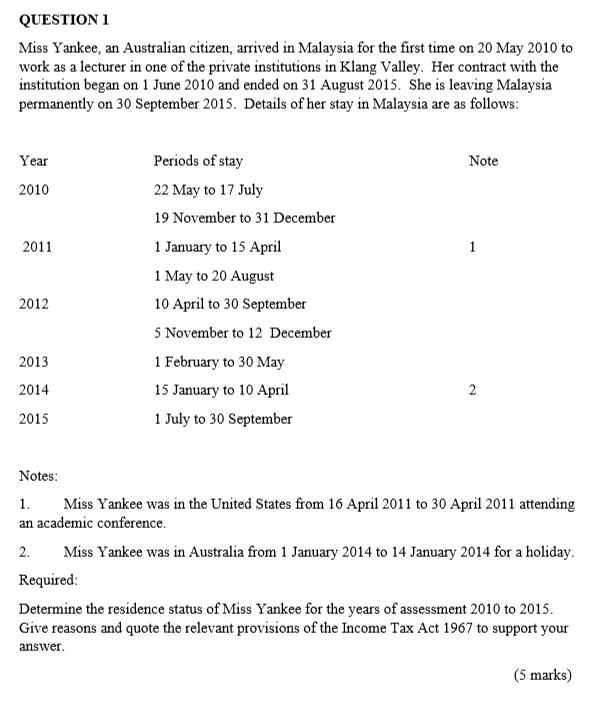

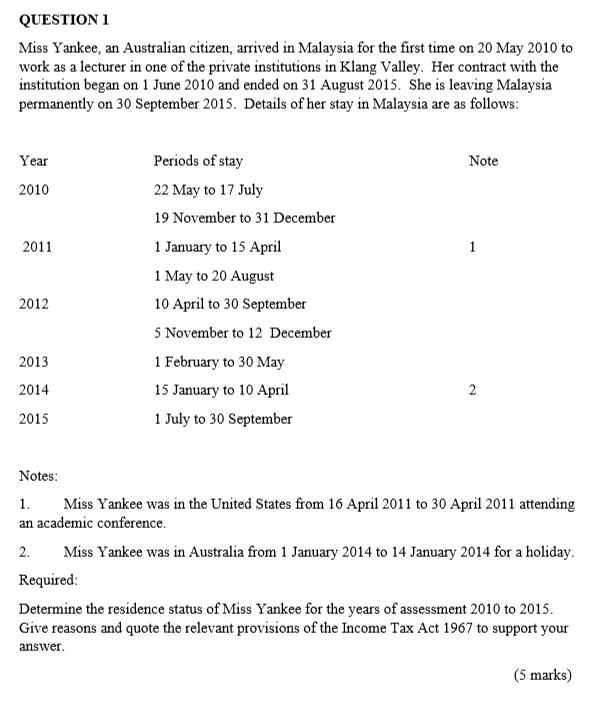

QUESTION 1 Miss Yankee, an Australian citizen, arrived in Malaysia for the first time on 20 May 2010 to work as a lecturer in one of the private institutions in Klang Valley. Her contract with the institution began on 1 June 2010 and ended on 31 August 2015. She is leaving Malaysia permanently on 30 September 2015. Details of her stay in Malaysia are as follows: Year Note 2010 2011 Periods of stay 22 May to 17 July 19 November to 31 December 1 January to 15 April 1 May to 20 August 10 April to 30 September 5 November to 12 December 1 February to 30 May 15 January to 10 April 1 July to 30 September 2012 2013 2014 2 2015 Notes: 1. Miss Yankee was in the United States from 16 April 2011 to 30 April 2011 attending an academic conference 2. Miss Yankee was in Australia from 1 January 2014 to 14 January 2014 for a holiday. Required: Determine the residence status of Miss Yankee for the years of assessment 2010 to 2015. Give reasons and quote the relevant provisions of the Income Tax Act 1967 to support your answer. (5 marks) QUESTION 1 Miss Yankee, an Australian citizen, arrived in Malaysia for the first time on 20 May 2010 to work as a lecturer in one of the private institutions in Klang Valley. Her contract with the institution began on 1 June 2010 and ended on 31 August 2015. She is leaving Malaysia permanently on 30 September 2015. Details of her stay in Malaysia are as follows: Year Note 2010 2011 Periods of stay 22 May to 17 July 19 November to 31 December 1 January to 15 April 1 May to 20 August 10 April to 30 September 5 November to 12 December 1 February to 30 May 15 January to 10 April 1 July to 30 September 2012 2013 2014 2 2015 Notes: 1. Miss Yankee was in the United States from 16 April 2011 to 30 April 2011 attending an academic conference 2. Miss Yankee was in Australia from 1 January 2014 to 14 January 2014 for a holiday. Required: Determine the residence status of Miss Yankee for the years of assessment 2010 to 2015. Give reasons and quote the relevant provisions of the Income Tax Act 1967 to support your