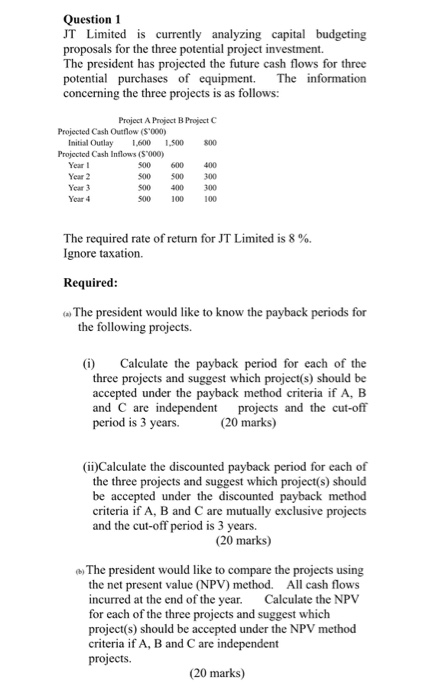

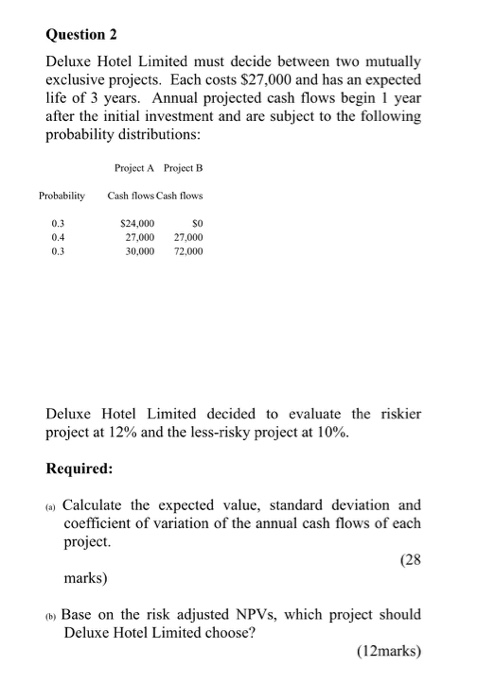

Question 1 JT Limited is currently analyzing capital budgeting proposals for the three potential project investment. The president has projected the future cash flows for three potential purchases of equipment. The information concerning the three projects is as follows: Project A Project B Project C Projected Cash Outflow ('000) Initial Outlay 1,600 1,500 800 Projected Cash Inflows (5000) Year 1 500 600 400 Year 2 500 500 300 Year 3 500 400 300 Year 4 500 100 100 The required rate of return for JT Limited is 8%. Ignore taxation. Required: The president would like to know the payback periods for the following projects. (1) Calculate the payback period for each of the three projects and suggest which project(s) should be accepted under the payback method criteria if A, B and C are independent projects and the cut-off period is 3 years. (20 marks) (ii)Calculate the discounted payback period for each of the three projects and suggest which project() should be accepted under the discounted payback method criteria if A, B and C are mutually exclusive projects and the cut-off period is 3 years. (20 marks) - The president would like to compare the projects using the net present value (NPV) method. All cash flows incurred at the end of the year. Calculate the NPV for each of the three projects and suggest which project(s) should be accepted under the NPV method criteria if A, B and C are independent projects. (20 marks) Question 2 Deluxe Hotel Limited must decide between two mutually exclusive projects. Each costs $27,000 and has an expected life of 3 years. Annual projected cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash flows Cash flows 0.3 0.4 $24,000 27,000 30,000 SO 27.000 72.000 0.3 Deluxe Hotel Limited decided to evaluate the riskier project at 12% and the less-risky project at 10%. Required: (a) Calculate the expected value, standard deviation and coefficient of variation of the annual cash flows of each project. (28 marks) 6) Base on the risk adjusted NPVs, which project should Deluxe Hotel Limited choose? (12marks)