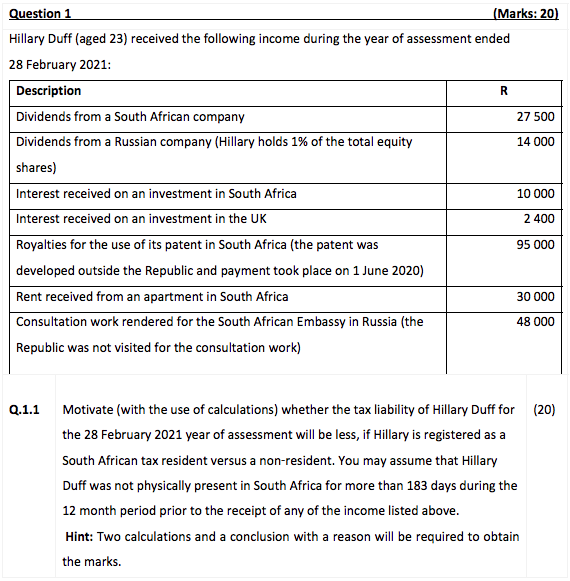

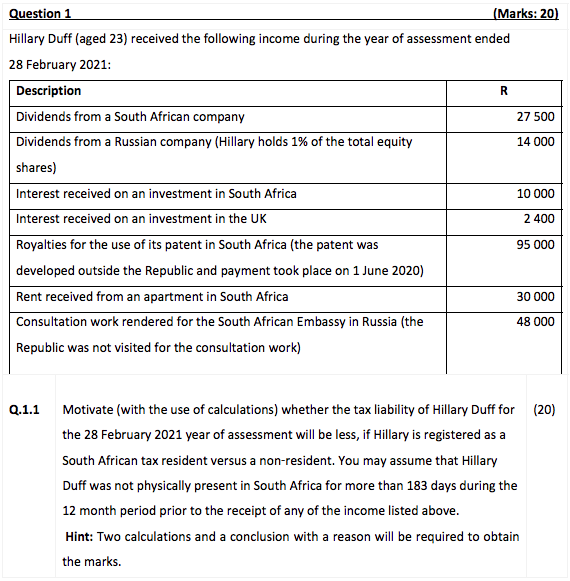

Question 1 (Marks:20) Hillary Duff (aged 23) received the following income during the year of assessment ended 28 February 2021: Description R Dividends from a South African company 27 500 Dividends from a Russian company (Hillary holds 1% of the total equity 14 000 shares) Interest received on an investment in South Africa 10 000 Interest received on an investment in the UK 2 400 Royalties for the use of its patent in South Africa (the patent was 95 000 developed outside the Republic and payment took place on 1 June 2020) Rent received from an apartment in South Africa 30 000 Consultation work rendered for the South African Embassy in Russia (the 48 000 Republic was not visited for the consultation work) Q.1.1 (20) Motivate (with the use of calculations) whether the tax liability of Hillary Duff for the 28 February 2021 year of assessment will be less, if Hillary is registered as a South African tax resident versus a non-resident. You may assume that Hillary Duff was not physically present in South Africa for more than 183 days during the 12 month period prior to the receipt of any of the income listed above. Hint: Two calculations and a conclusion with a reason will be required to obtain the marks. Question 1 (Marks:20) Hillary Duff (aged 23) received the following income during the year of assessment ended 28 February 2021: Description R Dividends from a South African company 27 500 Dividends from a Russian company (Hillary holds 1% of the total equity 14 000 shares) Interest received on an investment in South Africa 10 000 Interest received on an investment in the UK 2 400 Royalties for the use of its patent in South Africa (the patent was 95 000 developed outside the Republic and payment took place on 1 June 2020) Rent received from an apartment in South Africa 30 000 Consultation work rendered for the South African Embassy in Russia (the 48 000 Republic was not visited for the consultation work) Q.1.1 (20) Motivate (with the use of calculations) whether the tax liability of Hillary Duff for the 28 February 2021 year of assessment will be less, if Hillary is registered as a South African tax resident versus a non-resident. You may assume that Hillary Duff was not physically present in South Africa for more than 183 days during the 12 month period prior to the receipt of any of the income listed above. Hint: Two calculations and a conclusion with a reason will be required to obtain the marks