Question

Question 1 Manikam Berhad is a toy manufacturer. The financial year end of Manikam Berhad is on 31 December 2019. Presented below is a partial

Question 1

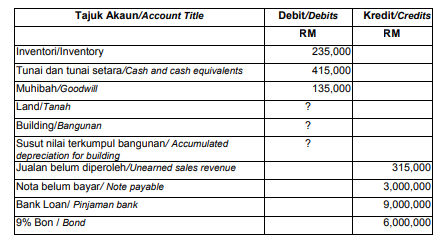

Manikam Berhad is a toy manufacturer. The financial year end of Manikam Berhad is on 31 December 2019. Presented below is a partial trial balance as at 31 December 2019.

Additional information:

1) Manikam Berhads inventory balance on 31 December 2019 was RM235,000 (based on an inventory count undertaken on 31 December 2019).The following items were all excluded from the RM235,000.

i) Merchandise shipped from Manikam Berhad f.o.b. destination on 31 December 2019 is expected to be received by the customer on 2 January CIA1002 3/12 2020. The sales price was RM95,000 and the merchandise cost RM75,000.

ii) Merchandise shipped to Manikam Berhad f.o.b shipping point on 31 December 2019 was received on 7 January 2020. The invoice cost was RM90,000

iii) Merchandise with the sales price of RM 145,000 and merchandise cost of RM140,000 was shipped from Manikam Berhad f.o.b shipping point to a customer on 27 December 2019. The customer is scheduled to receive the merchandise on 2 January 2020.

2) RM 325,000 of the cash balance above consists of cash held in a long-term bond sinking fund.

3) On 1 January 2019, Manikam Berhad decided to purchase several assets of Gugau Berhad in exchange for 25,000 units of Manikam Berhads ordinary shares. On 1 January 2019, Manikam Berhads ordinary share had a fair value of RM38 per share. Assets purchased are land and building which currently have fair values of RM320,000 and RM680,000 respectively. The building is estimated to have a useful life of 40 years and a residual value of RM146,000. Manikam Berhad uses straight line depreciation method.

4) Unearned sales revenue will be earned equally over the next 15 months.

5) The loan of RM9,000,000 above is due on 31 December 2036. On 1 July 2019, Manikam Berhad breached a covenant on its debt obligation and the loan becomes due on demand. Having convinced the bank that the covenant issue will resolved by the first quarter of 2020, Manikam Berhad managed to obtain a waiver from the bank on 24 December 2019.

6) 9 % of Bonds with a principal of RM6,000,000 above were issued for RM6,000,000 on 30 June 2017. The bond matures on 30 June 2037. bondholders have the option of calling (demanding payment on) the bonds at any time. However, the call option is not expected to be exercised given prevailing market conditions

7) RM 500,000 of the note payable amounting RM3,000,000 above is due in September 2020.

Required:

Based on the account balances from the partial trial balance and all the information given above and with reference to MFRS 101 - Presentation of Financial Statements, prepare a partial statement of financial position of Manikam Berhad, showing the current asset, non current asset, current liabilities and non current liabilities section that should be presented at 31 December 2019. The accounts should be properly classified between current assets, non current assets, current liabilities and noncurrent liabilities, and appropriate disclosure note should be included to explain the classification of the item (1) to (7). Provide all clear supporting calculations.

Tajuk Akaun/Account Title Kredit/Credits RM Debit/Debits RM 235,000 415,000 135,000 ? ? Inventori/Inventory Tunai dan tunai setara/Cash and cash equivalents Muhibah/Goodwill Land/Tanah Building/Bangunan Susut nilai terkumpul bangunan/ Accumulated depreciation for building Jualan belum diperoleh/Uneamed sales revenue Nota belum bayar/ Note payable Bank Loan/ Pinjaman bank 9% Bon / Bond ? 315,000 3,000,000 9,000,000 6,000,000 Tajuk Akaun/Account Title Kredit/Credits RM Debit/Debits RM 235,000 415,000 135,000 ? ? Inventori/Inventory Tunai dan tunai setara/Cash and cash equivalents Muhibah/Goodwill Land/Tanah Building/Bangunan Susut nilai terkumpul bangunan/ Accumulated depreciation for building Jualan belum diperoleh/Uneamed sales revenue Nota belum bayar/ Note payable Bank Loan/ Pinjaman bank 9% Bon / Bond ? 315,000 3,000,000 9,000,000 6,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started