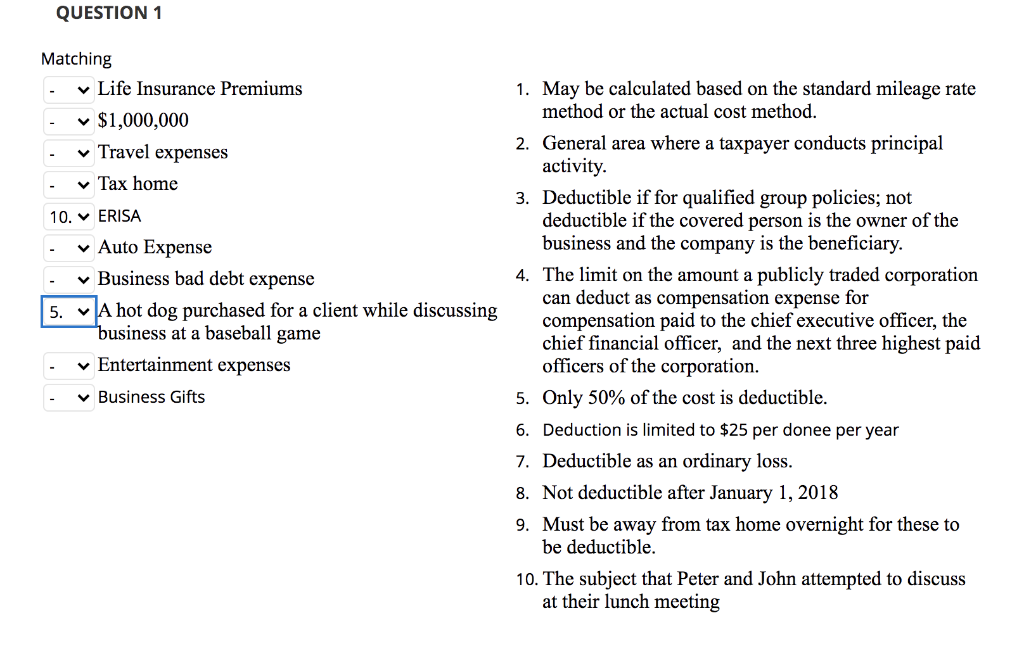

QUESTION 1 Matching Life Insurance Premiums $1,000,000 Travel expenses Tax home 10. ERISA Auto Expense Business bad debt expense 5. A hot dog purchased for a client while discussing business at a baseball game Entertainment expenses 1. May be calculated based on the standard mileage rate method or the actual cost method. 2. General area where a taxpayer conducts principal activity. 3. Deductible if for qualified group policies; not deductible if the covered person is the owner of the business and the company is the beneficiary. 4. The limit on the amount a publicly traded corporation can deduct as compensation expense for compensation paid to the chief executive officer, the chief financial officer, and the next three highest paid officers of the corporation. 5. Only 50% of the cost is deductible. 6. Deduction is limited to $25 per donee per year 7. Deductible as an ordinary loss. 8. Not deductible after January 1, 2018 9. Must be away from tax home overnight for these to be deductible. 10. The subject that Peter and John attempted to discuss at their lunch meeting Business Gifts QUESTION 1 Matching Life Insurance Premiums $1,000,000 Travel expenses Tax home 10. ERISA Auto Expense Business bad debt expense 5. A hot dog purchased for a client while discussing business at a baseball game Entertainment expenses 1. May be calculated based on the standard mileage rate method or the actual cost method. 2. General area where a taxpayer conducts principal activity. 3. Deductible if for qualified group policies; not deductible if the covered person is the owner of the business and the company is the beneficiary. 4. The limit on the amount a publicly traded corporation can deduct as compensation expense for compensation paid to the chief executive officer, the chief financial officer, and the next three highest paid officers of the corporation. 5. Only 50% of the cost is deductible. 6. Deduction is limited to $25 per donee per year 7. Deductible as an ordinary loss. 8. Not deductible after January 1, 2018 9. Must be away from tax home overnight for these to be deductible. 10. The subject that Peter and John attempted to discuss at their lunch meeting Business Gifts