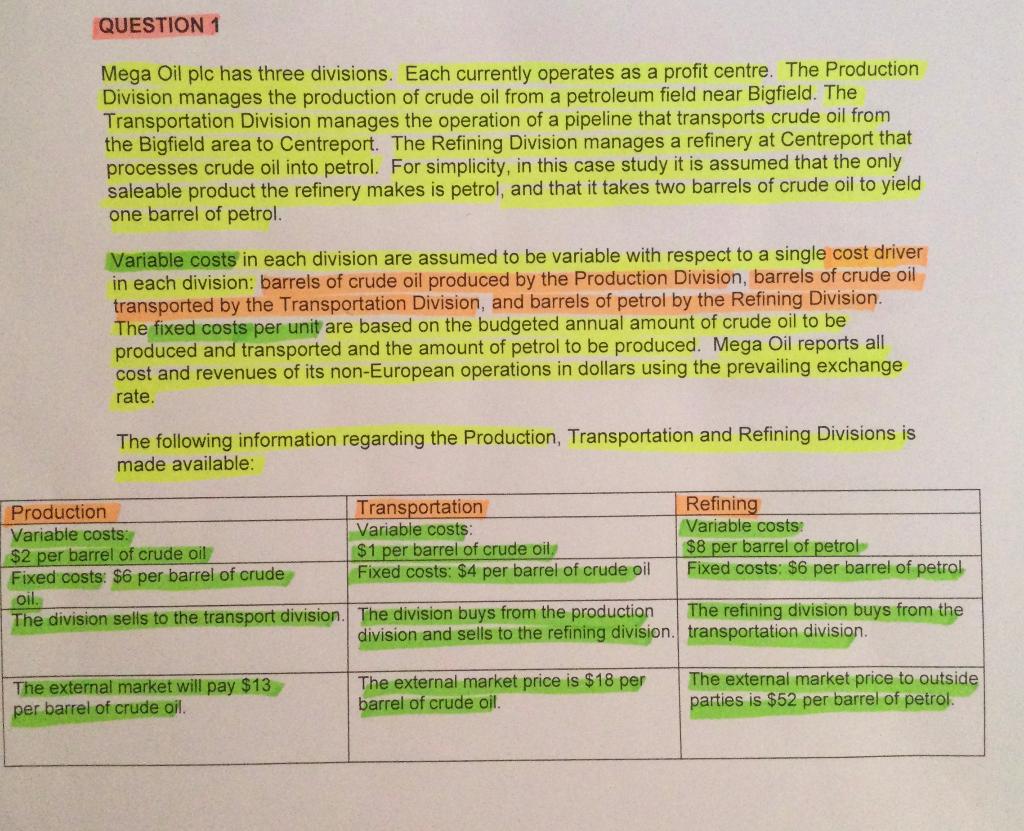

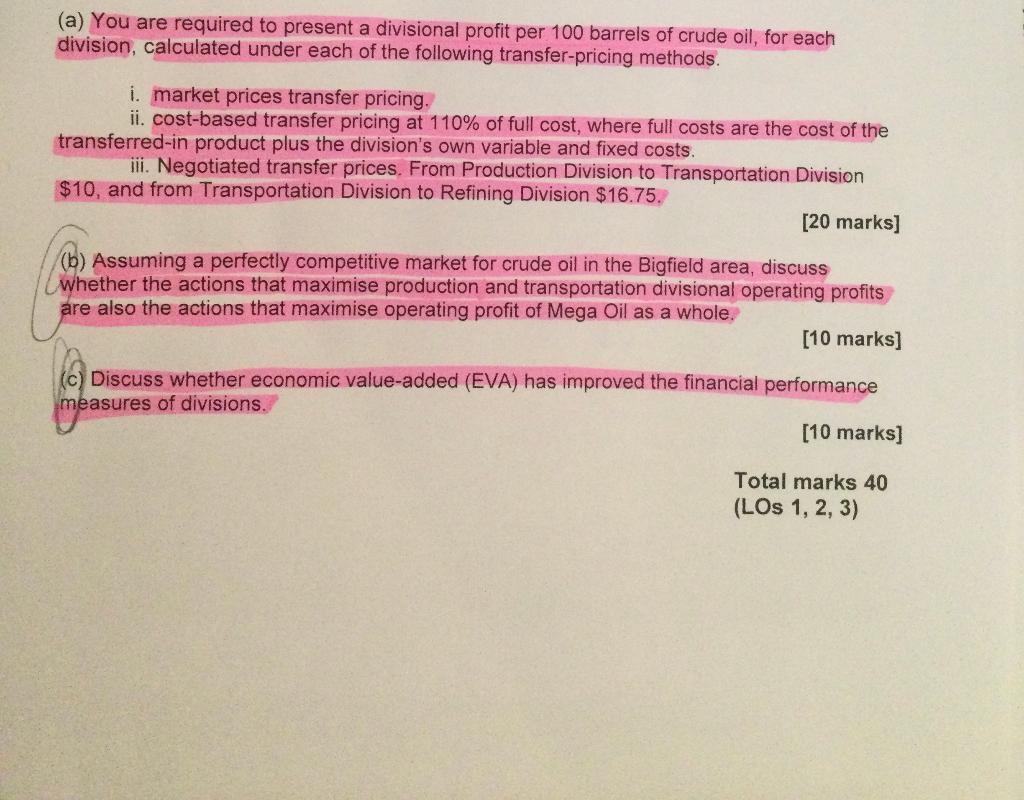

QUESTION 1 Mega Oil plc has three divisions. Each currently operates as a profit centre. The Production Division manages the production of crude oil from a petroleum field near Bigfield. The Transportation Division manages the operation of a pipeline that transports crude oil from the Bigfield area to Centreport. The Refining Division manages a refinery at Centreport that processes crude oil into petrol. For simplicity, in this case study it is assumed that the only saleable product the refinery makes is petrol, and that it takes two barrels of crude oil to yield one barrel of petrol. Variable costs in each division are assumed to be variable with respect to a single cost driver in each division: barrels of crude oil produced by the Production Division, barrels of crude oil transported by the Transportation Division, and barrels of petrol by the Refining Division. The fixed costs per unit are based on the budgeted annual amount of crude oil to be produced and transported and the amount of petrol to be produced. Mega Oil reports all cost and revenues of its non-European operations in dollars using the prevailing exchange rate. The following information regarding the Production, Transportation and Refining Divisions is made available: Production Transportation Refining Variable costs: Variable costs: Variable costs: $2 per barrel of crude oil $1 per barrel of crude oil $8 per barrel of petrol Fixed costs: $6 per barrel of crude Fixed costs: $4 per barrel of crude oil Fixed costs: $6 per barrel of petrol oil. The division sells to the transport division. The division buys from the production The refining division buys from the division and sells to the refining division. transportation division. The external market will pay $13 per barrel of crude oil. The external market price is $18 per barrel of crude oil. The external market price to outside parties is $52 per barrel of petrol. (a) You are required to present a divisional profit per 100 barrels of crude oil, for each division, calculated under each of the following transfer pricing methods. i. market prices transfer pricing. ii. cost-based transfer pricing at 110% of full cost, where full costs are the cost of the transferred-in product plus the division's own variable and fixed costs. iii. Negotiated transfer prices. From Production Division to Transportation Division $10, and from Transportation Division to Refining Division $16.75. [20 marks] (b) Assuming a perfectly competitive market for crude oil in the Bigfield area, discuss whether the actions that maximise production and transportation divisional operating profits are also the actions that maximise operating profit of Mega Oil as a whole. [10 marks] (c) Discuss whether economic value-added (EVA) has improved the financial performance measures of divisions. [10 marks] Total marks 40 (LOS 1, 2, 3) QUESTION 1 Mega Oil plc has three divisions. Each currently operates as a profit centre. The Production Division manages the production of crude oil from a petroleum field near Bigfield. The Transportation Division manages the operation of a pipeline that transports crude oil from the Bigfield area to Centreport. The Refining Division manages a refinery at Centreport that processes crude oil into petrol. For simplicity, in this case study it is assumed that the only saleable product the refinery makes is petrol, and that it takes two barrels of crude oil to yield one barrel of petrol. Variable costs in each division are assumed to be variable with respect to a single cost driver in each division: barrels of crude oil produced by the Production Division, barrels of crude oil transported by the Transportation Division, and barrels of petrol by the Refining Division. The fixed costs per unit are based on the budgeted annual amount of crude oil to be produced and transported and the amount of petrol to be produced. Mega Oil reports all cost and revenues of its non-European operations in dollars using the prevailing exchange rate. The following information regarding the Production, Transportation and Refining Divisions is made available: Production Transportation Refining Variable costs: Variable costs: Variable costs: $2 per barrel of crude oil $1 per barrel of crude oil $8 per barrel of petrol Fixed costs: $6 per barrel of crude Fixed costs: $4 per barrel of crude oil Fixed costs: $6 per barrel of petrol oil. The division sells to the transport division. The division buys from the production The refining division buys from the division and sells to the refining division. transportation division. The external market will pay $13 per barrel of crude oil. The external market price is $18 per barrel of crude oil. The external market price to outside parties is $52 per barrel of petrol. (a) You are required to present a divisional profit per 100 barrels of crude oil, for each division, calculated under each of the following transfer pricing methods. i. market prices transfer pricing. ii. cost-based transfer pricing at 110% of full cost, where full costs are the cost of the transferred-in product plus the division's own variable and fixed costs. iii. Negotiated transfer prices. From Production Division to Transportation Division $10, and from Transportation Division to Refining Division $16.75. [20 marks] (b) Assuming a perfectly competitive market for crude oil in the Bigfield area, discuss whether the actions that maximise production and transportation divisional operating profits are also the actions that maximise operating profit of Mega Oil as a whole. [10 marks] (c) Discuss whether economic value-added (EVA) has improved the financial performance measures of divisions. [10 marks] Total marks 40 (LOS 1, 2, 3)