Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION #1 - Last year Bridget purchased a $1,000 face value corporate bond with an 8% annual coupon rate and a 30 -year maturity. At

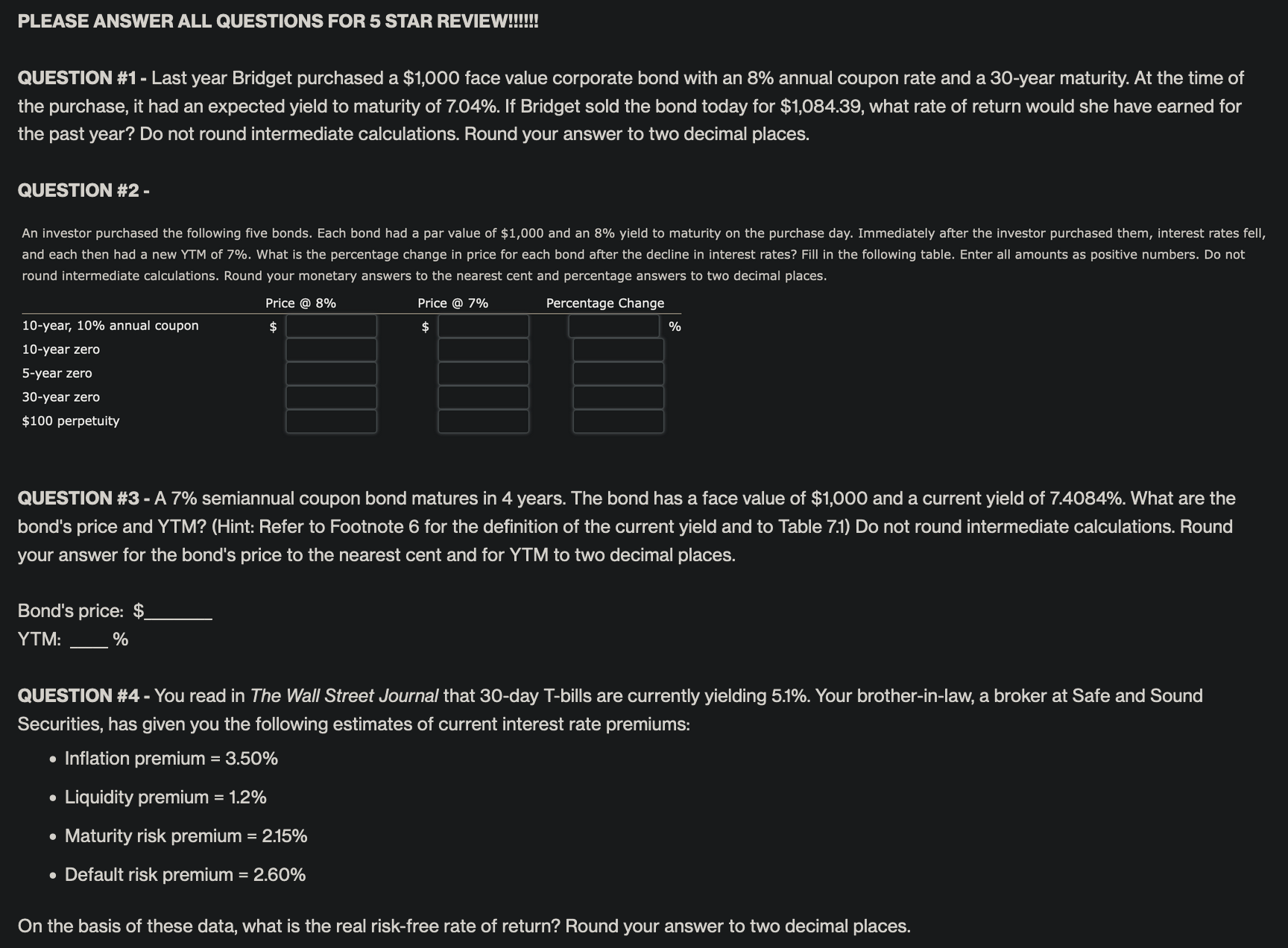

QUESTION \#1 - Last year Bridget purchased a $1,000 face value corporate bond with an 8% annual coupon rate and a 30 -year maturity. At the time of the purchase, it had an expected yield to maturity of 7.04%. If Bridget sold the bond today for $1,084.39, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places. QUESTION \#2 round intermediate calculations. Round your monetary answers to the nearest cent and percentage answers to two decimal places. QUESTION \#3 - A 7\% semiannual coupon bond matures in 4 years. The bond has a face value of $1,000 and a current yield of 7.4084%. What are the bond's price and YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answer for the bond's price to the nearest cent and for YTM to two decimal places. Bond's price: \$ YTM: % QUESTION \#4 - You read in The Wall Street Journal that 30-day T-bills are currently yielding 5.1\%. Your brother-in-law, a broker at Safe and Sound Securities, has given you the following estimates of current interest rate premiums: - Inflation premium =3.50% - Liquidity premium =1.2% - Maturity risk premium =2.15% - Default risk premium =2.60% On the basis of these data, what is the real risk-free rate of return? Round your answer to two decimal places

QUESTION \#1 - Last year Bridget purchased a $1,000 face value corporate bond with an 8% annual coupon rate and a 30 -year maturity. At the time of the purchase, it had an expected yield to maturity of 7.04%. If Bridget sold the bond today for $1,084.39, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places. QUESTION \#2 round intermediate calculations. Round your monetary answers to the nearest cent and percentage answers to two decimal places. QUESTION \#3 - A 7\% semiannual coupon bond matures in 4 years. The bond has a face value of $1,000 and a current yield of 7.4084%. What are the bond's price and YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answer for the bond's price to the nearest cent and for YTM to two decimal places. Bond's price: \$ YTM: % QUESTION \#4 - You read in The Wall Street Journal that 30-day T-bills are currently yielding 5.1\%. Your brother-in-law, a broker at Safe and Sound Securities, has given you the following estimates of current interest rate premiums: - Inflation premium =3.50% - Liquidity premium =1.2% - Maturity risk premium =2.15% - Default risk premium =2.60% On the basis of these data, what is the real risk-free rate of return? Round your answer to two decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started