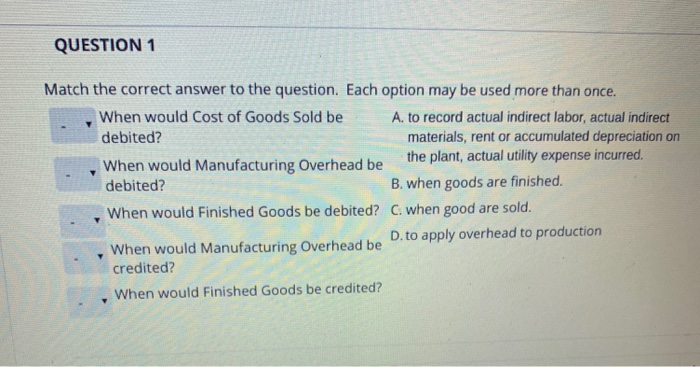

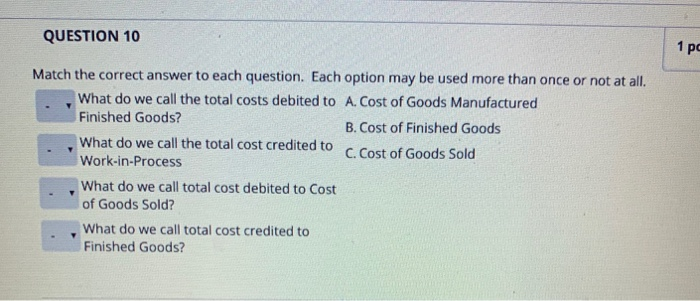

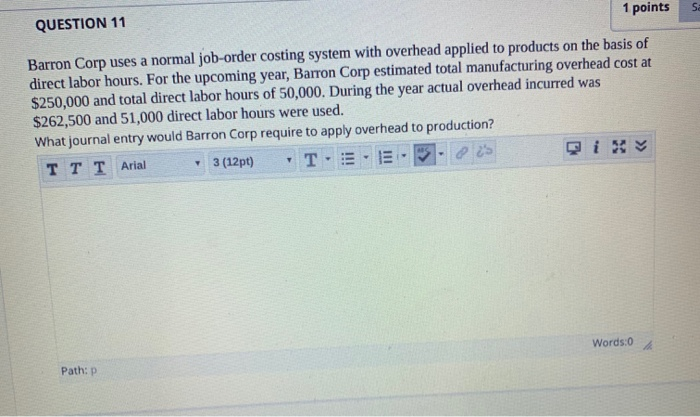

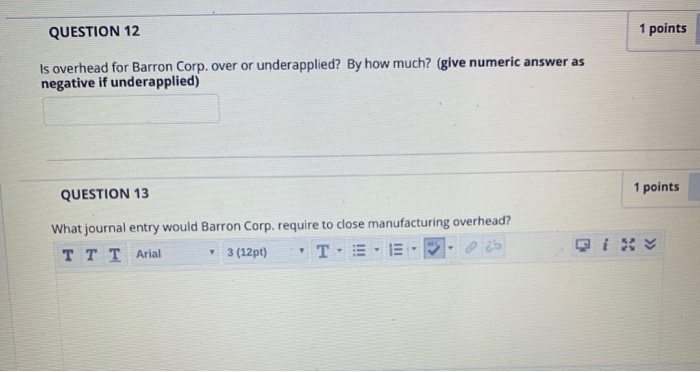

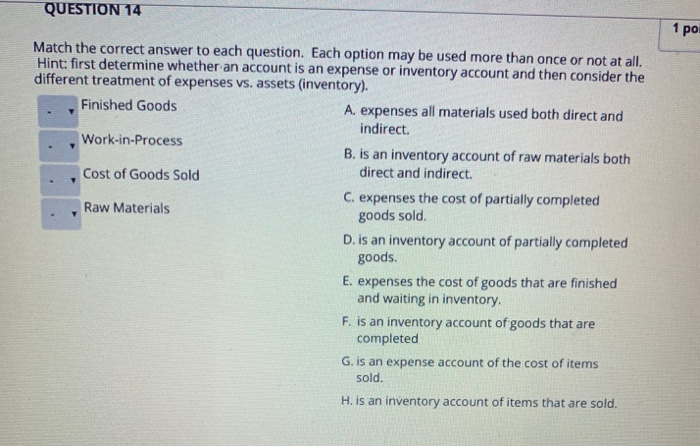

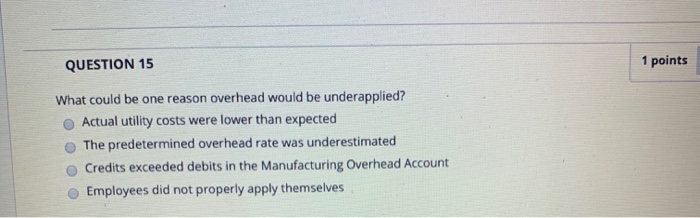

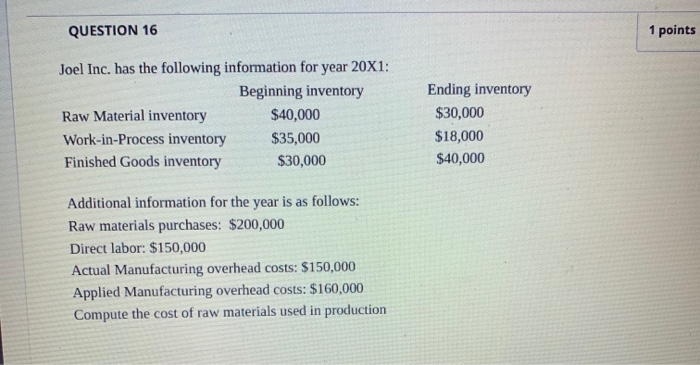

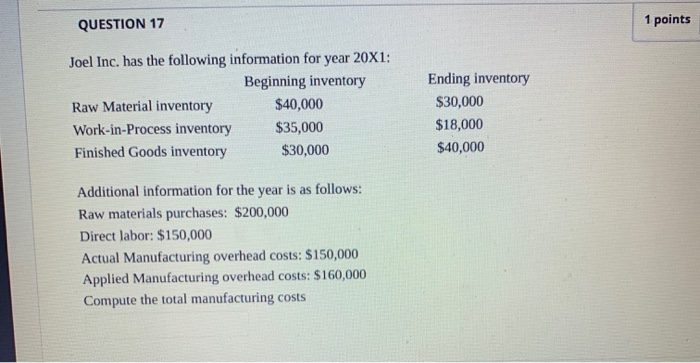

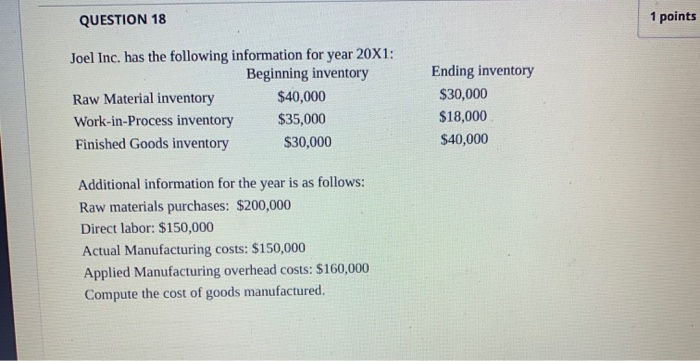

QUESTION 1 Match the correct answer to the question. Each option may be used more than once. When would cost of Goods Sold be A. to record actual indirect labor, actual indirect debited? materials, rent or accumulated depreciation on When would Manufacturing Overhead be the plant, actual utility expense incurred. debited? B. when goods are finished. When would Finished Goods be debited? C. when good are sold. D. to apply overhead to production When would Manufacturing Overhead be credited? When would Finished Goods be credited? Question Completion Status: What is the required journal entry when $1,000 of wood is used to build a bookcase? To receive full credit ALWAYS give ALL journal entries in proper form. See Hints/FAQ tab on Blackboard, Hint: Ask what kind of costic is (period or product? If product: DM, DL, indirect? and then decide how it is treated) T T T Arial 3 (12pt) T- i's Path: P Words:0 QUESTION 3 1 points What is the required entry to record $700 of wages for the supervisor to the carpenter of the above bookcase? Hint: Ask what kind of cost it is (period or product? If product: DM, DL, indirect? and then decide how it is treated) TT T Arial 3 (12pt) T ES Words:0 Path: P Question Completion Status: QUESTION 4 17 Give the entry for $50 worth of glue used to make jobs during the period including bookcases. Hint: Ask what kind of cost it is (period or product? If product: DM, DL, indirect? and then decide how it is treated TT T Arial 3 (12pt) T IE E'S Words:0 Path: P estion Completion Status: QUESTIONS 1 points What is the entry to record $500 of wages for the carpenter of the bookcase? Hint: Ask what kind of cost it is (period or product? If product: DM, DL, indirect? and then decide how it is treated) TT T Arial 3 (12pt) T 25 Words:0 Path: P estion completion Status: QUESTION 6 1 poir Give the entry to record the $200 wages for the bookkeeper that handles accounting for the bookcases. Hint: Ask what kind of cost it is (period or product? If product: DM, DL, indirect? and then decide how it is treated) TT T Arial 3 (12pt) T 7 Words:0 Path: P ses/_748 Question Completion Status: QUESTION 7 S: 1 points If actual indirect costs were $600 but our predetermined rate says we should apply $500 what is the required entry to apply overhead to the job? Hint: It is NOT asking you to close any over/underapplied overhead at this time. TT T Arial 3 (12pt) T E'S Words:0 Path:p QUESTION 8 1 poi The result of #7 on the Manufacturing Overhead account, would also ultimately (over/understate) the Cost of Goods Sold account. QUESTION 9 1 point Give the entry to record the completion of a bookcase which required $1,850 in costs (DM, DL, applied ). TT T Arial 3 (12pt) T QUESTION 10 1 pc Match the correct answer to each question. Each option may be used more than once or not at all. What do we call the total costs debited to A. Cost of Goods Manufactured Finished Goods? B. Cost of Finished Goods What do we call the total cost credited to C. Cost of Goods Sold Work-in-Process What do we call total cost debited to Cost of Goods Sold? What do we call total cost credited to Finished Goods? 1 points Si QUESTION 11 Barron Corp uses a normal job-order costing system with overhead applied to products on the basis of direct labor hours. For the upcoming year, Barron Corp estimated total manufacturing overhead cost at $250,000 and total direct labor hours of 50,000. During the year actual overhead incurred was $262,500 and 51,000 direct labor hours were used. What journal entry would Barron Corp require to apply overhead to production? TT T Arial 3 (12pt) T- PES Words:0 Path: P QUESTION 12 1 points Is overhead for Barron Corp. over or underapplied? By how much? (give numeric answer as negative if underapplied) QUESTION 13 1 points What journal entry would Barron Corp. require to close manufacturing overhead? TT T Arial 3 (12pt) T QUESTION 14 1 po Match the correct answer to each question. Each option may be used more than once or not at all. Hint: first determine whether an account is an expense or inventory account and then consider the different treatment of expenses vs. assets (inventory). Finished Goods A. expenses all materials used both direct and indirect. Work-in-Process B. is an inventory account of raw materials both Cost of Goods Sold direct and indirect. C. expenses the cost of partially completed Raw Materials goods sold D. is an inventory account of partially completed goods. E. expenses the cost of goods that are finished and waiting in inventory. F. is an inventory account of goods that are completed G. is an expense account of the cost of items sold. H. is an inventory account of items that are sold. QUESTION 15 1 points What could be one reason overhead would be underapplied? Actual utility costs were lower than expected The predetermined overhead rate was underestimated Credits exceeded debits in the Manufacturing Overhead Account Employees did not properly apply themselves QUESTION 16 1 points Joel Inc. has the following information for year 20X1: Beginning inventory Raw Material inventory $40,000 Work-in-Process inventory $35,000 Finished Goods inventory $30,000 Ending inventory $30,000 $18,000 $40,000 Additional information for the year is as follows: Raw materials purchases: $200,000 Direct labor: $150,000 Actual Manufacturing overhead costs: $150,000 Applied Manufacturing overhead costs: $160,000 Compute the cost of raw materials used in production QUESTION 17 1 points Joel Inc, has the following information for year 20X1: Beginning inventory Raw Material inventory $40,000 Work-in-Process inventory $35,000 Finished Goods inventory $30,000 Ending inventory $30,000 $18,000 $40,000 Additional information for the year is as follows: Raw materials purchases: $200,000 Direct labor: $150,000 Actual Manufacturing overhead costs: $150,000 Applied Manufacturing overhead costs: $160,000 Compute the total manufacturing costs QUESTION 18 1 points Joel Inc. has the following information for year 20X1: Beginning inventory Raw Material inventory $40,000 Work-in-Process inventory $35,000 Finished Goods inventory $30,000 Ending inventory $30,000 $18,000 $40,000 Additional information for the year is as follows: Raw materials purchases: $200,000 Direct labor: $150,000 Actual Manufacturing costs: $150,000 Applied Manufacturing overhead costs: $160,000 Compute the cost of goods manufactured. QUESTION 19 1 points Compute the UNADJUSTED cost of goods sold for Joel Inc. 1 points QUESTION 20 Compute the ADJUSTED cost of goods sold for Joel Inc. chedules of Cos X C Bunnell Corporation Is A X Mail - Rodriguez, Julian (23 unread) - Julian_marie x + Ourses/_74840_1/cl/outline Question Completion Status: QUESTION 19 1 points Say Compute the UNADJUSTED cost of goods sold for Joel Inc. QUESTION 20 1 points Save Compute the ADJUSTED cost of goods sold for Joel Inc. Click Save and submit to save and submit. Click Save All Answers to save all ansers. Save All Answers Save and Sub O A 96 $ & 6 7 8 4