Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1. Make a fictive investment in 1 to 10 ETF, mutual and/ or index funds for a client considering the following: Client profile: Aggressive

Question 1.

Make a fictive investment in 1 to 10 ETF, mutual and/ or index funds for a client considering the following:

Client profile: Aggressive

Residency: Europe

Investment horizon: 15 years

Should include 1 fund of each with: ESG, Gender equality and Water

Maximum PORTFOLIO ongoing fees: 1.5%

Present your results according to the following table:

| ETF/ Mutual/ Index Funds selected | ISIN code | % of total Portfolio | Fees (ongoing charges) | Weighted fees | % Equity | % Bond | % Cash | Weighted Equity | Weighted Bond | Weighted Cash | First Top region and % | First Top Sectors and % | Passive Mngt | Active Mngt | Net Asset Value N.A.V | Trailing 12-mth yield (%) or YTD | Morningstar risk rating | ||

| (w) | (f) | (w) * (f) | ( e) | (b) | ( c) | (w) * (e) | (w) * (b) | (w) * (c) | |||||||||||

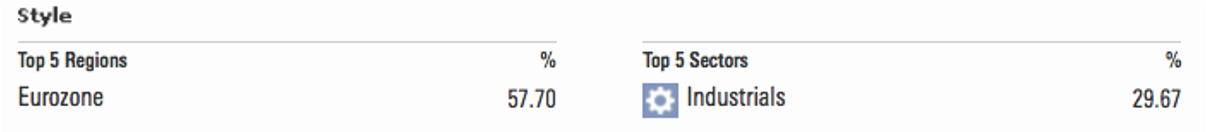

| EXAMPLE Amundi Small Cap C ** | LU1883306901 | 3.00% | 0.76% | 0.02% | 98.06% | 0.00% | 2.70% | 2.94% | 0.00% | 0.08% | EU | 57.70% | Industrials | 29.67% | 1 | 1136.05 | -18.61% | 6 | |

| Blackrock European HY Bond * | LU1191877379 | 2.00% | 1.22% | 0.02% | 0.60% | 89.21% | 0.86% | 0.01% | 1.78% | 0.02% | UK | 17.34% | NA | NA | 1 | 12.07 | -1.77% | 5 | |

| Fund B | |||||||||||||||||||

| Fund C .. | |||||||||||||||||||

| Portfolio | 100.00% | 0.05% | 2.95% | 1.78% | 0.10% | Pflio average: | Pflio average: | 0 | 2 | -0.593700% |

https://www.morningstar.es/es/funds/snapshot/snapshot.aspx?id=F00000W4ZH

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started