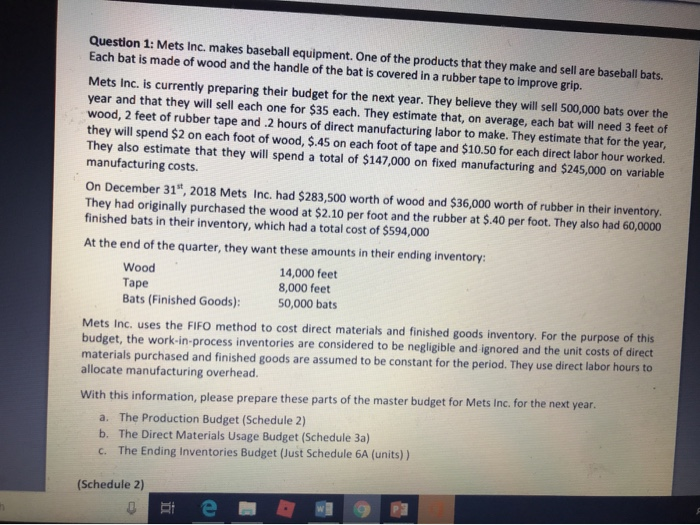

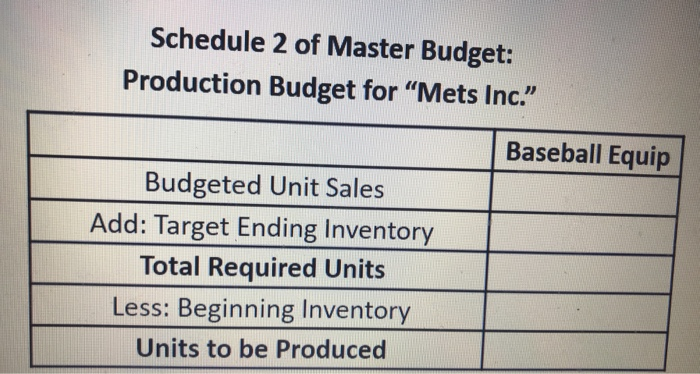

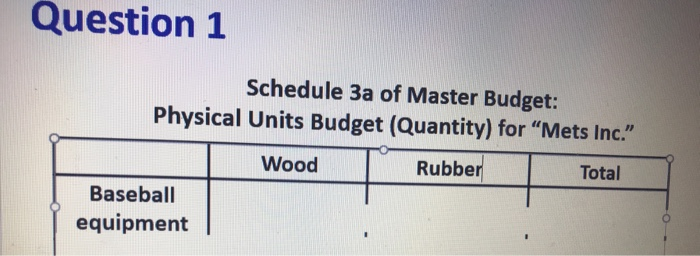

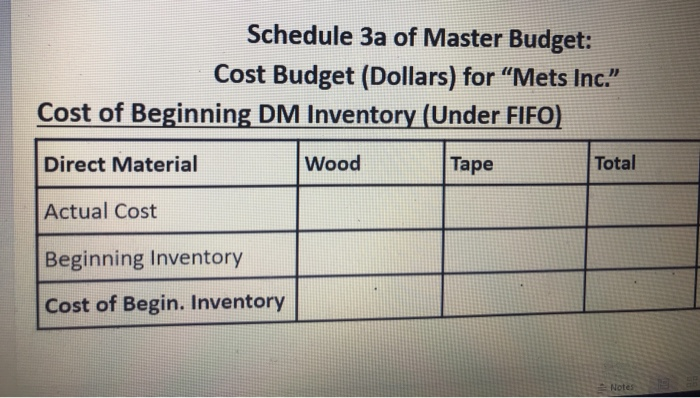

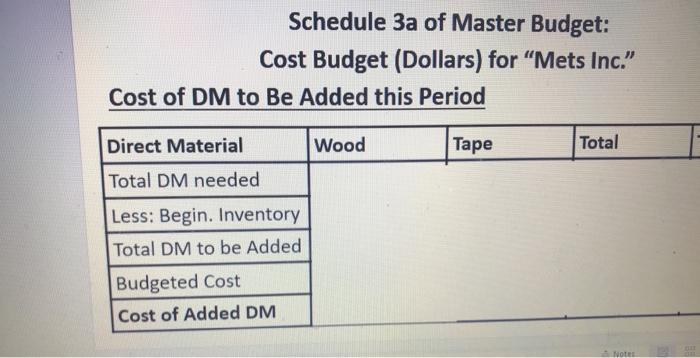

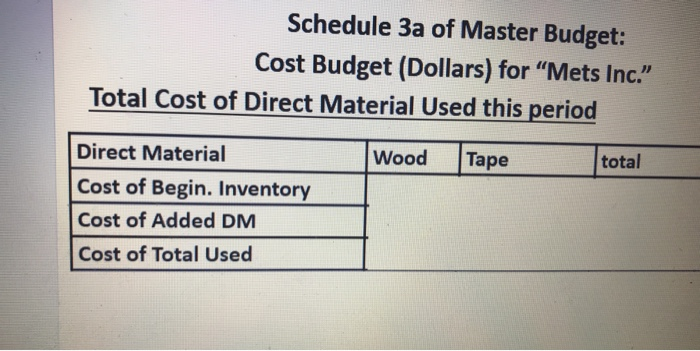

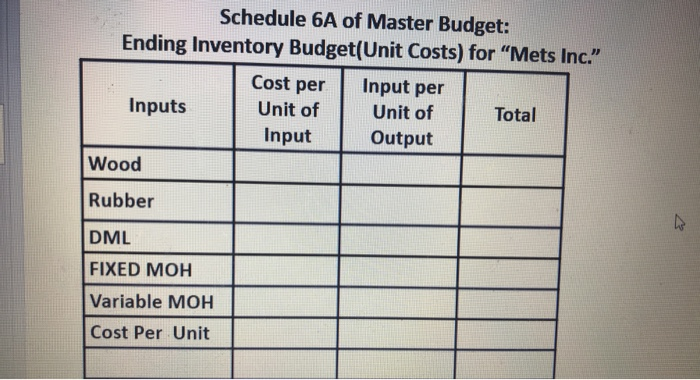

Question 1: Mets Inc. makes baseball equipment. One of the products that they make and sell are baseball bats Each bat is made of wood and the handle of the bat is covered in a rubber tape to improve grip Mets Inc. is currently preparing their budget for the next year. They believe they will sell 500,000 bats over the year and that they will sell each one for $35 each. They estimate that, on average, each bat will need 3 feet of wood, 2 feet of rubber tape and 2 hours of direct manufacturing labor to make. They estimate that for the year they will spend $2 on each foot of wood, $.45 on each foot of tape and $10.50 for each direct labor hour worked. They also estimate that they will spend a total of $147,000 on fixed manufacturing and $245,000 on variable manufacturing costs. On December 31st, 2018 Mets Inc. had $283,500 worth of wood and $36,000 worth of rubber in their inventory They had originally purchased the wood at $2.10 per foot and the rubber at $.40 per foot. They also had 60,0000 finished bats in their inventory, which had a total cost of $594,000 At the end of the quarter, they want these amounts in their ending inventory: 14,000 feet 8,000 feet 50,000 bats Wood Tape Bats (Finished Goods): Mets Inc. uses the FIFO method to cost direct materials and finished goods inventory. For the purpose of this budget, the work-in-process inventories are considered to be negligible and ignored and the unit costs of direct materials purchased and finished goods are assumed to be constant for the period. They use direct labor hours to allocate manufacturing overhead. With this information, please prepare these parts of the master budget for Mets Inc. for the next year a. The Production Budget (Schedule 2) b. The Direct Materials Usage Budget (Schedule 3a) c. The Ending Inventories Budget (Just Schedule 6A (units) ) (Schedule 2) Schedule 2 of Master Budget: Production Budget for "Mets Inc." Baseball Equip Budgeted Unit Sales Add: Target Ending Inventory Total Required Units Less: Beginning Inventory Units to be Produced Question 1 Schedule 3a of Master Budget: Physical Units Budget (Quantity) for "Mets Inc." Rubber Total Wood Baseball equipment Schedule 3a of Master Budget: Cost Budget (Dollars) for "Mets Inc." Cost of Beginning DM Inventory (Under FIFO Direct Material Actual Cost Beginning Inventory Cost of Begin. Inventory Wood Tape Total Notes Schedule 3a of Master Budget: Cost Budget (Dollars) for "Mets Inc." Cost of DM to Be Added this Period aterial Wood Tape Total Total DM needed Less: Begin. Inventory Total DM to be Added Budgeted Cost Cost of Added DMM Notes Schedule 3a of Master Budget: Cost Budget (Dollars) for "Mets Inc." Total Cost of Direct Material Used this period Direct Material Cost of Begin. Inventory Cost of Added DM Cost of Total Used Wood Tape total Schedule 6A of Master Budget: Ending Inventory Budget(Unit Costs) for "Mets Inc." Cost perInput per Unit of Output Unit of Input Inputs Total Wood Rubber DML FIXED MOH Variable MOH Cost Per Unit