Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (Marks 10) a) Suppose IBM can borrow long term at a fixed rate of 7% or at a floating rate of 30 basis

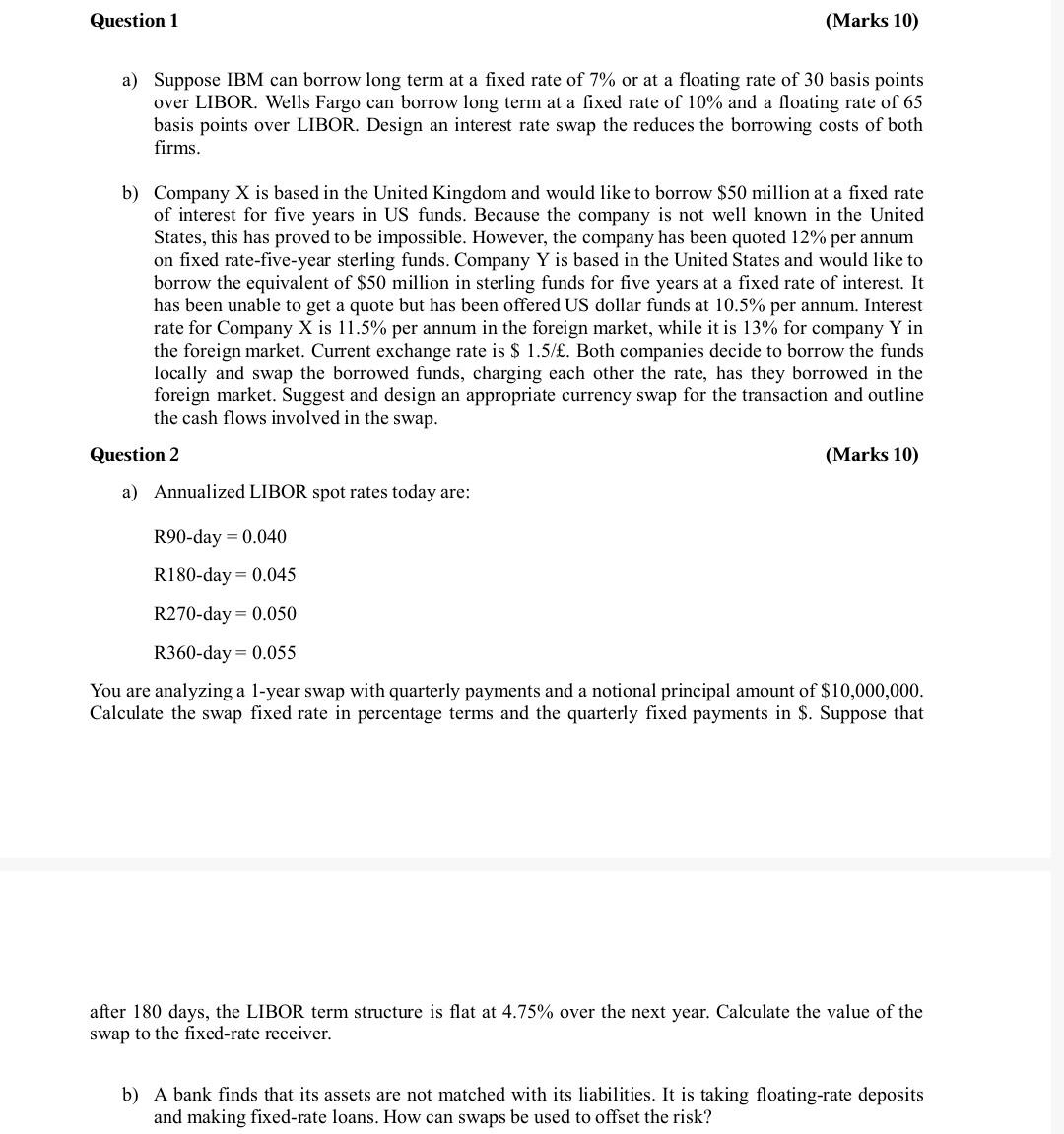

Question 1 (Marks 10) a) Suppose IBM can borrow long term at a fixed rate of 7% or at a floating rate of 30 basis points over LIBOR. Wells Fargo can borrow long term at a fixed rate of 10% and a floating rate of 65 basis points over LIBOR. Design an interest rate swap the reduces the borrowing costs of both firms. b) Company X is based in the United Kingdom and would like to borrow $50 million at a fixed rate of interest for five years in US funds. Because the company is not well known in the United States, this has proved to be impossible. However, the company has been quoted 12% per annum on fixed rate-five-year sterling funds. Company Y is based in the United States and would like to borrow the equivalent of $50 million in sterling funds for five years at a fixed rate of interest. It has been unable to get a quote but has been offered US dollar funds at 10.5% per annum. Interest rate for Company X is 11.5% per annum in the foreign market, while it is 13% for company Y in the foreign market. Current exchange rate is $ 1.5/. Both companies decide to borrow the funds locally and swap the borrowed funds, charging each other the rate, has they borrowed in the foreign market. Suggest and design an appropriate currency swap for the transaction and outline the cash flows involved in the swap. Question 2 (Marks 10) a) Annualized LIBOR spot rates today are: R90-day = 0.040 R180-day = 0.045 R270-day = 0.050 R360-day = 0.055 You are analyzing a 1-year swap with quarterly payments and a notional principal amount of $10,000,000. Calculate the swap fixed rate in percentage terms and the quarterly fixed payments in $. Suppose that after 180 days, the LIBOR term structure is flat at 4.75% over the next year. Calculate the value of the swap to the fixed-rate receiver. b) A bank finds that its assets are not matched with its liabilities. It is taking floating-rate deposits and making fixed-rate loans. How can swaps be used to offset the risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started