Question

Question 1. Mike company is considering the purchase of five three-month Japanese yen call options with an exercise price of $0.0096 per yen. Each option

Question 1.

Mike company is considering the purchase of five three-month Japanese yen call options with an exercise price of $0.0096 per yen. Each option contract is for 1,000,000 yens. The option premium is $0.000135 per yen. The spot price is $0.009528 per yen and the 90-day forward rate is $0.009571 per yen. What will be the speculator's profit if the yen appreciates to $0.0100 per yen at option expiration?

A speculator is considering the purchase of five three-month Japanese yen call options with an exercise price of $0.0096 per yen. Each option contract is for 1,000,000 yens. The option premium is $0.000135 per yen. The spot price is $0.009528 per yen and the 90-day forward rate is $0.009571 per yen. What will be the speculator's loss if the yen appreciates to $0.009571 per year?

2.

Determine the optimal strategy for the situation by representing it as a game and finding the saddle point. State your final answer in the terms of the original question.

A Republican and a Democratic candidate are running for office in a heavily Republican county. A recent newspaper poll comparing their views on taxes and welfare reform showed that when compared on taxes or on welfare reform, the Republican leads by 10%. When comparing the Democrat on welfare reform to the Republican on taxes, the Republican leads by 40%. But when comparing the Democrat on taxes to the Republican on welfare reform, the Republican leads by only 5%. Use this information to decide what each candidate should discuss at their next debate. (Let T represent taxes and W represent welfare reform)

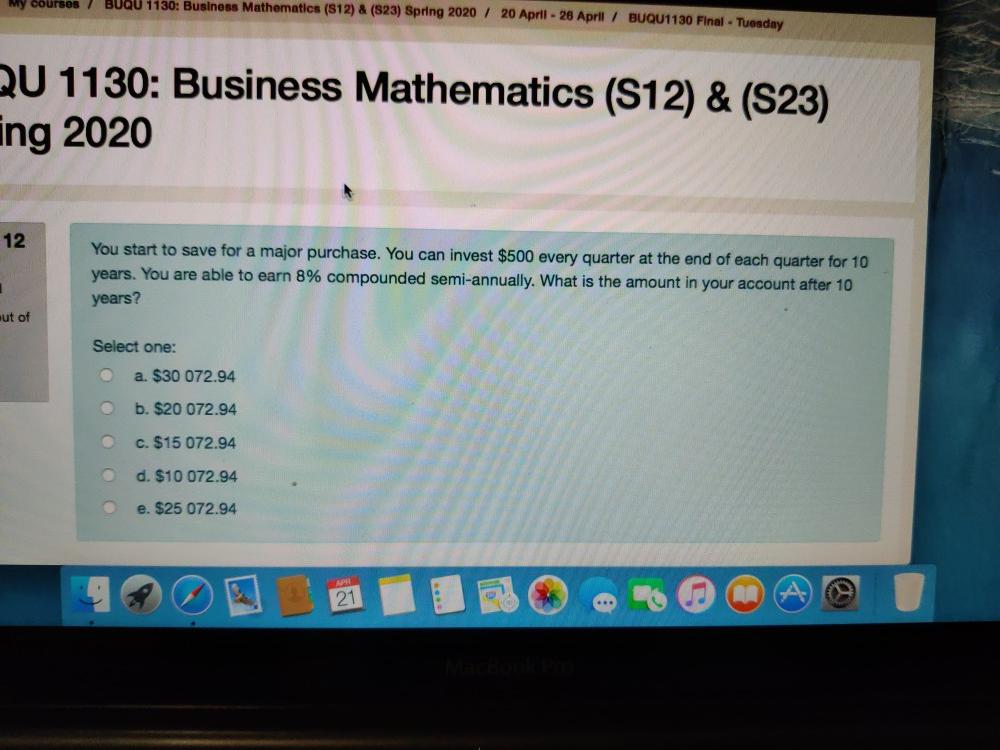

My courses BUQU 1130: Business Mathematics (S12) & (823) Spring 2020/20 April-26 April / BUQU1130 Final - Tuesday QU 1130: Business Mathematics (S12) & (S23) ing 2020 12 1 out of You start to save for a major purchase. You can invest $500 every quarter at the end of each quarter for 10 years. You are able to earn 8% compounded semi-annually. What is the amount in your account after 10 years? Select one: a. $30 072.94 b. $20 072.94 c. $15 072.94 d. $10 072.94 e. $25 072.94 APR 21 ...

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Question 1 Given information Mike is considering the purchase of five threemonth Japanese yen call options The exercise price is 00096 per yen Each option contract is for 1000000 yens The optio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started