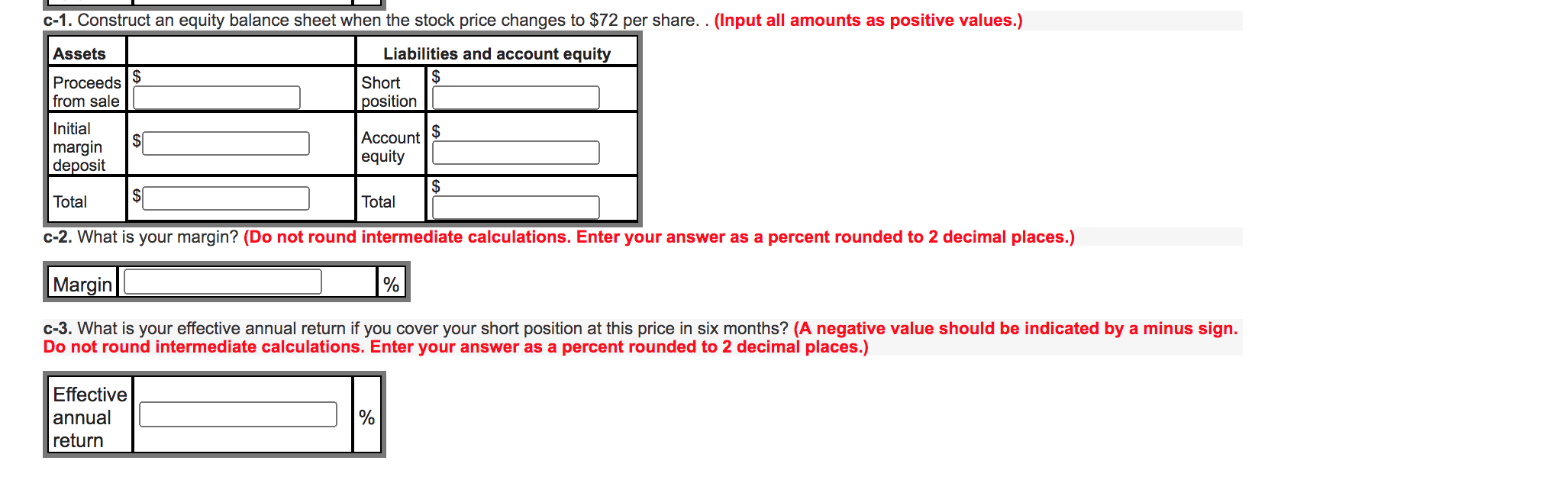

QUESTION 11 You believe the price of Freeze Frame Co. stock is going to fall, so you short 750 shares at a price of $67. The initial margin is 70 percent. Ignore dividends. a. Construct the equity balance sheet for the original trade. (Input all amounts as positive values.) Liabilities and account equity Short $ position Assets Proceeds $ from sale Initial $ margin deposit $ Account equity $ Total Total b-1. Construct an equity balance sheet when the stock price changes to $58 per share. (Input all amounts as positive values.) Assets $ Liabilities and account equity Short $ position Proceeds from sale Initial margin deposit $ Account $ equity $ Total $ Total b-2. What is your margin? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Margin % b-3. What is your effective annual return if you cover your short position at this price in six months? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return % C-1. Construct an equity balance sheet when the stock price changes to $72 per share. . (Input all amounts as positive values.) Assets Liabilities and account equity $ Proceeds Short $ from sale position $ Initial margin deposit $ Account equity $ Total Total C-2. What is your margin? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Margin % C-3. What is your effective annual return if you cover your short position at this price in six months? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return % QUESTION 11 You believe the price of Freeze Frame Co. stock is going to fall, so you short 750 shares at a price of $67. The initial margin is 70 percent. Ignore dividends. a. Construct the equity balance sheet for the original trade. (Input all amounts as positive values.) Liabilities and account equity Short $ position Assets Proceeds $ from sale Initial $ margin deposit $ Account equity $ Total Total b-1. Construct an equity balance sheet when the stock price changes to $58 per share. (Input all amounts as positive values.) Assets $ Liabilities and account equity Short $ position Proceeds from sale Initial margin deposit $ Account $ equity $ Total $ Total b-2. What is your margin? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Margin % b-3. What is your effective annual return if you cover your short position at this price in six months? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return % C-1. Construct an equity balance sheet when the stock price changes to $72 per share. . (Input all amounts as positive values.) Assets Liabilities and account equity $ Proceeds Short $ from sale position $ Initial margin deposit $ Account equity $ Total Total C-2. What is your margin? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Margin % C-3. What is your effective annual return if you cover your short position at this price in six months? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return %